The seismic shift of the pandemic on online shopping, coupled with continued e-commerce growth over the past few years, has forced online retailers to rethink decades-old strategies to reach new e-shoppers whose motivations have moved beyond just price and convenience.

Altman Solon’s second annual Store-to-Door Supply Chain Survey illuminates the shifts in consumers’ online shopping expectations around delivery criteria and shopping incentives. It also uncovers sentiments long associated with in-person shopping — like a giddiness when making a purchase — that have crossed over into online shopping.

We found that online shopping triggers a positive emotional response in most high-volume male shoppers that they don’t experience when trudging through the aisles of a brick-and-mortar store. Online retailers’ ability to capitalize on this feeling during the virtual shopping experience could unlock pathways to new, loyal customers.

Based on the evolving e-commerce environment, we have defined six new online shopper profiles and recommended strategies for online retailers to realign their supply chain processes to cater to these new segments.

E-Commerce grows post-pandemic, but is driven by frequent shoppers

Online shopping has continued its growth in the post-pandemic years. But we found that consumers who make daily or near-daily online purchases are driving the growth.

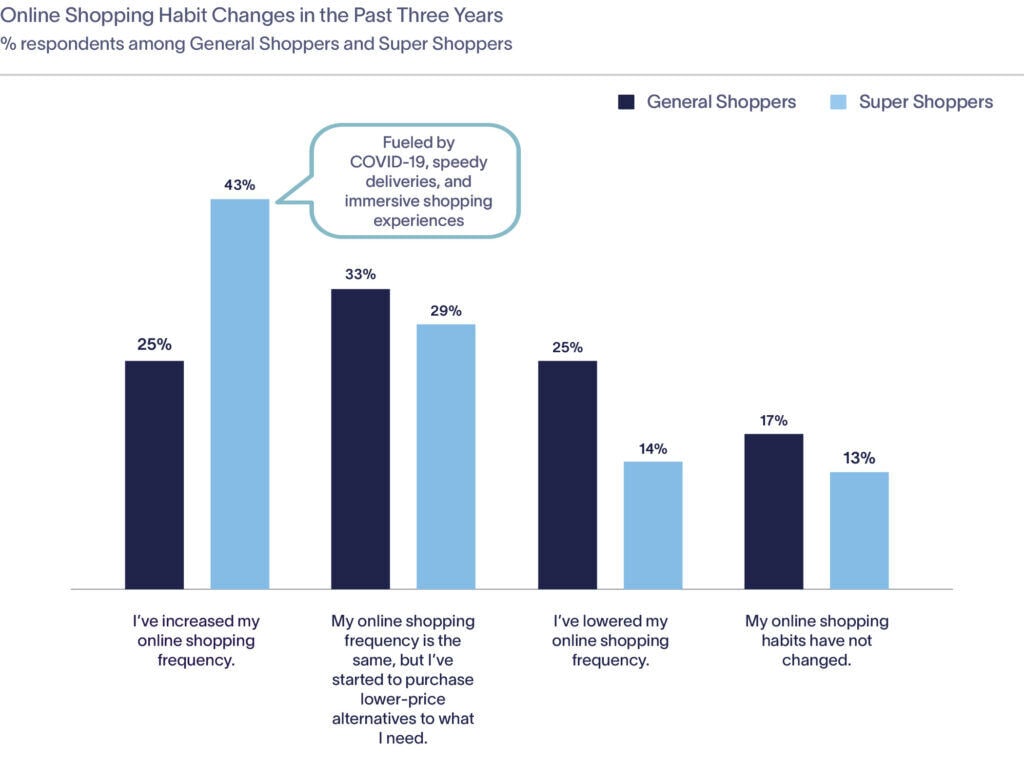

Since the pandemic’s start, nearly half (43%) of daily or near-daily shoppers — who we call Super Shoppers — have increased their online purchase frequency — in contrast to a quarter of shoppers purchasing weekly or less frequently.

Who are the new online shoppers?

From fast deliveries to value-based shopping, online shoppers look for different things in their shopping experience. We introduced the concept of Super Shoppers in last year’s survey. As we expanded the survey’s scope for 2023, five additional profiles of online shoppers have emerged from the data: Thrill Shoppers, Green Shoppers, City Shoppers, Rural Shoppers, and Suburban Shoppers. Since it’s possible for shoppers to align with multiple profiles, online retailers must embrace adaptable and holistic strategies to serve these multifaceted shoppers.

