The “Big Three” have much at stake in the cloud but each is taking very different approaches to implementing their strategies.

Ultimately, the victor may not be determined by the providers themselves but by how well they collaborate with the partner channel. Estimates of the percentage of cloud sales attributed to partners range from ~30% to as high as 80%, providing a significant opportunity for small to mid-sized channel partners to benefit from the growth of public cloud.

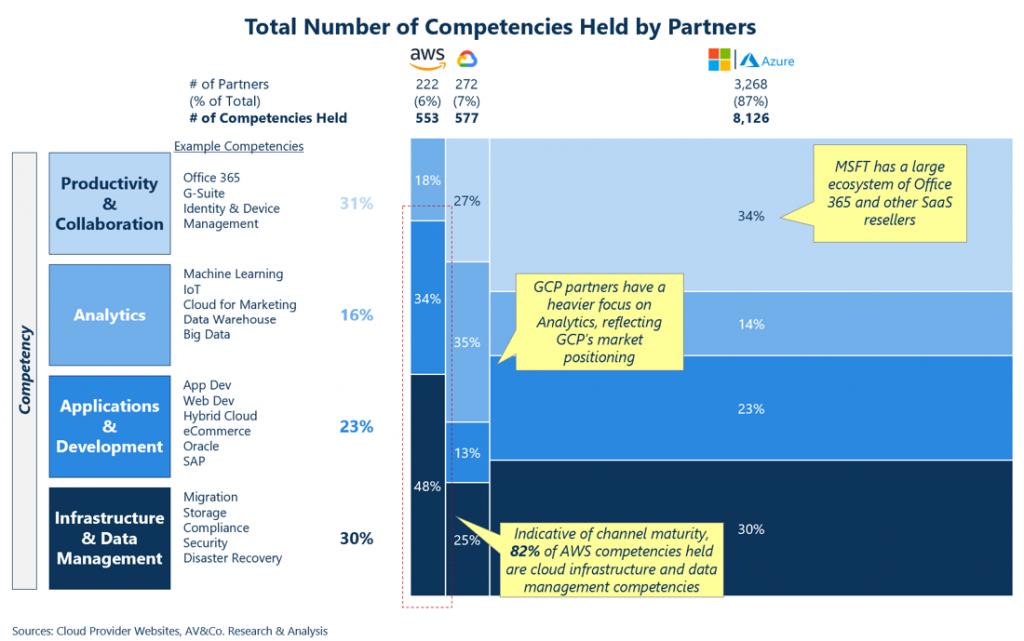

The Big Three partner channels will evolve further to address differences between them, including Amazon Web Services (AWS) partners’ relative maturity in core IaaS/PaaS services, Microsoft Azure’s large partner program leveraging its legacy in collaboration and communications, and Google Cloud Provider (GCP) partners’ advanced analytics positioning. Various stakeholders in the rapidly evolving partner channel stand to gain by addressing the scarcity of specific competencies as well as by addressing customer demand to deploy multiple-cloud platforms. The Big Three will look to the partner channel to extend relationships with customers beyond IT transactions and address customers' business needs – which will ultimately drive more adoption of cloud services.

Serving the cloud with partners

Cloud providers typically work with two types of partners: service partners and technology partners. Our research focused on service partners, who implement, deploy and manage public cloud resources for customers. Service partners range from those who can work on core IaaS/PaaS-related migrations and deployments to those who implement and/or manage advanced machine learning analytics deployments.

Service partners’ competencies fall into four categories:

- Infrastructure & Data Management – IaaS-focused services such as cloud migration, data backup, and high-performance computing.

- Application & Development – PaaS-focused services such as application development, and cloud-based mobile/web development.

- Analytics – advanced services such as data analytics, AI, and machine learning that help customers digest the massive amounts of data they pull from the cloud.

- Productivity & Collaboration Tools – tangential SaaS tools such as Office 365 and G Suite that help cloud platforms’ products win a higher share of the end customers' IT spend.

Big share, big partner channel differences

The Big Three rule the cloud with a combined U.S market share of 73% in 2019, forecasted to grow to ~85% by 2023. In addition, cloud revenues for these providers were critical to the overall growth of their companies. All providers heavily rely on service partners to scale revenue, provide value-added/vertical-specific services, and develop apps. The structure of these partnerships, however, varies greatly from provider to provider.

