INSIGHTS

The Athletes Driving Sports Viewing and Valuations Globally

Top sports stars are well known at home, but which athletes drive interest among fans abroad, and which are creating value for clubs, leagues, and partners?

The world’s most successful athletes have become household names (Messi, Ronaldo, LeBron, Serena) and have seen their popularity grow as sports have become more global and athletes more accessible. But which stars are generating the most interest among international fans, and what are the implications for clubs, leagues, and media partners? Altman Solon addressed these questions as well as overall sports viewership and popularity in its 2021 Global Sports Survey.

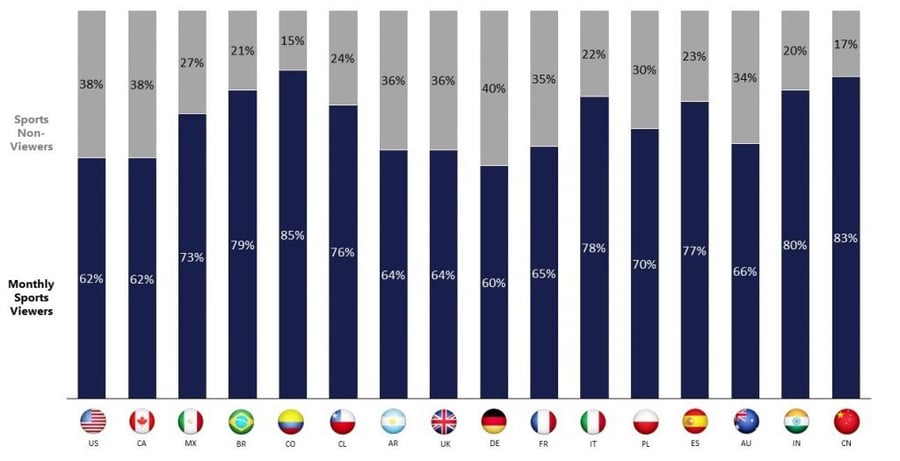

Altman Solon’s 2021 Global Sports Survey, which gauged viewing and fandom among 18,000 respondents in 16 countries across the Americas, Europe, and APAC, shows that despite falling TV ratings, sports remain popular globally. Over 60% of respondents say they watch sports at least monthly, an increase from 2020, when sports were suspended for most of the year due to COVID-19.

Sports Viewership by Frequency

(% of all respondents)

