The survey provides insights into the pace of transformation programs, the propensity for TMT companies to undertake transformation, and the breadth of transformational program types or “levers” pulled. As a group, TMT executives surveyed experienced an average of more than two transformations over the past five years. However, the transformation frequency for Asia-Pacific TMT executives averaged only one transformation in five years. Interestingly, nearly all TMT executives across geographies and industries had at least one transformational program experience. Transformation is becoming more common in the TMT sector and increasing in pace and frequency, with some companies adopting a state of “frequent transformation.”

Pace and propensity

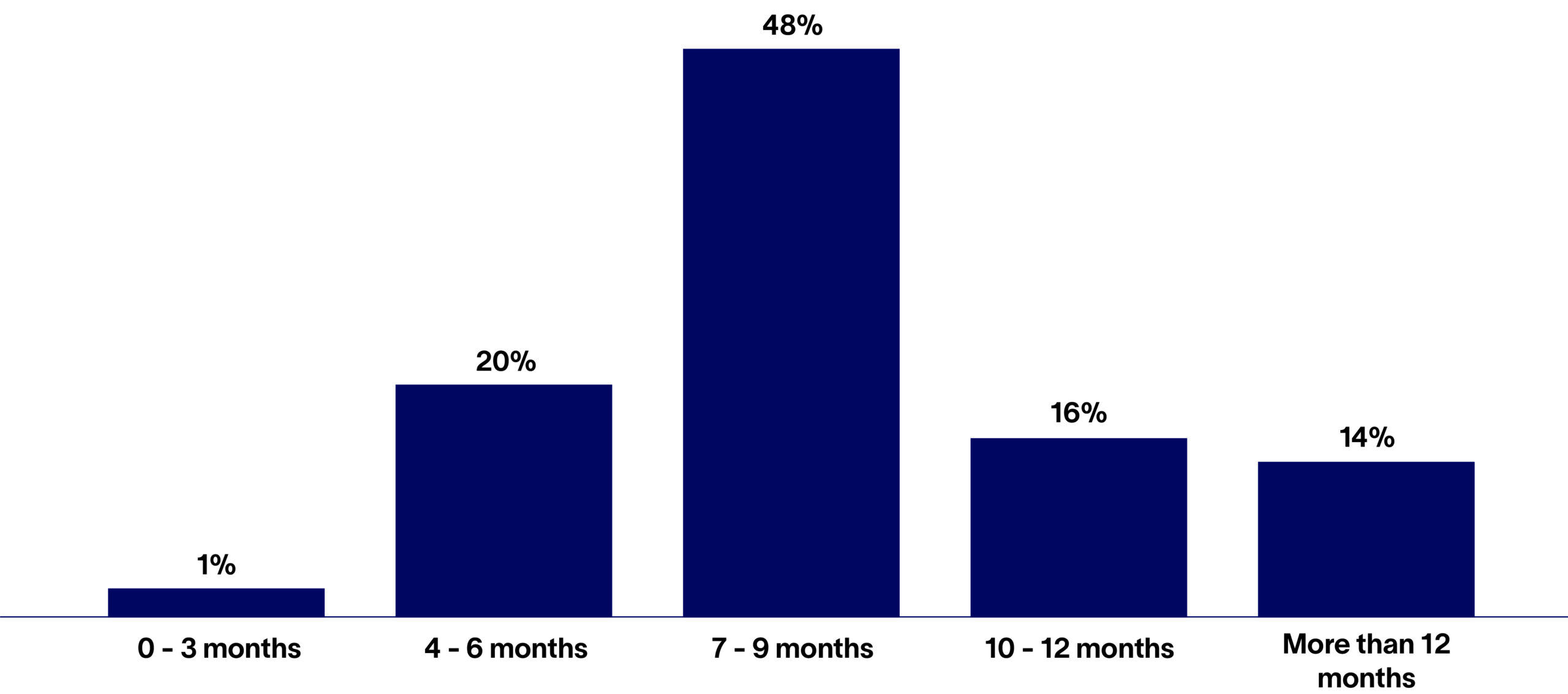

Across all industries, most respondents estimate the average length of their company’s transformations to be seven to nine months. Visualized in the graphics below, this equals ~20% on the bell curve’s four to six-month and 10-to-12-month sides. With an average of two to three transformations in the last five years, TMT executives potentially spend up to 50% of their time on transformational programs.