Super shoppers

As online shopping has become more sophisticated, so have the customers. This is particularly true for Super Shoppers, who are no longer only interested in getting the best deal or the convenience of online shopping. Super Shoppers want their orders now. Not only do the majority (59%) of Super Shoppers say fast shipping is important, but they also expect it — and will cancel orders that won’t arrive quickly enough.

How to reach super shoppers

Super Shoppers are demanding shoppers, and their money talks. They aren’t hesitant to pay up to a 5% premium for items in their e-carts if shipping fees are included. But their focus isn’t only on “free” shipping; it’s also on quick delivery. Super Shoppers won’t hesitate to wholly abandon their cart if fast delivery isn’t an option — and will pay more for fast delivery. Even if well-priced, retailers will lose out on orders if they don’t meet the consumers’ need for speed.

Super Shoppers’ impatience extends beyond the need for quick deliveries. It’s also captured by social media, and retailers can leverage social media to influence more Super Shoppers’ purchases. When products in social media advertisements appeal to male Super Shoppers, 86% want to purchase them immediately — compared to 70% of female Super Shoppers. Online retailers must capitalize on their impatience by coupling effective, targeted social media ads with quick and easy checkout.

Thrill shoppers

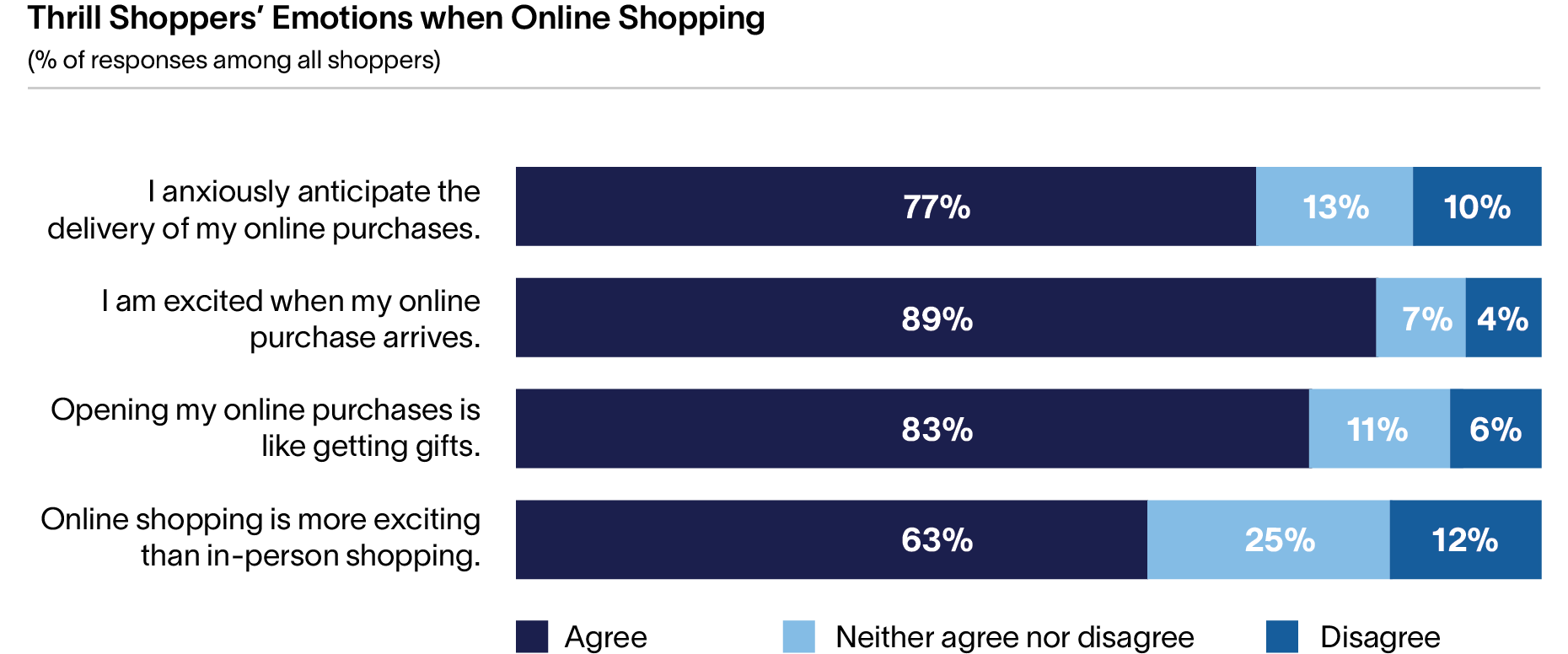

Passion purchases have long been associated with the sensory experience of brick-and-mortar shopping. But the survey shows that half of all shoppers find online shopping more exciting than brick-and-mortar shopping. The result: The Thrill Shopper, who experiences dopamine spikes when making online purchases.

