For many businesses today, sector dynamics, competitive intensity, and customer demands drive an ongoing “improvement imperative.” Businesses have always needed to evolve to survive, but it’s not just about incremental improvements in today’s global marketplace. All companies, particularly those in the Telecommunications, Media, and Technology (TMT) sector, must take advantage of every opportunity to transform.

Transformation can mean many different things in many different business contexts, but Altman Solon’s Global TMT Transformation Survey defines transformation as “a major company initiative leading to fundamental business or operational change, such as a business launch, merger integration, carve-out, new business model, new target model, cost-out or cost-reduction, step-wise uplift revenue generation, or end-to-end functional restructuring.” At the highest executive levels, survey respondents strongly believe that companies within TMT are frequently undergoing business transformation: survey respondents have experienced an average of more than two transformations over the past five years.

While competition and innovation drive TMT firms to transform, similarities and differences in the business dynamic and the improvement imperative exist at the sector level. The TMT industries are unique in that they are both generators and enablers of transformational pressure and change, with computing, content, and communications driving and/or enabling change in all industries.

Altman Solon’s Global TMT Transformation Survey polled business leaders in TMT across three continents to generate insights on the current state of TMT transformation. The goals of the survey were to:

- Better understand forces driving the transformation imperative within TMT;

- Identify and gain insight into the transformational initiatives or “levers” undertaken by TMT companies; and

- Determine best practices to increase success of TMT companies undertaking transformation.

In addition to these three objectives, this report translates best practices into recommendations for transformation leaders, reporting workstream leaders, and steering committees (or management team members) undertaking a transformation.

Competitive, technological, and customer-driven forces catalyze the transformation imperative