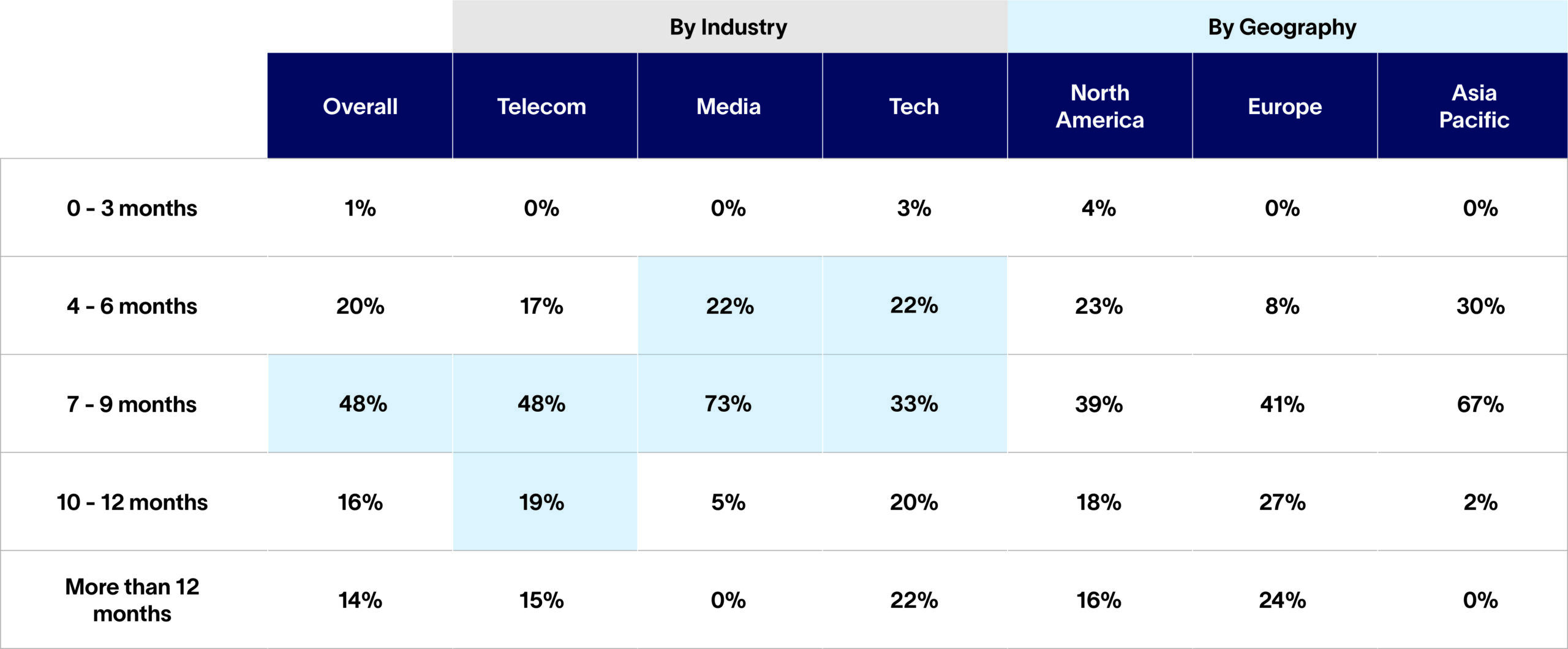

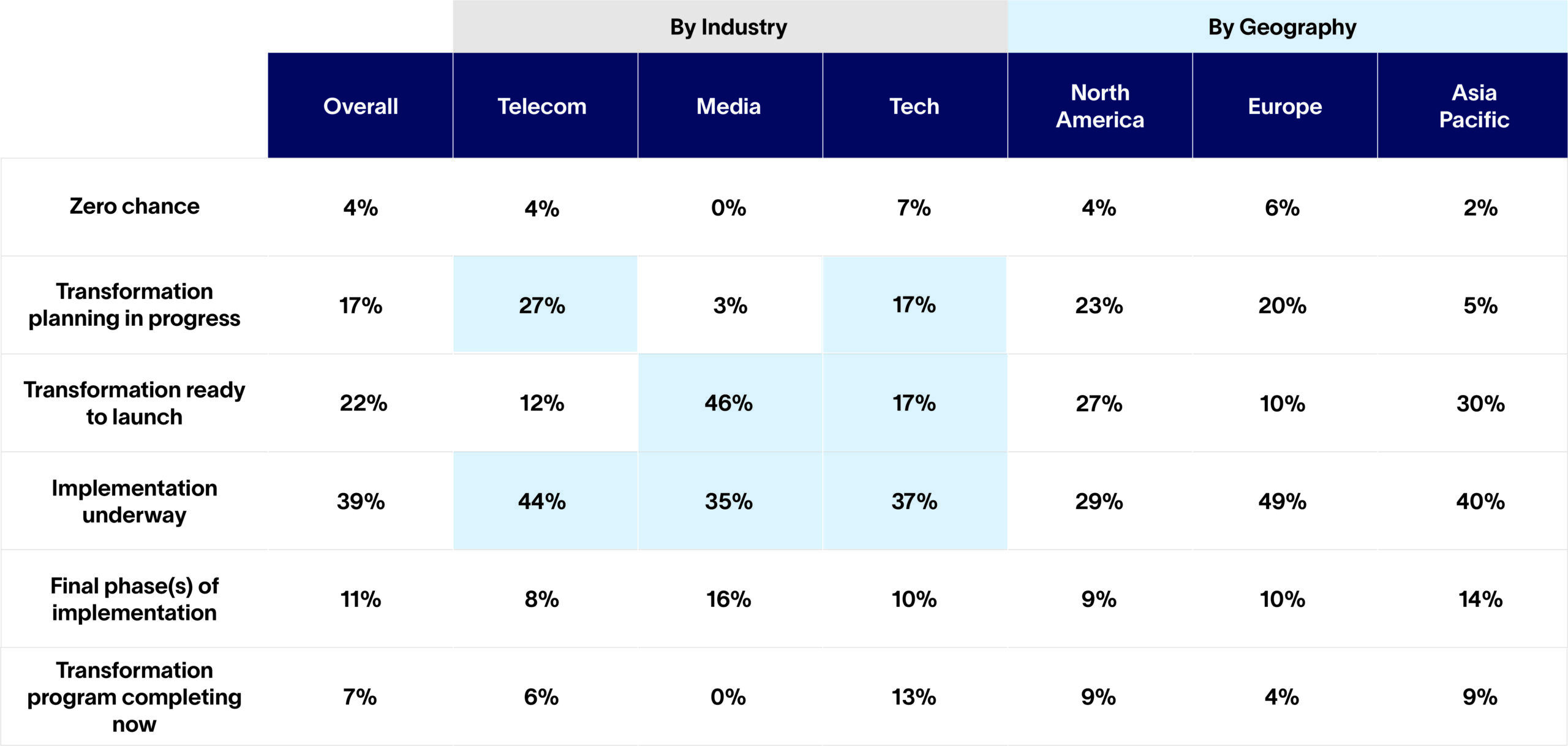

This conclusion is borne out by the respondents’ estimated propensity for their companies to undertake transformation. Across the three TMT industries and three geographies, less than five percent of each sector and geography state that there will be zero chance of transformation. On average, nearly 40% of executives (#1 in schematic) report that their companies had either started or were about to launch transformation planning. Fifty percent (#2) indicate implementation was underway or nearing completion.