Thrill Shoppers aren’t just buying stuff online; they’re all about the excitement that comes with it. Thrill Shoppers compose over three-fourths of all shoppers (77%) who anxiously anticipate their deliveries and the 89% who are bursting with excitement upon their arrival. The delivery is not just a package to these Thrill Shoppers, as 83% of all shoppers say that ordering online purchases feels like getting a gift.

How to reach thrill shoppers

For Thrill Shoppers, the boundary between clicking “buy” and the hands-on experience is blurry, and online retailers must embrace strategies to cater to thrill-seeking shopping styles. For retailers, it’s a chance to create experiences — like a more theatrical unboxing process — that tingle the shoppers’ senses and keep them coming back. Reaching Thrill Shoppers necessitates a holistic approach that combines anticipation, engagement, social connection, and a touch of urgency to engineer an experience that engages them from the virtual cart to the unboxing moment. Online retailers must reevaluate the supply chain — from start to finish — to understand how it capitalizes on shopper emotions.

Green shoppers

In recent decades consumers have continued to prioritize retailers and products that reflect their values, like a commitment to sustainability and fair trade. Online shoppers are as interested in how products are made as in how they arrive on their doorsteps. The Green Shopper values products shipped in sustainable materials and is willing to pay more for shipping that is eco-friendly. While nearly half (47%) of Green Shoppers prefer expedited delivery, they will not compromise their eco-values for the sake of speed. However, Green Shoppers are not above impulse buys, much like Super Shoppers. Nearly three-fourths of Green Shoppers will immediately buy products in social media ads if they appeal to them. Green Shoppers strive to balance indulging in the impulses of the digital world with their sustainable principles.

How to reach green shoppers

To effectively engage Green Shoppers, retailers must adopt an eco-value-led strategy. Transparency in the delivery supply chain is key to fostering loyalty and trust with Green Shoppers — from clear information on how vendors make the product through its journey to the customer. Since Green Shoppers want more eco-friendly shipping options — and are willing to pay more for it — online sellers should collaborate with supply partners on providing more “last-mile” delivery options — similar to what Amazon now offers. They could also rebrand slower, more sustainable shipping options as eco-friendly, much like mobile driving apps offer slower routes that use less fuel.

City shoppers

The retail shutdowns during the COVID-19 pandemic and the related shift to work-from-home have shuttered thousands of urban stores or pushed them into the suburbs. As a result, City Shoppers have fewer choices for in-person shopping than they did at the start of the decade. As a result, City Shoppers are focused on applying the speed of in-person shopping to the web: nearly all City Shoppers (96%) prefer or even expect their deliveries to be as fast-paced as their lives, with nearly three-quarters getting most or all of their purchases the next day. On top of that, half of City Shoppers are willing to open their wallets a bit more to guarantee same-day delivery.

How to reach city shoppers

To effectively tap into City Shoppers’ preferences and cater to their fast-paced lifestyles, retailers must position themselves as a time-saving solution — prioritizing convenience and delivery speed. Emphasizing the availability of fast delivery may draw in more City Shoppers. As a result, retailers should ensure the supply chain is nimble enough to keep up with the potential uptick in demand. This would include ensuring their inventory management is optimized to keep popular items in stock, reducing the potential for unmet customer expectations. By effectively communicating this to the City Shopper segment, retailers can tap into the desire for convenience and efficiency that City Shoppers prioritize, ultimately fostering greater customer loyalty and satisfaction.

Rural shoppers

Rural Shoppers are a distinct segment of online customers with unique needs. Big-box stores or shopping centers are less accessible than in urban or suburban areas. While Rural Shoppers shop equally online and in brick-and-mortar stores, the relatively limited hours of local stores fuel the overwhelming majority (86%) of Rural Shoppers to turn to e-commerce stores for their 24/7 access. The pandemic only underscored the importance of e-storefronts for Rural Shoppers, with a third increasing their online shopping frequency. For Rural Shoppers, product accessibility is what draws them to online shopping. Over half cite shipping speed and 65% cite free shipping as a key non-price-related criteria for their e-purchase decisions. However, Rural Shoppers are unlikely (46%) to pay a premium for a product if it includes shipping.