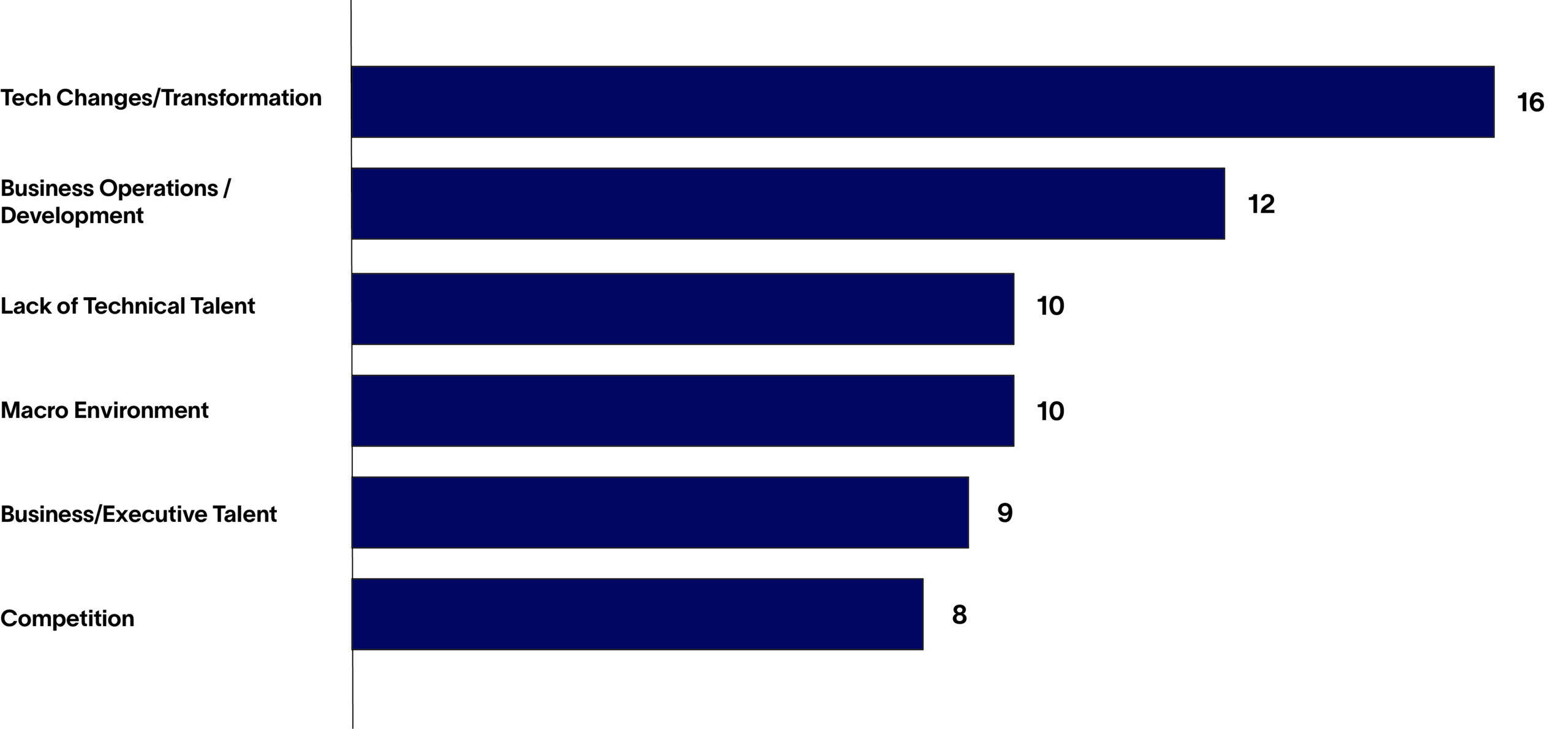

When asked to name their company’s most significant challenge, half of all respondents coalesce around six challenges that fell into two categories: directly addressable challenges (business operations, lack of technical talent, and talent gaps) and external challenges (technology changes, macro business environment, and competition).

The survey identified three broad areas where TMT companies face the most significant challenges to business operations and ongoing transformation: competitive, technological, and customer-driven forces. Within these broad categories, several issues were common across the telecom, media, and technology industries, while others were unique to each.

To the question, “What will have the largest impact on your business in the next 12 months?,” 77% of all survey respondents indicated that customer demand was the most significant factor impacting their business. Factors such as shifts in customer habits and the increased role of social media lead the list.

Seventy percent of respondents identify technology (e.g., Artificial Intelligence, Internet of Things). And 66% choose competitive forces (e.g., new entrants, Mergers & Acquisitions [M&A]) as a leading factor impacting the business.

Among competitive forces, the threat of new entrants, M&A, and pricing pressure rank high across the TMT sectors. Within the media industry, the survey indicates that the increasing role of social media was the most significant factor impacting media businesses at 89%. The need for expanding networks within the telecom industry ranks high, with 77% indicating an immediate need. Eighty percent of technology respondents say software automation is the leading issue impacting their business.

Addressing challenges through investment

Investments by businesses are a solid indicator of business intent and effort to seize initiative and/or address challenges. While current investment through budgets is a direct indicator of in-progress action, planned investment views by industry executives, despite being an indirect measure, can be even more insightful in addressing emerging challenges instead of fully manifested or enduring ones.

