Artificial intelligence is turning software investment approaches inside-out. Today, investors are switching their focus from functionality to a far more basic question:

Is this company AI-resilient?

To help investors make informed decisions, Altman Solon has developed an AI Resilience Diagnostic, an integrated commercial and technical diligence framework that evaluates software companies with durable value in the AI era. The Diagnostic is designed for use in commercial and technical diligence, as well as investment decision support, and value-creation planning.

Why the bar is rising in software

AI-driven disruption comes from general-purpose AI platforms, AI-native vendors, and AI-embedded incumbents. All pose two primary threats to conventional software-as-a-service (SaaS) companies:

- Replication: AI lowers the cost and time required to build competitive software and features.

- Replacement: Agentic AI workflows can bypass legacy software interfaces and lightweight workflow tools by completing tasks end-to-end. As fewer humans interact directly with software, seat-based usage can decline. This in turn increases pricing pressure and pushes buyers toward usage- or outcome-linked models.

The impact is uneven. In some categories, AI becomes a productivity layer that enhances existing workflows. In others, it changes how work gets done and which systems remain essential.

The result is a widening gap between companies with durable moats against AI replication and replacement and those without. For businesses with strong moats, AI can drive outsize gains in differentiation, monetization, and value.

The AI Resilience Diagnostic: what we assess

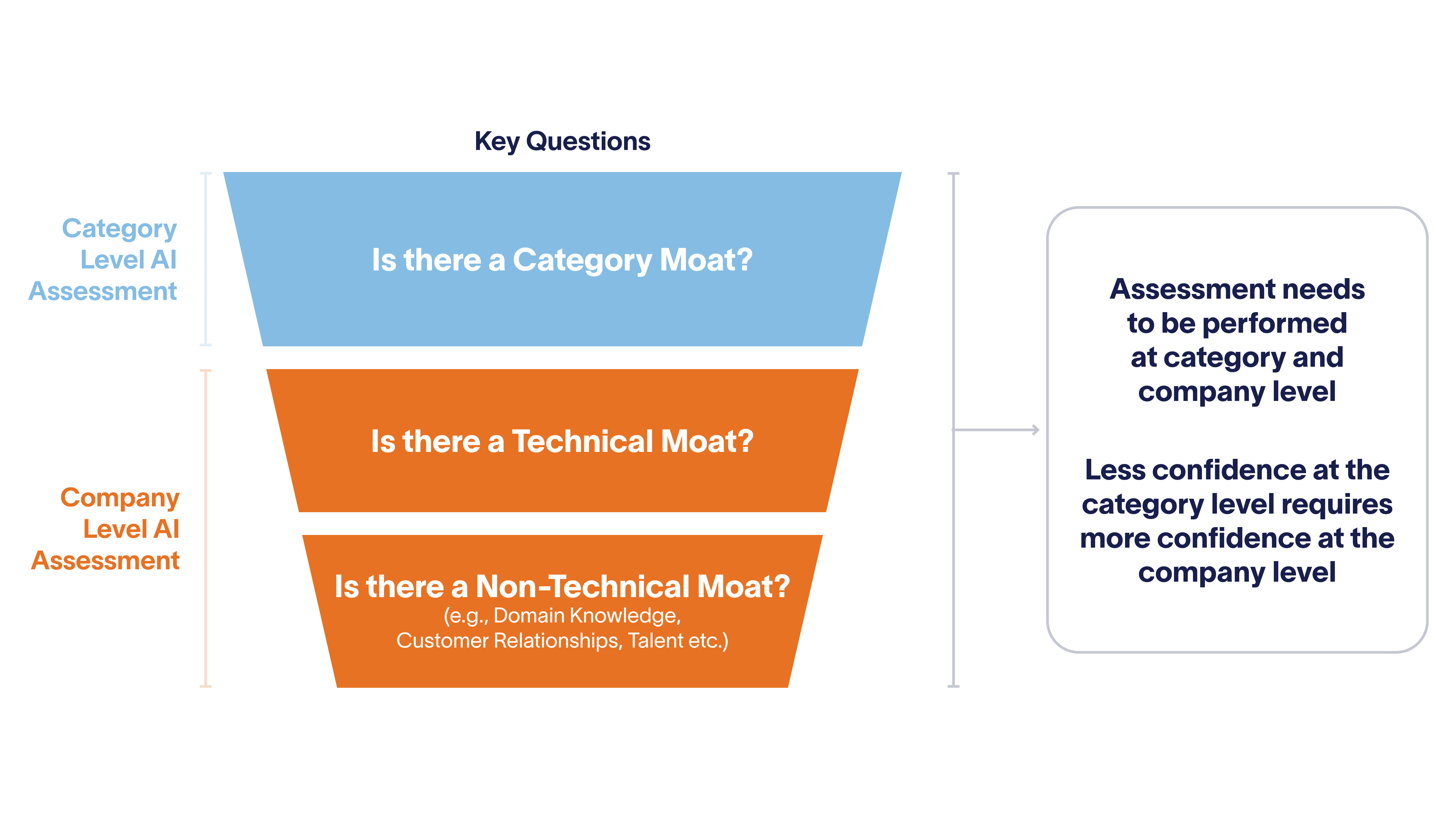

Altman Solon’s moat-first approach evaluates resilience at two levels:

Category moats

We assess how quickly AI can reshape a category based on factors such as:

- Workflow complexity and variability.

- Tolerance for probabilistic output.

-

Compliance, auditability, and governance requirements.

-

Clarity and stability of success criteria.

As a practical rule of thumb, highly verticalized software, core infrastructure, cybersecurity, and systems-of-record often exhibit greater category resilience, while broad horizontal applications (especially productivity and lightweight workflow tools) tend to see faster AI-driven disruption.

Company moats: technical and non-technical

Within a category, we evaluate whether the company has moats that are difficult for AI-native entrants, or general-purpose AI alternatives, to replicate or bypass.

Technical moats often show up in areas such as:

- Data: These are proprietary, high-signal datasets that materially improve accuracy and outcomes.

- Integrations: These companies have deep integrations with systems of record and workflows, especially where auditability and controls matter.

- AI/ML strategy: These companies have a credible roadmap to embed intelligence into the product and workflows, not just bolt-on features.

Non-technical moats often determine who can adopt AI fastest and most credibly. These typically include:

- Domain knowledge that translates real-world requirements into workflows and outputs.

- Customer relationships and workflow embedding that raise switching costs.

- Talent and culture that enable rapid iteration without sacrificing reliability.

- Funding to invest through multiple AI cycles rather than reacting ad hoc.

Key takeaway: Even in categories exposed to AI disruption, companies can be strong investments, but the bar is higher. The winners are those with moats that not only defend against AI-driven pressure but also use AI to widen differentiation, deepen workflow embedding, and unlock new monetization.

How Altman Solon can help

Altman Solon leverages the AI Resilience Diagnostic across the investment lifecycle. Typical applications include:

- Integrated commercial and technical diligence anchored in category and company moat assessment.

- Investment decision support across the deal cycle linking resilience drivers to growth durability, pricing power, and value-creation priorities.

- AI resilience diagnostics to inform product and growth value creation priorities.