The automotive industry, dominated by the internal combustion engine (ICE) for over a century, is now charging toward an electric future: U.S. sales of electric vehicles (EVs) more than doubled in 2021 – with growth in Germany and the U.K. close behind – building on a banner year in 2020. According to findings from Altman Solon’s most recent Connected, Electric, & Autonomous Car Survey, this surge in EV sales signals a tipping point in global automotive consumption trends.

Surveying over 2,400 car owners across the U.S., U.K., and Germany and featuring interviews with global automotive industry executives, the report shows the U.S. is starting to trend toward mass adoption of EVs – while still trailing Germany and the U.K. – with consumers across all three markets equally interested in EVs despite sharing anxieties related to the driving range, public charging infrastructure, and price. The survey reveals that manufacturers must better educate the public on the benefits of EVs. As one leading product engineer said: ”The biggest hindrance towards EV adoption is the lack of knowledge and education around the space.”

Electric vehicles gain a foothold in the U.S., slowly catching up with European countries

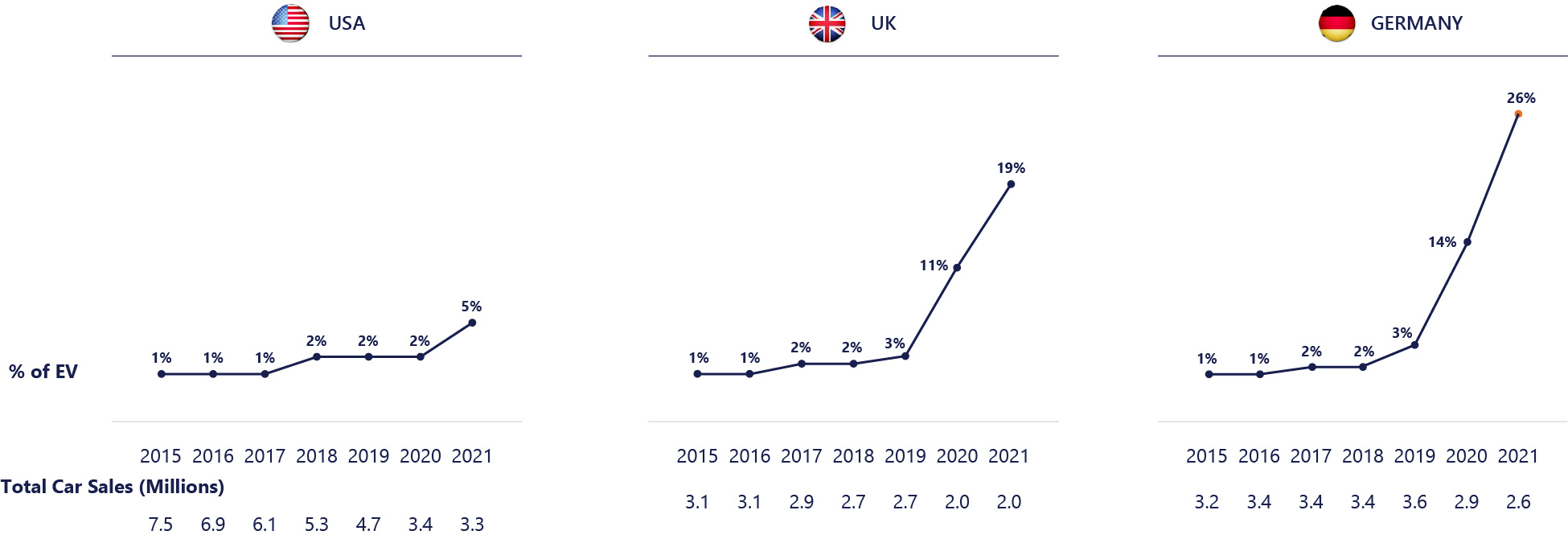

Overall, EV sales in the U.S. more than doubled from 2020 to 2021, from 295,000 to more than 630,000, making up 5% of all new cars sold. This growth reversed a downward trend during the pandemic, which saw overall car sales sag due to supply chain challenges. In Europe, EV sales also saw tremendous growth, with U.K. sales jumping from 3% of new vehicle sales in 2019 to 19% in 2021 and even greater growth in Germany – from 3% to 26% – during the same period.