AWS has built an ecosystem of 222 U.S. and U.K. cloud-certified service partners driven by strong demand for its cloud offering. The service partner channel drives nearly a third of AWS sales and has a support organization of ~2,000 staff. Its channel, the first to rapidly develop among the cloud players, is highly focused – 82% of competencies held – on core IaaS/PaaS-related Infrastructure & Data Management, and App Development (see figure 1).

Microsoft’s Azure, the most ‘partner-friendly’ cloud provider, has about 3,300 U.S. and U.K. cloud-credentialed service partners who sell, assist with migration, and manage customers on Azure. Azure’s partner network is critical to its success, with a majority of its sales originating through partners. Having built this channel by enabling its network of legacy reseller partners to provide cloud service, Azure’s ecosystem today is largely composed of single-competency partners who are focused on Productivity and Collaboration (i.e., Office 365).

GCP has rapidly acquired about 272 U.S. and U.K. cloud-credentialed partners with slightly more aggressive economic incentives than its two counterparts and has about 500 staffers to support this channel, which contributes 35-45% of GCP’s sales. Given Google’s Big Data legacy, its partners are far more focused on analytics than its competitors: 35% of all Google cloud competencies are analytics-focused versus approximately ~15% for Azure and AWS.

Big three make big bet on partners, revealing opportunity

Since the Big Three providers rely on partner channels, partners are faced with many opportunities to create value. AWS and Azure have mature partner networks but will continue to work with partners to drive sales, while Google is still looking to expand its partner channel.

Partners need to stand out in the market and specialization can help do that. Partners can seek to receive awards from cloud players or higher tier partner status that could differentiate them in a competitive sales process. For instance, only ~50% of Azure partners have the ‘Gold’ certification in their competency, providing an opportunity to upgrade partner credentials.

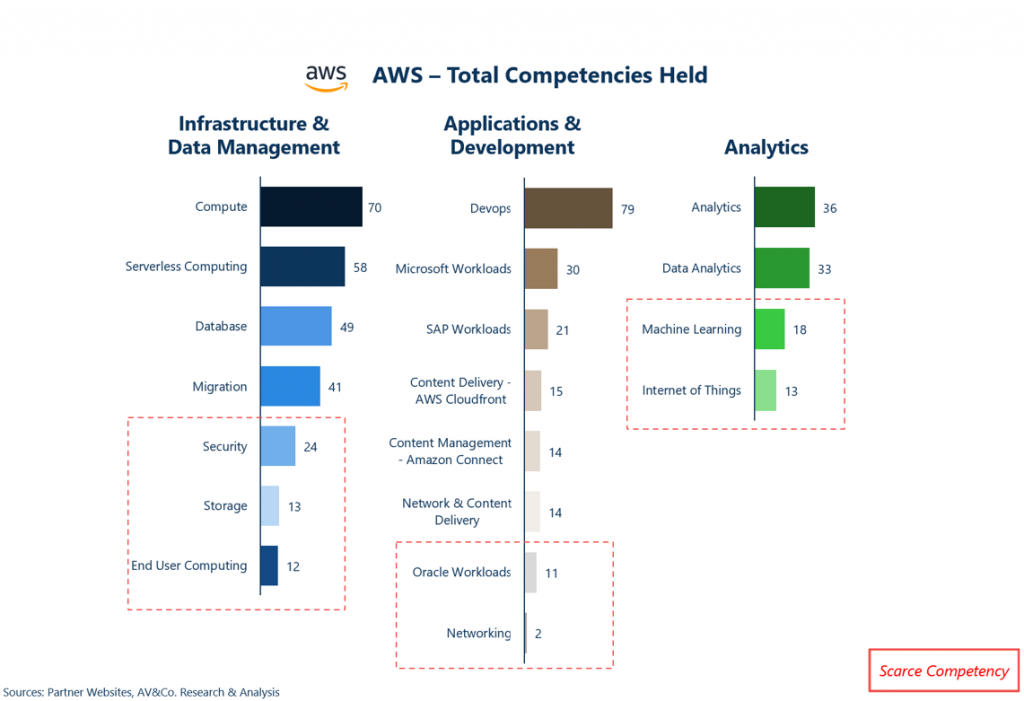

There is an opportunity for partners in under-indexed verticals to upskill/step up and win business in an under-developed vertical for a specific provider. For example, only ~1% of Google’s service partners currently serve the public sector cloud, so those that do serve the vertical could be attractive to Google as it pursues AWS in that vertical. Furthermore, as IaaS/PaaS adoption grows, partners who can shore up competencies that are scarce in the partner ecosystem stand out in the marketplace. For example, in the AWS channel ecosystem, Security, experience with Oracle workloads, IoT, and Machine Learning are noteworthy competencies that are ‘scarce’ (See Figure 2).