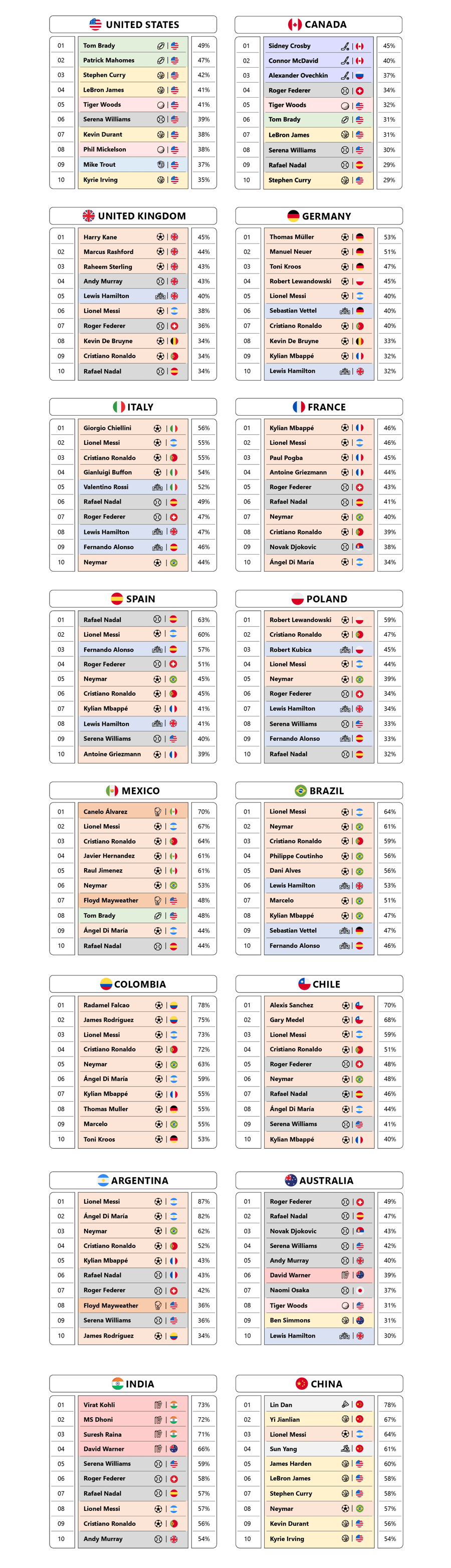

“Bankable” Sports Stars

The survey, which explores sports interests for 30+ leagues and tournaments, 50+ clubs, and 75+ athletes across 16 countries, reveals clear differences in sports interests, although soccer is popular in all countries tested. A look at top athletes across countries shows strong interest in global soccer players and tennis stars. The survey also identifies more localized athlete interests—boxers in Mexico; Formula 1 drivers in Brazil, Italy, and Spain; cricket stars in India; and badminton, basketball, and swimming stars in China—that garner significant country-level interest, which reinforces the diverse interests of modern sports fans and viewers.

Percentage of Monthly Sports Viewers in Each Country Rating Each

Athlete a 4 or 5 (Very Interested) on a 5-Point Fandom Scale

Here’s a snapshot of how top U.S. and European stars are faring with international sports fans:

North America—The top athletes among fans in the U.S., Canada, and Mexico are all stars in their country’s most popular sport: Tom Brady (US, National Football League), Sidney Crosby (Canada, National Hockey League), and Canelo Alvarez (Mexico, Boxing).

Europe—The top athletes in most countries are soccer players with local roots: Harry Kane (UK), Thomas Müller (Germany), Giorgio Chiellini (Italy), Kylian Mbappé (France), and Robert Lewandowski (Poland). Rafael Nadal had the strongest interest in Spain ahead of soccer, Formula 1, and other tennis stars.

Latin America—The top athlete in all but one country is a soccer player with local roots. Meanwhile, the survey revealed surprisingly stronger interest in Brazil for Argentina’s Lionel Messi than Brazil’s Neymar.

APAC—In India (Virat Kohli, Cricket) and China (Lin Dan, Badminton), the top athletes are homegrown stars in their country’s biggest sports, while in Australia, global tennis stars are most interested.

Most Popular Athlete in Each of the 16 Countries Surveyed

(most popular = highest % interest among monthly sports viewers in each country)

