Amazon created a hullabaloo in early 2023 when it unveiled a new policy of charging one dollar for each returned order. While Amazon only applies this return fee if the consumer fails to partake in available free return options, it still felt like a harbinger of change for e-commerce’s ubiquitous free-returns culture that was pioneered by Amazon.

Altman Solon’s 2023 Store-to-Door Survey shows that returns continue to be a significant pain point for online shoppers, but also highlights opportunities for retailers to stand out with more efficient processes and flexible return policies. What’s more, the most frequent online consumers (who we call Super Shoppers) say they often make decisions on where to shop based on return policies – meaning retailers may be losing customers without realizing it due to rigid return rules.

The good news is that there are steps retailers and their supply chain partners can take to reduce the frequency and internal costs of e-commerce returns, in part by nudging consumers into new habits, as well as by implementing a pain-free returns policy that attracts new consumers and satisfies even the most sophisticated shopper.

Reduce unforced errors

Customer fickleness has always been a reason for returns, but more of today’s consumers are initiating e-commerce returns due to kinks in the delivery supply chain itself. The survey shows that 25% of shoppers returned packages due to damage vs. 11% in 2022. Similarly, 17% of shoppers returned packages because the wrong product was delivered compared to 8% last year. This data provides evidence that disruptions in the transportation and distribution process are creating more unnecessary returns, further complicating the supply chain and inconveniencing customers.

Moves for retailers and supply chain partners

Retailers have an opportunity to leverage innovations to reduce hiccups in their supply chain that are ultimately leading to more e-commerce returns, including:

- Integrating robotics and other warehouse technologies to ensure products are packaged correctly to reduce damage

- Implementing pick/pack technology – including augmented reality and other visual packing aids – to get the right product shipped in the first place

- Investing in or partnering with vendors boasting strong last-mile capabilities to reduce delivery times

Make returns less costly

No matter how much effort retailers and supply chain partners commit to reducing returns, they are inevitable in the e-commerce world. In 2022, returns in the U.S. retail market accounted for nearly $816 billion in lost sales. What’s more, they come with added shipping costs, restocking fees, and staff time spent on returns. Retailers must first find ways to make them less costly.

Moves for retailers/supply-chain partners

Online retailers can save money through streamlined returns processes by:

- Providing value-added services for shoppers in the form of self-print labels for end customers – a tactic leveraged by some retailers today.

- Facilitating omni-channel returns & inventory rotations (store/store, store/customer, etc.), improving sales and cutting costs – currently in earlier stages of adoption.

- Charging an additional fee for returns through at-home pickup, passing the cost incurred in restocking off to the customer.

There’s value in options for shoppers quick (and slow) to returns

Survey findings show that fast delivery continues to be a big deal for shoppers, with 60% of Super Shoppers citing next day delivery as a top priority. But fast e-commerce returns also matter to consumers: the frequency of general shoppers who return packages within a week has nearly tripled since 2022 (23% to 67%). Thus, making this process as seamless as possible is crucial for retaining customers and capturing share among the general and super shopper segments.

When asked about pain points in the returns process, consumers identified printing return mailing labels as the second most common obstacle, especially as fewer households have printers today. Providing pre-printed labels can make returns less frustrating, especially for younger shoppers who may be making more purchases online.