Levers

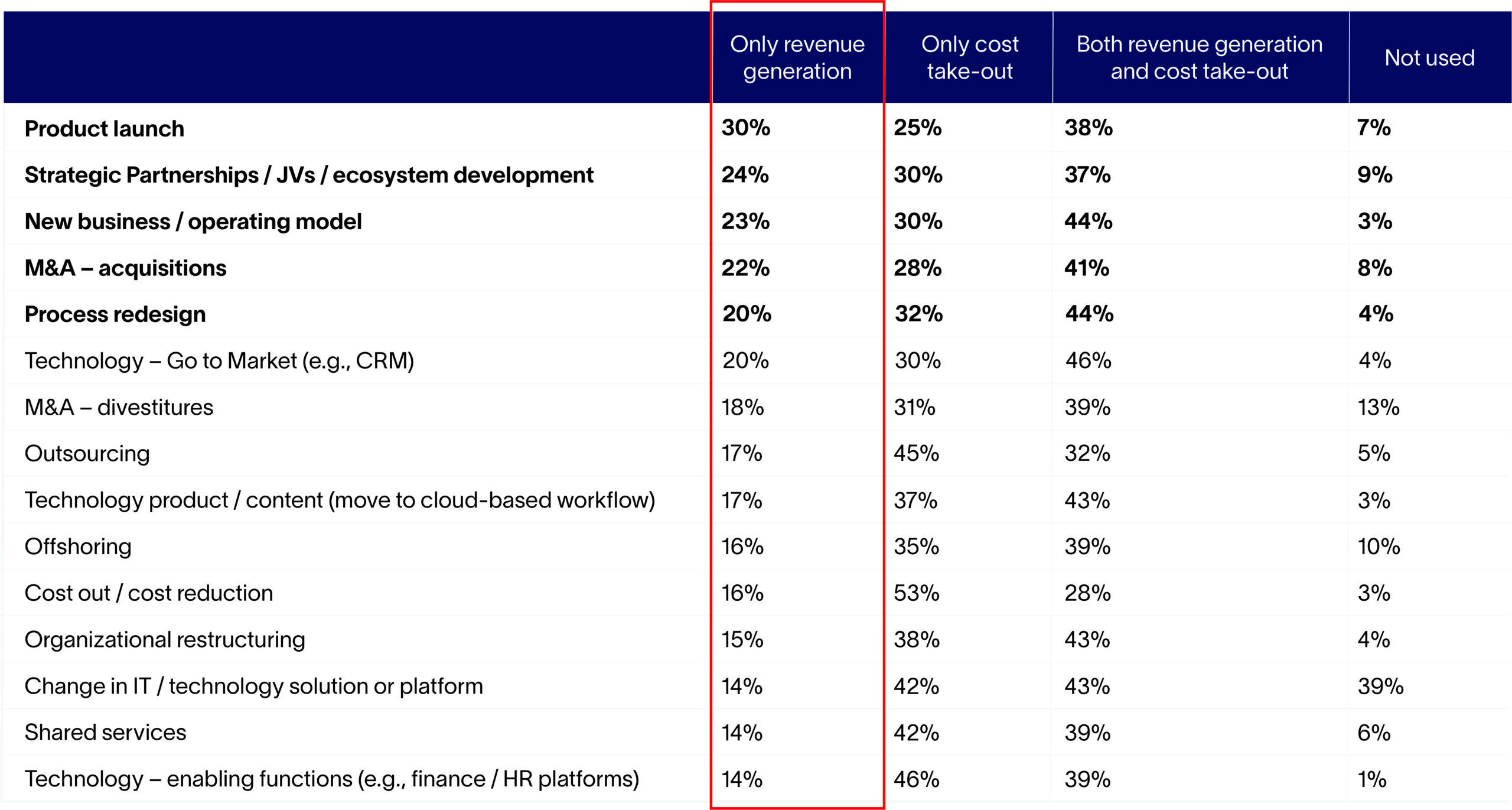

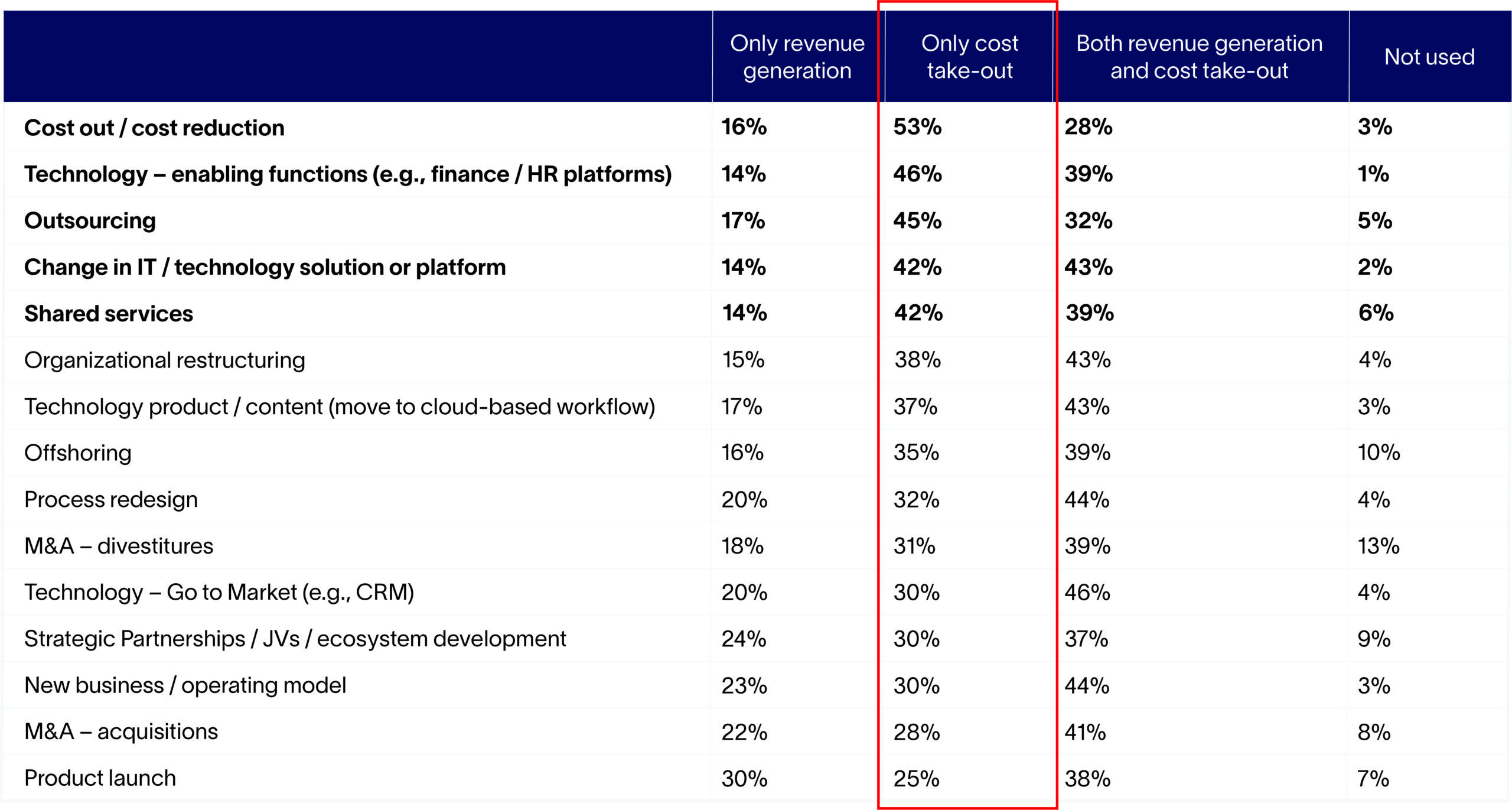

Defining “levers” as actions that are taken to affect transformational change, survey results show that for revenue-driving transformations, TMT companies most often leverage new product launches, strategic partnerships, M&A / new business, and go-to-market technology. Differences exist across industries, with technology respondents more inclined to undertake transformation to lift revenue and media executives more willing to undertake process redesign to grow revenue and reduce costs. Telecom executives, on the other hand, note a focus on revenue generation through transformation, aligning on M&A and joint ventures (JVs), plus new product launches and op model changes.

However, for cost structure transformation, there is significant alignment across the three sectors on four levers: pure cost-reduction, functional technology solutions, outsourcing, and shared services.

There is also a strong correlation across the three industries in underutilized transformation levers. Those used less frequently among TMT companies include divestitures, offshoring, and JVs/partnerships. Low utilization of JVs and partnerships is expected, given the complexity of structuring, continuing, and exiting JVs. Given the pressure to re-shore as a means of cost transformation, reduced offshoring is a more recent trend in the U.S. The apparent failure to pull the divestiture transformation lever exists even when accounting for company size. This is surprising given the potential for shorter timelines, meaningful transformational impact, and value creation potential delivered through the sale or IPO of business carve-outs.

Altman Solon is the leading strategy advisor focused on Telecommunications, Media, and Technology. Altman Solon works with leading global companies and investors on strategy and diligence within and across all three sectors. We also focus on delivering strategy through go-to-market implementation, value creation/operational improvement, operational integration/divestiture support, and transformation.

The inaugural Altman Solon Global TMT Transformation survey and report represents the baseline perspective of Altman Solon on transformation with the TMT industries. Longitudinal analysis through annual surveys will yield trends, additional questions, analyses focused on answering hypotheses, and fresh insights as the survey evolves.

Explore our additional insights from Altman Solon’s Global TMT Business Transformation Survey:

Thank you to Guy Kinley for his leadership of the Global TMT Business Transformation Survey and valuable contributions to this report.