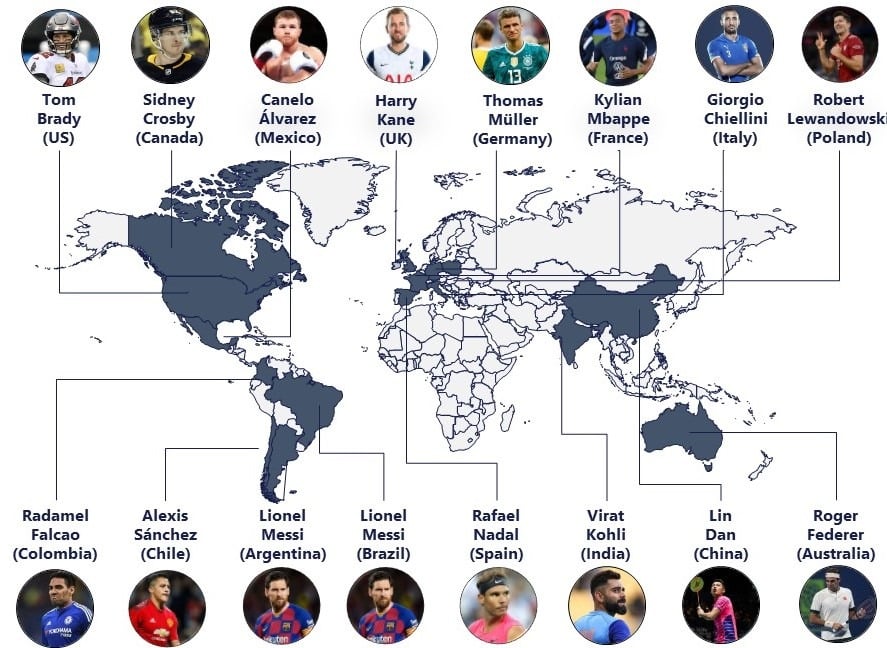

The survey also shows that three of the top five athletes globally are soccer players currently engaged in Europe: Lionel Messi (Paris St. Germain), Cristiano Ronaldo (Manchester United), and Neymar (Paris St. Germain). Meanwhile, the survey revealed strong interest in top tennis stars, including Serena Williams, the most popular female athlete.

Top Athlete Interest

(number of countries where athletes are ranked top 10 in fan interest out of 16 countries)

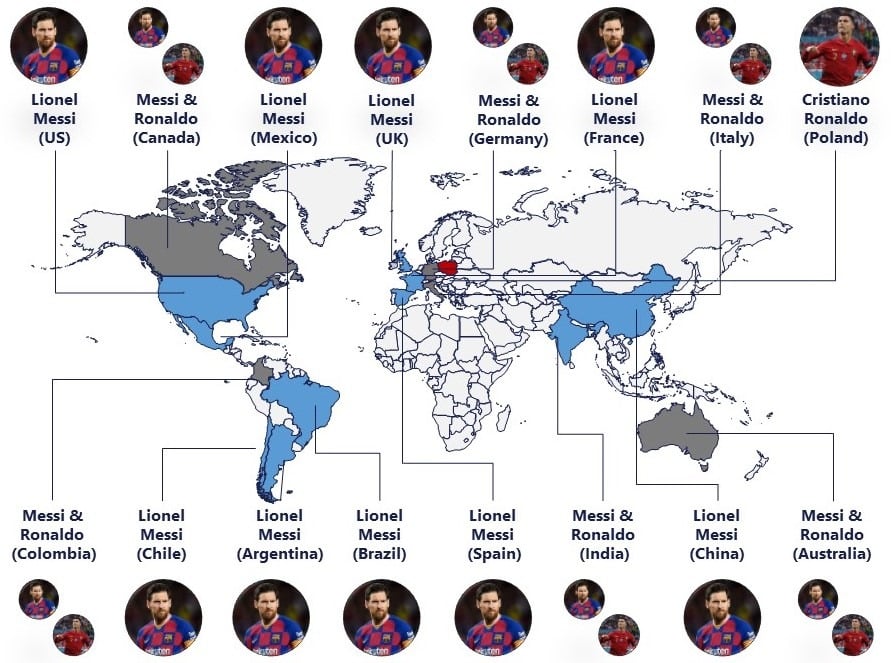

The Great Debate: Messi vs. Ronaldo

The survey provides evidence that there is no contest between the world’s two most popular athletes, both international soccer superstars: Lionel Messi has higher interest than Cristiano Ronaldo in nine of sixteen countries tested, while the latter is more popular only in Poland.

More Popular Athlete, Messi or Ronaldo, in Each of the 16 Countries Surveyed

(more popular = higher % interest among monthly sports viewers in each country)

As big as Messi’s and Ronaldo’s impacts on the pitch, their impacts off the pitch are even more impressive. Ronaldo’s transfer to Juventus (Italy) in 2018 triggered a significant increase in share value and fan engagement for the Italian club, while his departure was less noticeable. The stock price of Juventus rose 150% in the first year after Ronaldo was transferred, and sponsorship deals rose from €143M to €175M during his three years with the club. After Paris St. Germain (France) recently signed Messi after 16 seasons at Barcelona (Spain), Google searches for PSG went up 15-fold, and an initial run of 150,000 Messi PSG jerseys sold out within 10 minutes after he was signed. The price of PSG’s digital fan tokens increased over 100% with news of Messi’s arrival and after reports that part of his signing bonus was paid in the club’s cryptocurrency fan tokens. The popularity and reach that both Ronaldo and Messi have with global sports fans include hundreds of millions of followers on social media: 300 million (Ronaldo) and 265 million (Messi) followers on Instagram, respectively.