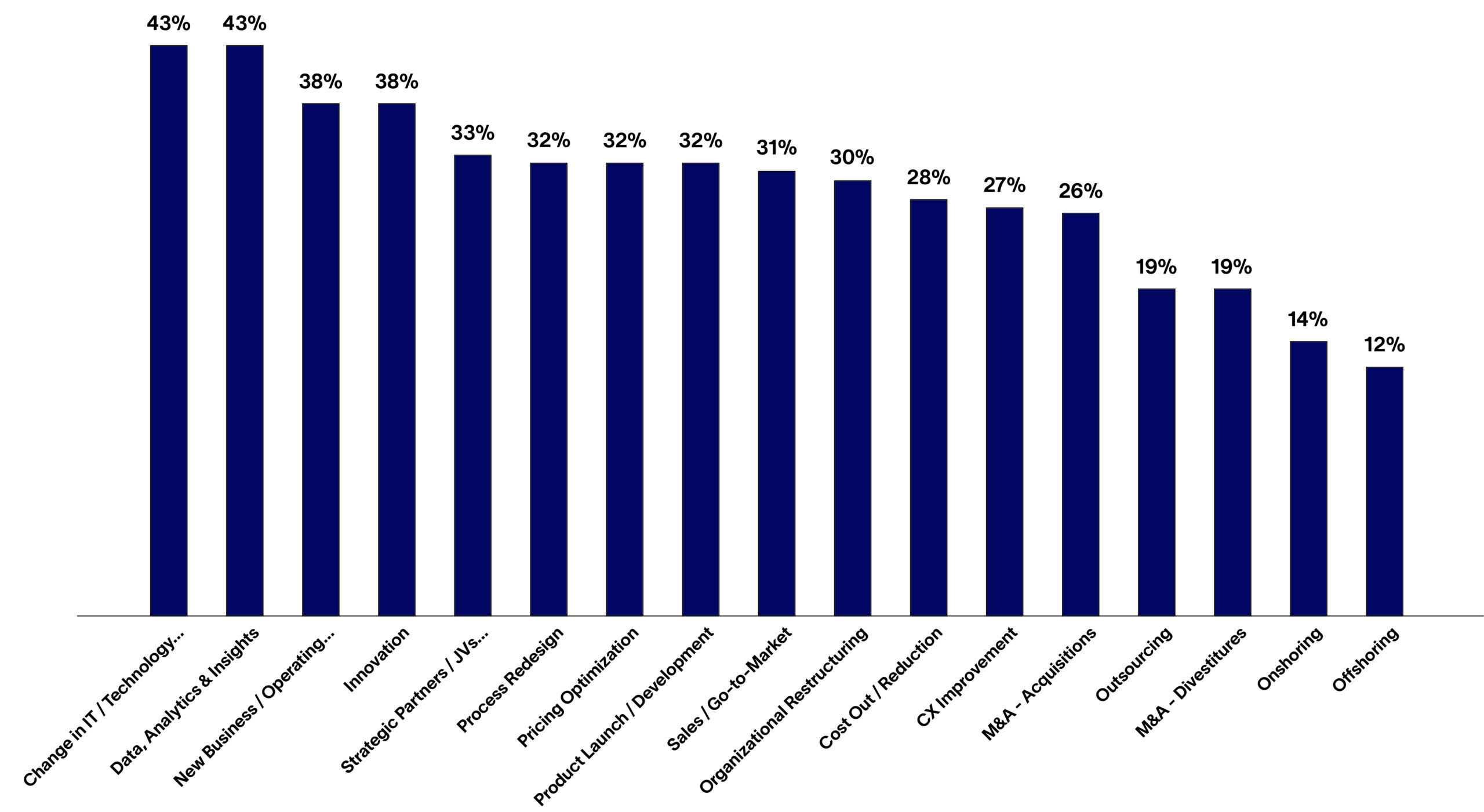

Survey respondents identify four leading areas of investment: technology & IT, data analytics, operational model changes, and innovation. The survey shows the tech industry is more focused on resource investment in technology solutions compared to telecom and media. After the primary four investment areas, telecom and media companies choose to invest in product launch and pricing as additional transformation investment areas. Organizational restructuring as a transformation resource priority is exclusive to media respondents.

Looking toward the next several years, telecom executives strongly view customer acquisition and retention as the most important areas of future investments. Tech executives point to automation, security and privacy, and operational improvement as areas of priority investment. In contrast, media executives take a broader investment view, noting higher-than-average investment in automation and service responsiveness.

Altman Solon is the leading strategy advisor focused on Telecommunications, Media, and Technology. Altman Solon works with leading global companies and investors on strategy and diligence within and across all three sectors. We also focus on delivering strategy through go-to-market implementation, value creation/operational improvement, operational integration/divestiture support, and transformation.

The inaugural Altman Solon Global TMT Transformation survey and report represents the baseline perspective of Altman Solon on transformation with the TMT industries. Longitudinal analysis through annual surveys will yield trends, additional questions, analyses focused on answering hypotheses, and fresh insights as the survey evolves.

Explore our additional insights from Altman Solon’s Global TMT Business Transformation Survey:

Thank you to Guy Kinley for his leadership of the Global TMT Business Transformation Survey and valuable contributions to this report.