Moves for retailers/supply chain partners

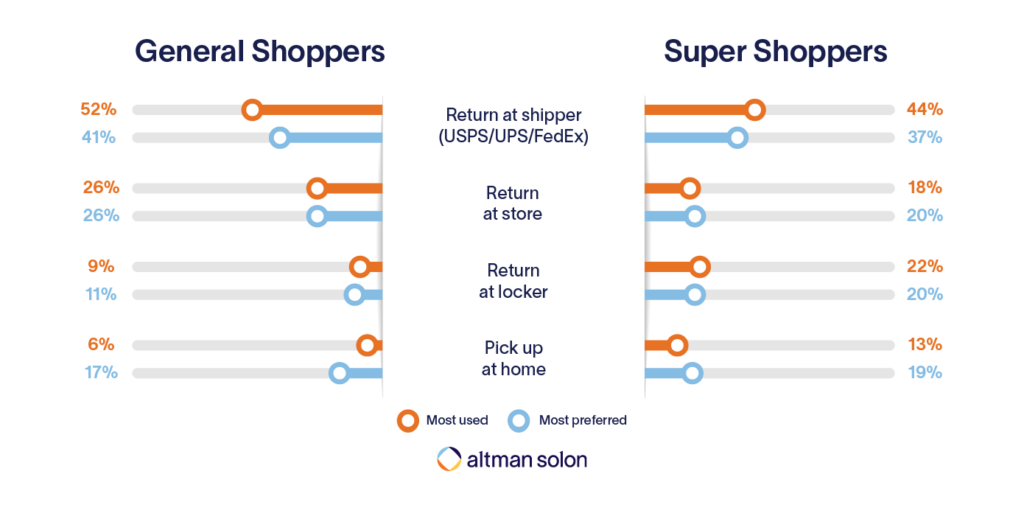

Despite e-commerce’s obsession with speed, retailers can slow it down when it comes to returns by encouraging customers to use common collection options, like lockers, their own brick-and-mortar stores, or third-party retailers. The survey confirms that regular online shoppers crave more options for return locations. Super Shoppers are more than twice as likely (22%) to make a return at a locker than general shoppers (9%), making them an effective way to attract frequent online consumers. Packages collected at these sites have less urgency to be picked up, meaning retailers can wait until more packages are dropped off and use bulk or slower shipping options to reduce costs.

For both Super Shoppers and general shoppers, a significantly higher percentage of consumers identify at-home returns as a favorite practice than those who employ it regularly. Validating a trend that has evolved since 2022, the survey findings highlight a gap between current use and consumer preference for at-home pickup as a return method. Both Super Shoppers and general shoppers over-indexed on preference for this as a return channel, despite lower adoption compared to alternative methods. Investing in last-mile partners to conduct returns could make home pick-up more viable for more consumers and supply chain partners alike.

How can retailers address fickle customers driving up return rates?

What is the strategy for veteran e-commerce customers who view returns as just a part of the online shopping experience, including the 25% of Super Shoppers who return up to 25% of orders? Consumers, particularly Super Shoppers, are resigned to the fact that in many cases, the product they see in digital form will be much different when it arrives on their doorstep. The best way to address this issue is to better replicate the in-person experience online so there are fewer disappointments in real life. Retailers can boost the online store user interface through tools that help shoppers better visualize the product in their everyday lives, replicating the in-person shopping experience through a screen. This includes interactive AR technology like Wayfair’s “View in Room 3D” or Warby Parker’s “Virtual Try-On.”

Cost-effective and consumer-centric: the supply chain of the future

Amazon dipping its toe into charging for returns underscores the challenge and opportunity facing all retailers when it comes to curbing returns. As retailers look to cut costs brought by through returns, and return policies play continue to play an important role in a consumer’s decision on where to shop, supply chain partners should consider:

- Investing in technology innovations that can reduce errors in their supply chain processes, including robotics within their warehouses, pick/pack technologies, and augmented reality tools to aid in packaging.

- Streamlining costs for retailers and consumers alike through self-print labels, omni-channel returns & inventory rotation, and fees for at-home pickup – a return method growing in consumer preference.

- Leveraging common collection options for returns, like lockers, brick-and-mortar stores, and third-party retailers, for bulk pickup and shipping coordination.

About the Survey

Altman Solon’s Second Annual Store-to-Door Supply Chain Survey polled nearly 450 U.S. consumers in early 2023 to explore online purchasing and return habits across consumer segments. Survey findings shed light on online shopping motivations, the impact of social media on purchases, delivery preferences, return methods, and more.