Fandom and Financial Impact

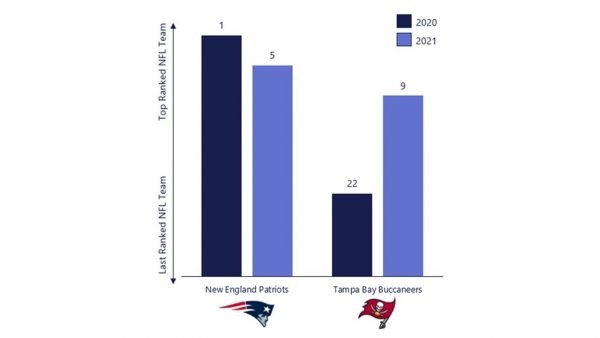

This stickiness of fandom and the impact top athletes can have on both new and former clubs and franchises can also be observed in our survey. Tom Brady, who joined and led the Tampa Bay Buccaneers to the 2020 Super Bowl after 20 seasons with the New England Patriots, has helped turn the Buccaneers into one of the 10 most popular teams in the NFL. The survey also revealed that the Patriots are still one of the 10 most popular teams despite losing their star player, indicating that star athletes can create sticky and sustainable fandom. For Tampa Bay, signing Brady has brought financial gains, including increased merchandise sales (from near the bottom to the top of the league) and an increased franchise valuation by ~$650M, or 2x the NFL average.

Rank of NFL Team Based on Popularity

(ranked out of all 32 NFL teams; 2020 vs. 2021)

The impact of bankable stars is positive only until they break the bank. Due to COVID-19, many sports clubs/teams suffered significant operating losses from absent revenue while carrying massive salaries committed to top players, which was the key factor in Juventus letting Ronaldo leave the club and sign with Manchester United this summer. With increased investment and expected returns from private equity investors and funds, there will be much more focus on operating and business management rigor and the fundamental basics of operating a P&L in good order. Clubs/teams will also need to strike the right balance between sporting performance, the brand of the club, and the brand of individual athletes to avoid creating complex team dynamics. With Messi joining Neymar and Kylian Mbappé at PSG, three of the world’s best soccer players and biggest brands need to co-exist both on- and off-the-pitch.

Implications for clubs, leagues, and media partners:

- Top athletes are key assets for teams, leagues, and investors. They drive interest and value not only in their home countries but also among global fans. As such, they are a key pillar of international growth.

- Clubs/teams need to measure value of signing a new athlete not only by value created domestically over the term of their contract, but also globally, and over a timeframe that extends beyond contract length.

- Sports rights and club valuations are driven in large part by the quality of athletes competing and their appeal to global fans. As such, clubs, leagues, and media partners need to invest in marketing top athletes globally.

- Specifically, clubs and teams may be better served by marketing and monetizing top athletes alongside the club or team itself to grow their fan base, increase fan intensity/loyalty, and subsequent spending outside of home territories.

- Athletes are increasingly their own brands and content creators. They can be assets for media partners and brands but increasingly are engaging directly with fans rather than solely relying on traditional media outlets and partners.

In our next spotlights, we will explore the live TV and video services fans are using to watch sports globally, where fans are participating in sports betting, collectibles, and other sports-related activities, and what it means for sports properties and their partners.

Altman Solon conducted the 2021 Global Sports Survey in August-September with more than 18,000 respondents across 16 countries. Altman Solon tapped its expertise across Europe and the Americas following last summer’s merger of the U.S.-based Altman Vilandrie & Company and Europe-based Solon Consulting to form the world’s largest strategy consulting firm focused exclusively on Telecommunications, Media, and Technology. The results shown are from Altman Solon’s 2021 Global Sports Survey, which was completed and released in September. To see more results from the survey, please click here.

To stay current on the latest insights and press releases from our 2021 Global Sports Survey, please provide your contact information below or contact a member of our leadership team.

Photo credit for featured editorial image: Ververidis Vasilis / Shutterstock.com