How to reach rural shoppers

Online retailers should leverage the scarcity of brick-and-mortar retail options when reaching Rural Shoppers. This could range from optimized websites for easy product discovery — as you would in the aisles of a big-box store—to virtual shopping assistants to provide personalized recommendations. Since free shipping is a critical factor in Rural Shoppers’ purchasing decisions, retailers should incorporate shipping costs into pricing strategies instead of imposing a premium or even a shipping fee. Transparent and predictable final costs will win over shoppers in rural areas, which since the pandemic have seen significant population growth from more populated areas.

Suburban shoppers

Suburban Shoppers may have more options for local shopping — especially with the migration of chain retailers from cities — but their shopping habits still gravitate towards online stores (71%) over brick-and-mortar shops. Within this significant proportion of online purchases, Suburban Shoppers note a reduced frequency of buying home furnishings, décor, and goods (80%), as well as clothing and fashion accessories (76%), a trend attributed to the current economic climate. Notably, alongside the allure of free shipping, these shoppers prioritize purchase decisions based on product reviews (48%) and shipping speed (49%).

How to reach suburban shoppers

To effectively target Suburban Shoppers, online retailers should prioritize their online presence with user-friendly websites and apps. They should tailor their product offerings to align with the preferences of Suburban Shoppers while considering the current economic climate, by offering budget-friendly options, value-driven bundles, or practical and utilitarian products. Actively responding to customer reviews — and highlighting positive ones — to inform purchase decisions remains crucial, along with fast shipping options and free shipping incentives. If the migration of stores from the city to the suburbs continues, online retailers will need to ramp up efforts to retain and attract this important customer segment.

What does this mean for e-commerce vendors and their supply chain partners?

Understanding these consumer profiles is critical but also requires a recognition that these new consumers often have overlapping profiles. Servicing the modern online consumer — regardless of profile — requires retailers and their supply chain partners to stay flexible and well-informed to optimize consumer demands beyond the product itself. Companies that manage the supply chain services for product fulfillment will require a network of nimble systems, processes, and data insights to balance customer experience with optimizing costs.

The survey data reveals that retailers should be asking themselves the following questions:

- For which customer segments should I prioritize free and fast delivery? Super and City Shoppers are the biggest fans of free overnight delivery.

- Should we offer eco-friendly packaging or provide sustainability certifications that describe where and how all products were sourced? Green Shoppers are more likely to pay a premium for eco-friendly packaging and fair-trade policies

- Should we invest in more social media advertising? For products targeted at men, social media ads are an effective way to generate business, according to survey data.

It is important for online retailers, in collaboration with their supply chain partners, to develop a flexible, agile, and lean supply chain. To make this happen, retailers should implement these approaches simultaneously:

- Foster deeper collaboration and partnerships across the end-to-end ecosystem, managing and mitigating supply chain risks through integrated supply chain planning. Retailers can support that effort by developing flexible terms with supply chain partners that benefit both sides as businesses scale up — also working to protect each other from new competitors. In the new e-commerce era, companies need to anticipate sudden peaks and valleys in demand and develop multiple supply chains, from agile to lean. An agile supply chain focuses on responding to the market demand with smaller, customizable batches of items. Based on our analysis of the cost-conscious levels of various customers, retailers must recognize which type of customers they need to reach — and how data can inform the best way to reach them.

- Audit supply chain capabilities and use that information to scale up the entire store-to-door experience. This should eliminate constraints across critical processes, allowing retailers to scale up the supply chain by focusing on the 3Vs: improve visibility across the supply chain; increase data/product velocity from orders to delivery; and reduce variability to manage costs and ensure a consistent customer experience.

- Manage real-time data (low latency, metric-driven, supply chain event management) and invest in data capabilities, especially if considering and integrating cognitive, advanced data analytics capabilities across the supply chain. Data will play a critical role in enabling retailers to deliver improved customer service, smoother operational efficiency/lower costs to serve customers, and gain a competitive advantage in their e-commerce marketplace.

As the overall retail marketplace continues to evolve post-pandemic, savvy e-commerce providers can grow by adapting supply chain capabilities around changing consumer preferences. From speedy delivery to increased transparency on price and environmental impacts, online retailers are taking a closer look at consumer purchasing trends and creating a customized shopping experience for all consumer profiles.