Consumers Prefer Game Platforms for Socializing, Driving Social Media Synergy

April 2022

Insights

We are the world’s largest strategy consulting firm exclusively focused on telecommunications, media, and technology. Our global team delivers data-driven strategies and insights that help clients shape the future of telecommunications, media, and technology.

From interns to experienced hires, see how Altman Solon empowers professionals to shape the future of TMT while building rewarding, high-impact careers around the world.

April 2022

Once localized to arcades and home consoles, the global video game industry is now dominated by online communities that will continue the evolution toward mainstream adoption of digital experiences and entertainment. Furthermore, gaming is benefiting from continued growth in adjacent media formats such as game-related Video-on-Demand (VOD), live-streaming, and communication platforms.

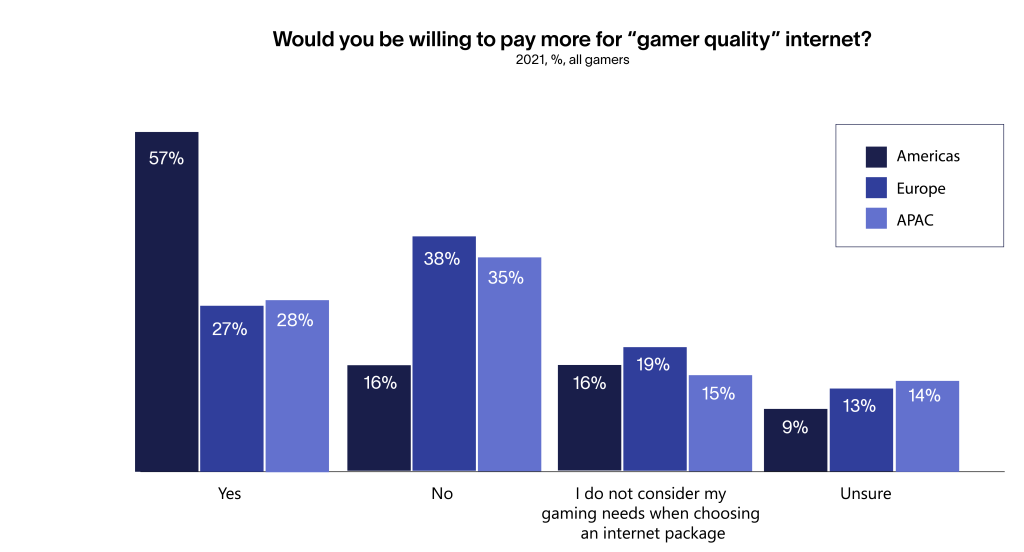

All these services are being enabled by continued investment in broadband and cloud infrastructure, which is reducing the friction of consumer adoption, itself hastened by the stay-at-home guidelines of the pandemic. Operators who provide or enable these digital experiences are likely to be rewarded by consumers, who express a strong willingness-to-pay for gaming-related digital experiences, applications, and infrastructure.

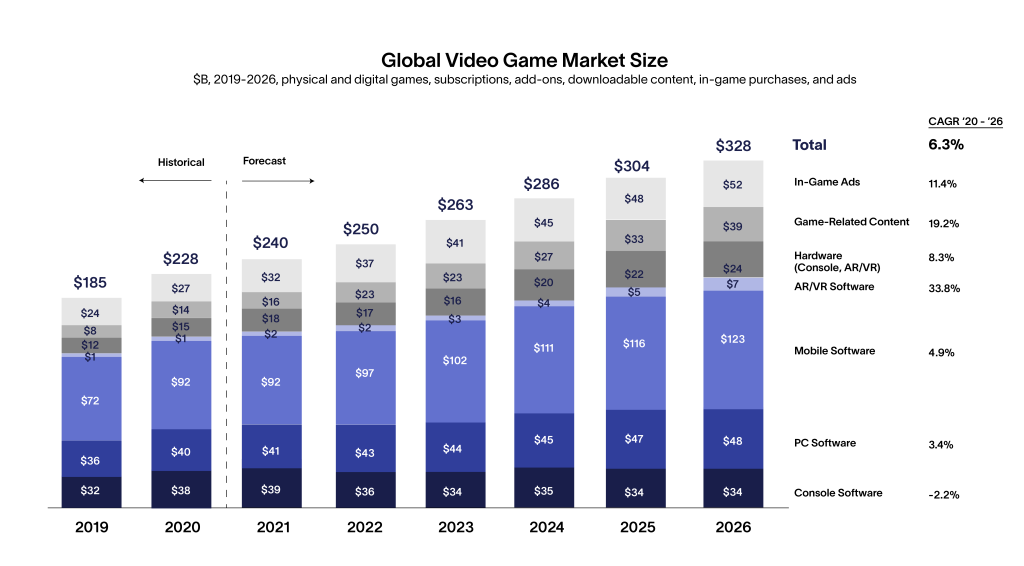

Altman Solon’s new Global Consumer Gaming Survey, which measures consumer behavior and trends within the gaming industry across nine countries, shows that the $250 billion global gaming market is expected to grow by six percent per year through 2026. The survey also reveals that the number of players and average time-spent-gaming increased during the pandemic, with most of the growth concentrated in more immersive games and platforms. Players suggested a high willingness-to-pay for both content and the broadband over which that content is delivered to their connected devices. Survey findings indicate mixed consumer sentiment for early cloud platforms but strong interest in adopting and continuing to explore new digital environments (e.g., GTA Online, Animal Crossing, RuneScape).

