INSIGHTS

From Unbanked to Cutting-Edge: The Opportunity for Telecom Providers to Expand Financial Accessibility in Emerging Markets

In many developing countries, the percentage of consumers who are “unbanked” – meaning they do not have accounts with banks or financial institutions – exceeds 50 percent. While this means a significant number of consumers have historically been excluded from traditional financial services offerings, our inaugural Global Fintech Survey shows how new connected technologies are empowering consumers in Africa, the Caribbean, Latin America, and Southeast Asia to take control of their financial futures. The survey included nearly 950 consumers across 17 markets, identifying strong interest in MFS among consumers, while providing opportunities for Mobile Money Operators (MMO), telecom providers, and governments to expand fintech options for consumers.

The results of the survey suggest that widespread adoption of MFS – also known as mobile money – will be aided by existing relationships and trust between consumers and mobile service providers: While 66% of respondents said they generally trust banks and traditional financial institutions, an even greater percentage of respondents (70%) said they trust their mobile service provider. However, the successful proliferation of these options could be slowed by inconsistent regulations and high-profile fintech flops, as well as countries excluding telecom providers and MMOs from offering MFS products.

No banks, no problem

The unbanked trend echoes a similar dynamic prevalent across the developing world a couple of decades ago, when access to landline telephones was limited. With the growth of mobile communications, which had a lower barrier to entry due to less physical infrastructure, many consumers in emerging markets leapfrogged landlines and moved directly to using mobile phones.

Fast forward to today, consumers in many of these same regions are bypassing traditional banking services in favor of less expensive and more convenient MFS tools right on their smartphones. This shift from the vault to the phone provides significant opportunities for mobile phone carriers and MMOs to enter financial services and usher in a new era of financial accessibility for consumers in many emerging markets.

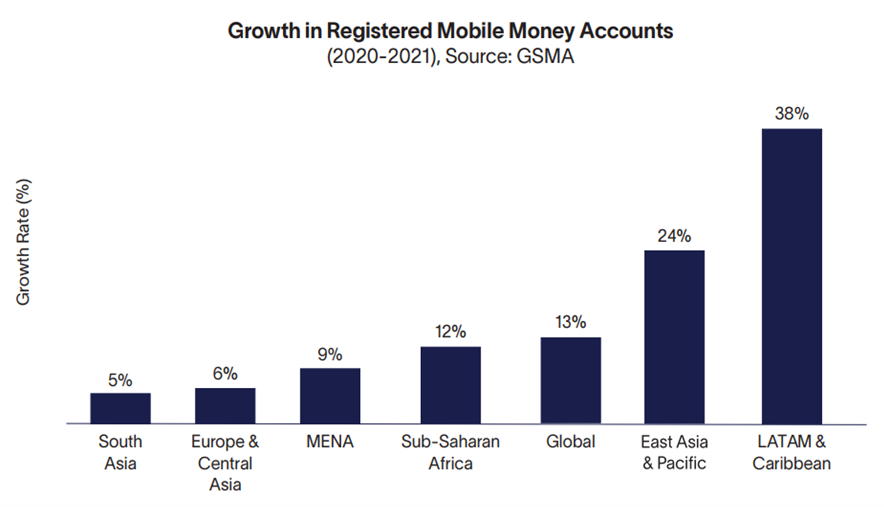

The survey revealed that MFS adoption and engagement has been varied across emerging markets and customer segments. In Latin America/Caribbean and Southeast Asia, the growth in mobile money accounts in 2022 was 22% and 30% respectively, with both outpacing the global average in recent years. This growth can be attributed in part to strong incumbent telecom providers jumping into markets that also enjoy favorable regulatory conditions. Other regions, like South Asia, experienced slower growth because of inconsistent government regulations, while Kenya has been heralded as an MFS success story.

In a similar vein, the survey identified four unique customer segments with varying degrees of comfort adopting mobile services and integrating into the MFS ecosystem. “Intuitives”, on one end, are heavily integrated with a preference for MFS over traditional institutions, whereas “Deliberators” and “Skeptics” are more reluctant to adopt new banking solutions, tend to be more price sensitive, and have lower levels of trust with both banks and MSPs.

New opportunity for mobile providers

The MFS boom should benefit mobile service providers by helping them retain existing customers and gain new ones: Our survey found users of MFS were nearly 10% more likely to be “highly satisfied” with their mobile provider than non-MFS users, and 64% stated their usage of MFS increased their level of satisfaction.

Respondents to the survey recognize mobile money as easier to use, more accessible, and more transparent than cash. In response to this consumer demand, retailers have also made a big push into MFS across emerging markets. Survey respondents reported that 51% of stores and shops they frequent accept mobile payments, with 46% of respondents saying they sometimes accept mobile payments, underscoring the strong potential for MFS growth in these markets.

Crypto fluctuations, government regulations could stifle growth

Some high-profile examples of fintech failures have chilled the potential for MFS in certain markets. However, there are additional headwinds to MFS growth, including strict regulatory climates that have hindered non-traditional financial providers from delivering products to consumers. In certain countries, like Vietnam and Nigeria, telecom firms are currently prohibited from offering MFS – although legislators in both of those nations are working to change that.

With its connections with cryptocurrency, there could also be some vulnerabilities for MFS given the recent turbulence in those markets. The survey reveals a strong interest in crypto, with a majority of respondents expressing a willingness to pay, trade, or invest in cryptocurrency if it were offered by their mobile provider. However, continued crypto volatility could erode that support among consumers and push regulators into implementing more restrictive policies.

MFS’ bright future

MFS is opening many doors for mobile providers while creating more transparency, affordability, and financial accessibility for consumers across emerging markets – particularly for those who have never previously participated in the financial system. With the rise of fintech super-apps and Web 3.0, the capabilities and possibilities for MFS are just getting started.

This report, building on interviews with experts at MMOs and payment service providers, explores how MMOs and telecom providers can succeed in the MFS markets, with strategies for reaching new customers, launching new products, and navigating changing regulatory and consumer markets.