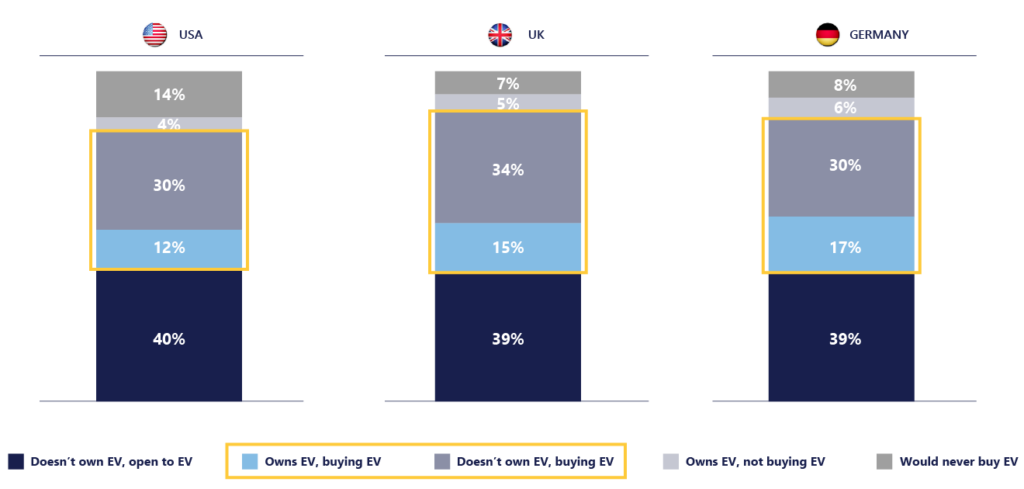

Even though the share of EV sales in the U.S. trails Germany and the U.K., 5% has historically represented a threshold to mass adoption in European and Asian countries and could foretell a similar jump for EVs in the U.S. market. Indeed, consumer interest in electric vehicles is similar across all three markets, with roughly 40% of consumers who don’t own an EV saying they’re open to buying one. However, the U.S. has the highest share (14%) of respondents who do not own an EV and never intend to purchase one.

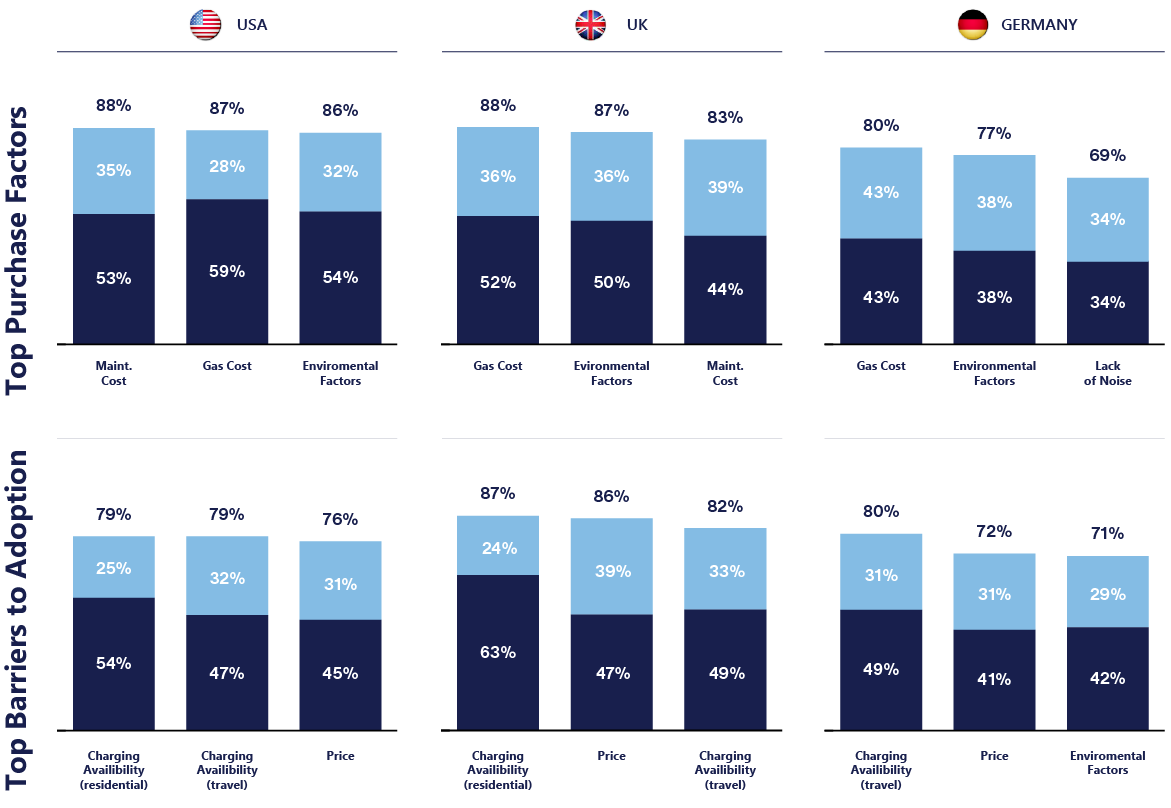

Motivations of EV purchasers are consistent across all three markets, with buyers stating lower maintenance costs, lower gas costs, and environmental factors as key criteria in purchasing a vehicle. Similarly, criteria affecting consumers’ refusal to buy an EV are the same across the three markets, with charging availability and price as the main barriers to adoption.