Partners could add Value-added/Advanced Services Specialization, like Data Analytics, enhancing their ability to cross-sell and up-sell cloud services. AWS and Azure partners could benefit from developing advanced analytics services to help their cloud partners compete with Google in that space; only about 30% of AWS and Azure service partners are currently certified with advanced analytics competencies versus 72% of GCP service partners.

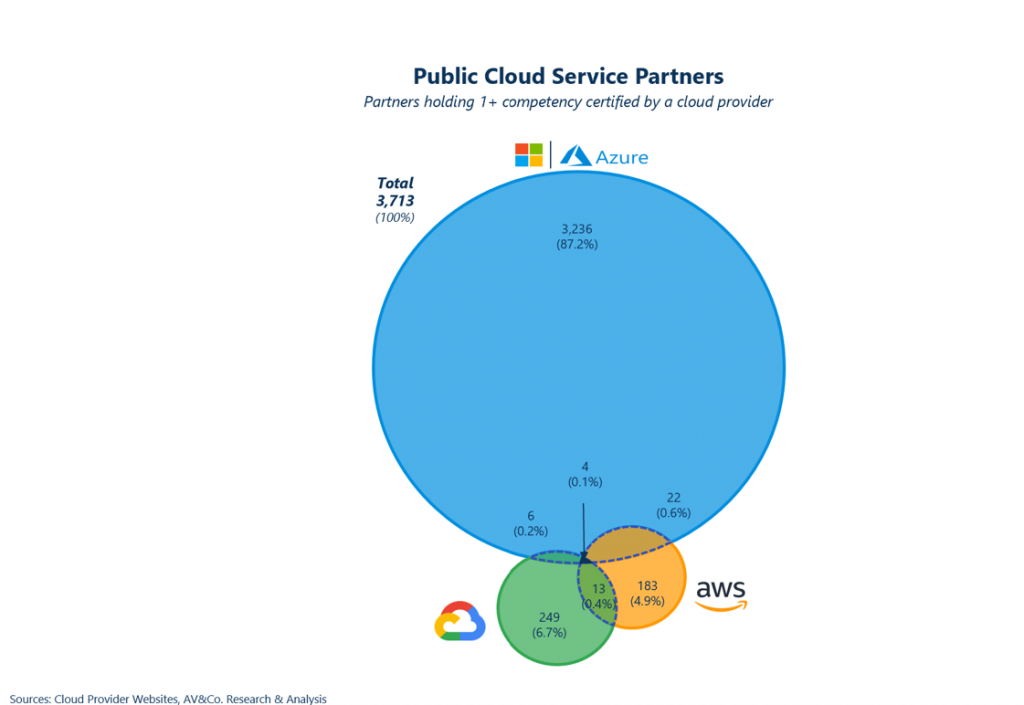

Lately, spurred by customer demand for not concentrating services in one cloud provider, there has been more openness to multi-cloud partners by providers, who no longer shy away from partners who work with their competitors. A small portion (~1%) of cloud-credentialed partners hold competencies in more than one cloud provider’s ecosystem, indicating significant opportunity (See Figure 3).

