As enterprises continue to migrate to the cloud, independent software vendors (ISVs) are at the forefront of this digital transformation. Certain ISVs are growing, reflecting a new enterprise IT tech stack, especially in areas like security, cloud, data analytics, and digital transformation. Operating in a fragmented and highly competitive landscape, today’s ISVs are redefining how enterprises deliver value through more automated, intelligent, and vertically tailored solutions. Increased competition between established tech leaders and emerging ISVs like Snowflake, Databricks, Crowdstrike, and UI Path among others, indicates major transformation in the enterprise tech landscape.

Altman Solon has developed a proprietary database of the service partner ecosystems of the 69 largest ISV’s by market cap. The database of 195,000 global service partners providers gives Altman Solon unparalleled ability to run market assessments on service investment, fair share analysis, and competitive comparisons. The database establishes Altman Solon as a thought leader able to provide accurate advice on how service providers can differentiate and win in the market.

Below, we explore findings from our database including investment opportunities in the ISV ecosystem and key drivers for partner growth. ISVs are becoming essential to enterprise digital transformation. Investors, service providers, and vendors have much to gain in better understanding the ecosystem.

Investment opportunities in the ISV ecosystem

We believe there's enormous untapped value in mapping and understanding the ISV ecosystem, especially for investors, service providers, and vendors seeking to expand their reach. By identifying which ecosystems are growing, which competencies are in demand, and which partners are thriving, stakeholders can make smarter, data-driven decisions about where to place their bets. Our ISV ecosystem analysis provides a strategic edge in a rapidly evolving digital economy.

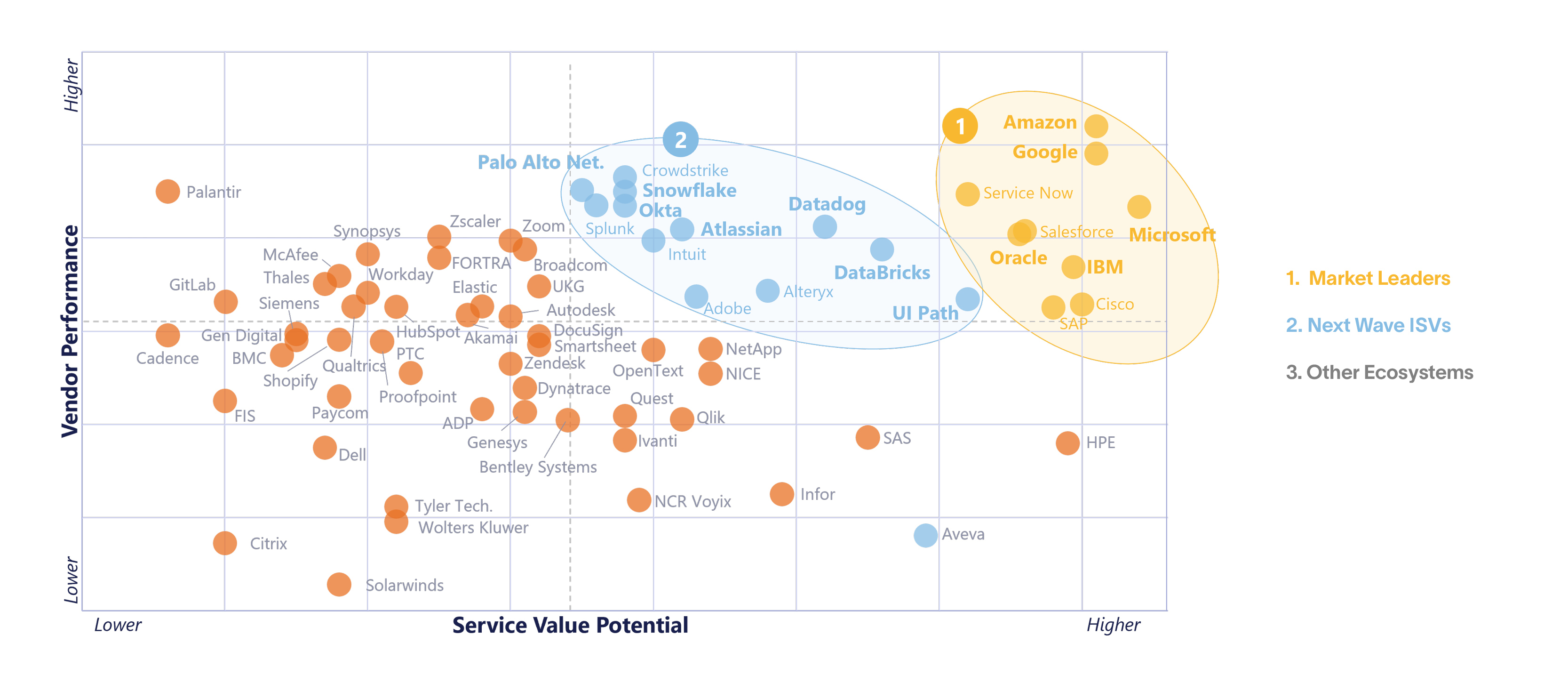

Leveraging data from company websites, public directories, and our proprietary research, we assessed both vendor attractiveness and service partner ecosystem feasibility. We then categorized vendors into three groups:

- Market-Leading Vendors – These vendors offer both highly attractive products and well-developed partner ecosystems. Service partners aligned with these vendors tend to grow faster and benefit from greater enablement resources.

- Next Wave ISVs– These are large ISVs with strong segment positioning that have strong, but evolving partner ecosystems. Solid offerings with decent partner support, but with less aggressive growth potential.

- Other Ecosystems – These vary but can include niche vendors focused on specific verticals. These vendors may lack scale but can still present strategic opportunities.

What’s driving partner growth?

We identified independent software vendors who successfully scaled their partner ecosystems alongside their own growth. These ISVs built partner programs that enable growth including specialized referral programs for elite-tier partners, access to co-marketing funds, competency and certification training tools, and service attach requirements. When evaluating growth rates among service partners, our proprietary data revealed that vendors like Databricks, Snowflake, and Okta have built some of the fastest-growing ecosystems.

Even more telling: pure-play service partners (those who work with only one software vendor) grew faster than their multi-vendor peers from 2022 to 2023. This could reflect a deeper alignment and specialization that yields better outcomes for both vendors and clients.

Altman Solon's ISV database is expanding

Our ISV database is growing in scope and complexity. In our upcoming edition, we will be analyzing new criteria including deep dives into ISV marketplaces and advanced AI capabilities.