Consumer anxieties over battery range, charging infrastructure, and price threaten to dent future EV growth

”Range anxiety,” or the fear that a vehicle will run out of battery before drivers reach their destination, is a significant concern for consumers – with 86% citing this as a reason not to purchase an EV. This fear is partly exaggerated due to poor awareness, with 36% of U.S. respondents underestimating EV range versus 43% in Germany and 56% in the U.K. At the same time, the true median range for vehicles in 2021 was over 200 miles, well within consumers’ daily average driving time of fewer than 45 minutes. U.K. respondents spend even less time in the car than German or U.S. respondents and have the biggest misperceptions about EV’s range. Of course, range anxiety goes beyond the daily commute, but the perception gap suggests that EV manufacturers would do well to communicate more clearly about their vehicles’ range.

Even though consumers need clarification on electric vehicle range, they accurately perceive the lack of supporting infrastructure. Indeed, compared to leaders in public EV infrastructure – like Korea, Mexico, and Indonesia – Germany, the U.K., and the U.S. have underdeveloped public charging infrastructures. This is a challenge given that approximately half of the EV owners surveyed charge their electric cars away from home. However, governments in all three markets have made strides toward accelerating public charging stations. All countries have seen a compound annual growth rate (CAGR) of charging stations of approximately 40% over the past six years. The U.S. has been the slowest to grow public charging stations, but Congress approved $7.5 billion to build a network of half a million charging stations through the 2022 Bipartisan Infrastructure Law. As of March 2023, grants have been made available with a particular focus on building the charging network beyond highways and high-population areas. In addition, the U.S. Department of Transportation and the Department of Energy enacted a series of measures to standardize fragmented EV charging infrastructure.

Likewise, both the German and U.K. governments are continuing to invest aggressively in public charging infrastructure, with the German government pledging to invest €6.3 billion ($6.1 billion) to reach one million public charging stations by 2030, and the U.K.’s Department for Transport investing £450 million ($558 million) to increase charging infrastructure tenfold by 2030.

Unlike ICE vehicles, which can be fully refueled in minutes at gas stations, an AC public charging station in the U.S. can take 2.5 to 5 hours to achieve the charge necessary for 50 miles. DC Fast charging stations, which can charge an EV to 80% capacity in 20-60 minutes, only make up 20% of U.S. public charging ports.

Finally, the upfront cost of EVs has been a deterrent to some consumers. The transaction price for EVs in the U.S. is, on average, approximately $10,000 above equivalent ICE vehicles due to the cost of electric battery packs. However, electric battery prices declined by 66% between 2015 and 2021, going from $393 per kilowatt hour in 2015 to $132 per kilowatt hour in 2021. That trend has accelerated in recent months, prompting talk in the media of an EV “price war.” In February, Tesla announced the list price of its entry-level Model 3, which costs nearly $5,000 less than the average new vehicle in the U.S., before government incentives.

U.S. EV buyers also received help through the infrastructure bill with the renewal of federal tax rebates, which are now restored for certain Tesla, Ford, and GM electric vehicle models after they ceased being qualified for the rebates upon exceeding the previous sales limit.

Plug-in hybrids offer another path to achieving many EV benefits while being less exposed to battery prices and sidestepping “range anxiety” concerns. However, the EV range for hybrids is typically under 30 miles, falling short of most commutes, and the need for both a conventional drivetrain and electric motor means these vehicles still cost more than their ICE equivalents.

Meanwhile, for all-electric EVs to be consistently cost-competitive with ICE vehicles upon purchase, battery prices would need to reach $100 per kilowatt hour. While the cost of battery packs is expected to decline, factors including supply chain constraints, demand for batteries, and tech advances will affect how cost-competitive EVs will be in the future. Furthermore, total cost savings in maintenance and fuel for EVs vary widely and depend on local fuel price levels, power prices, and available tax breaks, among other factors not explored in the survey.

Charging infrastructure investment, subsidies, and consumer education are necessary for mainstreaming EVs

With Toyota reportedly launching an EV-only manufacturing platform, MotorTrend naming the Ford F150 Lightning EV 2023’s ”Truck of the Year,” and more luxury manufacturers jumping on the EV bandwagon, electric vehicles are poised to go mainstream. However, EVs have a long way to go before they overtake ICE vehicles. Reinforcing charging infrastructure and, when applicable, subsidies that alleviate upfront costs can further entice consumers to go electric. In parallel, manufacturers and advocates would be well served by more consistently emphasizing EV range, availability of public charging stations, and any consumer subsidies to quell common anxieties from buyers. As gas prices continue to fluctuate – and more non-EV owners express interest in purchasing one – manufacturers have a unique opportunity to onboard a new cohort of drivers to electric vehicles.