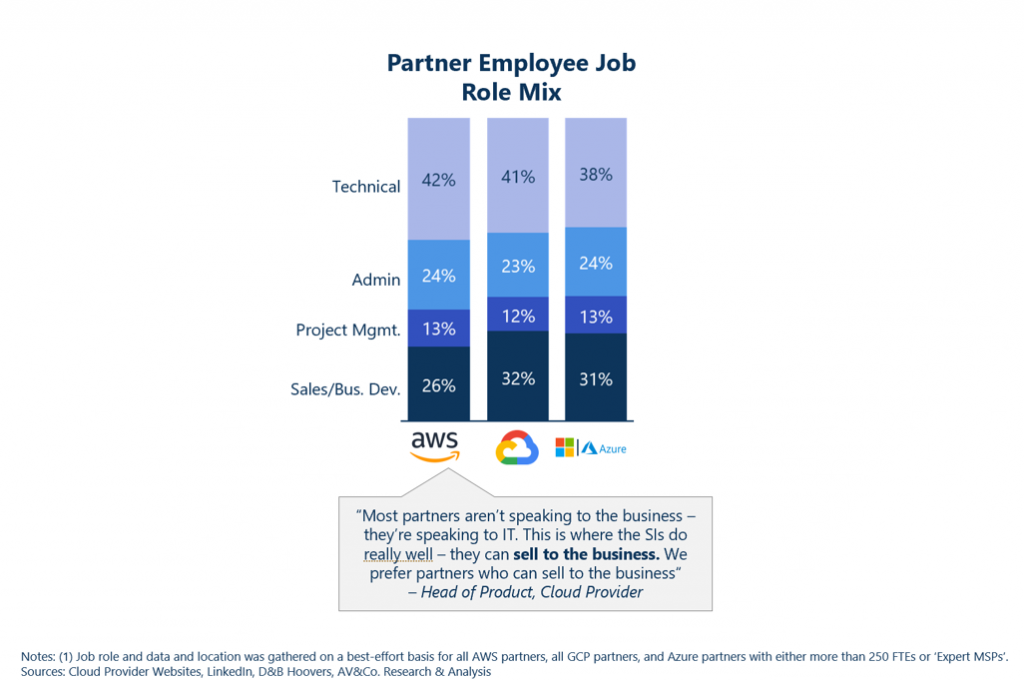

While a partner’s technical capabilities are critical, strong go-to-market is still very important. Specifically, sales matter, and partners who can “land and expand” will always be in demand and be rewarded with attractive economics and deal flow. Providers have cited a preference for partners who can drive sales and penetration of accounts by selling to both IT and business functions, helping customers increase cloud adoption and consumption (See Figure 4).

What this means for …

The public “Cloud Wars” will be waged by companies with trillions of dollars in combined market valuation, but smaller companies will be critical to the success of the Big Three. Here are some opportunities for select categories of players in the public cloud ecosystem:

Channel partners

- Earn competencies to address gaps/scarcity in the ecosystems referenced in this report, and better support customer cloud deployments

- Only ~13% of AWS and ~5% of GCP analytics competencies held are in Machine Learning and IoT, making them scarce competencies relative to others

- GCP partner ecosystem lags Azure/AWS in infrastructure and app development competencies and can seek to scale these competencies to serve customer cloud adoption

- Develop competencies across clouds, particularly in a world of multi-cloud (Only 1% of credentialed partners currently hold competencies across cloud providers)

- Mitigate long-term risk of margin erosion by limiting dependence on a resale model and building robust service businesses that position partners as trusted advisors to customers

- Look to invest in upskilling workforce and talent recruitment to keep up with newer features of cloud technology

Investors

- Consider a “Platform investment” to enter the market. There are numerous rapidly growing (>30% revenue CAGR) companies of meaningful size (250-750 FTEs, $25-100M Revenue) that have already established their position in the market.

- Identify channel partners that hold high value and scarce competencies across multiple clouds and evaluate potential roll-up opportunities to capitalize on customer demand for multi-cloud and scarce competencies

- AWS or Azure channel partners with analytics competencies are potentially attractive targets as the cloud ecosystems develop to ‘catch up’ with the penetration of analytics in GCP’s ecosystem

Our research

Recognizing the relevance of the partner channel in the rapidly growing cloud market, Altman Solon has developed a proprietary database of 3,700+ partners that serve AWS, Azure, and GCP in the US and UK markets. Data on channel partner revenue/growth, ownership, employee role types/geographies, and technical competencies was aggregated from 7+ sources and collated into an analyzable format.

Leveraging an analysis of this dataset and augmenting with other primary and secondary research and our deep experience and knowledge base in the space, Altman Solon has developed critical insights about opportunities and gaps for various stakeholders in this industry. These insights enable us to serve clients in the development of cloud strategy, go-to-market, and operations as well as M&A identification and assessment for strategists and investors.

Contributors

Karthik Ayyagari, David Paasche, Robert Perry, and Danny Gridley