The survey polled more than 10,000 gamers in the United States, United Kingdom, China, South Korea, Japan, France, Germany, Brazil, and Mexico. More results will be released over the next several weeks.

In 2021, Facebook’s rebranding placed the Metaverse front and center, with industry players immediately looking to capitalize on the continued shift to digital environments, entertainment, and general digital existence. While the term is new to the mainstream, consumers have already shown an affinity for live online gaming through the MMORPGs of the early 2000s, but adoption of the Metaverse so far has been isolated to only the most die-hard segments.

In order to see mainstream adoption, you need three things: best-in-class networking; a slick device form factor that can deliver low latency; and engaging, immersive content,

Jon Wakelin, Partner at Altman Solon

“Many countries have solved the networking challenge, and the big tech players are racing to find a wireless device that is comfortable and capable of delivering the high bandwidth streams needed for mixed reality. Once the platforms are established, the content will find its way there quickly.”

Altman Solon’s survey highlights the relatively low adoption levels of “next-gen” platforms, with only 39% of gamers having played a VR or AR game and only 45% of gamers aware of cloud gaming technology or providers. However, the survey showed support for the continued migration of gaming and entertainment to online formats. Nearly 3 in 5 gamers play multiplayer online games, and overall 42% of players’ game time is spent online in digital communities. This trend was especially prevalent in APAC countries, where 3 in 4 Korean and Chinese players engage with multiplayer games on a regular basis, and over half of their playing time is spent online.

While awareness and adoption of immersive tech is low today, players are showing strong adoption of current-gen games with inherent social aspects like GTA Online, Animal Crossing, League of Legends, and other multiplayer games.

Laurence Wong, Partner at Altman Solon

“Competitive or not, game players are increasingly seeking out online communities.”

Another trend highlighted by Altman Solon’s survey is the convergence of different types of social media, led in part by game-playing consumers. Nearly 60% of gamers watch some form of game-related video content, including walkthroughs, clips of competitive gameplay, and eSports matches. Nearly eight in 10 (78%) gamers state that watching game-related videos makes them more likely to play the underlying game, while 77% report that playing leads to more watching, highlighting the symbiotic nature of “lean-in” gameplay and “lean-back” video consumption. Moreover, the number of gamers who share gameplay clips on video-sharing websites is expected to double soon, underscoring the rise of user-generated content.

We are seeing a convergence across all forms of social media, with games, forums, image sharing, and live streaming all being used simultaneously as people interact with different aspect of games.

Jon Wakelin, Partner at Altman Solon

“Gamers are definitely leading the way – you can have someone playing Fortnite, using Discord to talk to their friends, checking Reddit to see clips and the latest news related to the game, and watching their favorite pro play the game on Twitch – all within a 60 minute session.”

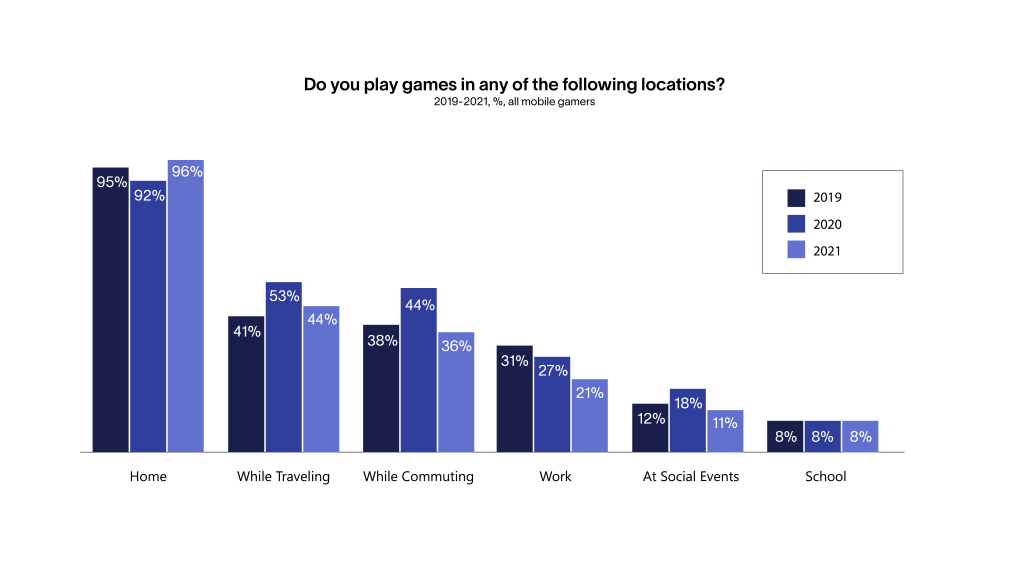

As gamers continue to shift more consumption to mobile devices and play more cloud-hosted and processed games, the need for telecommunications infrastructure will grow. Gamers want faster data plans, lower latency, and availability across their fixed (home) and mobile devices.

The good news is that they’re willing to pay for that better networking experience.

Swope Fleming, Partner at Altman Solon.

The strategy consulting firm’s survey showed that 40% of gamers are willing to pay around $10 more per month for gamer-quality broadband that offers high speeds (1+ Gbps) and low latency. Fleming noted, “Gamers know that internet quality impacts their experience, and if you’re paying $15 a month for Game Pass, what’s another $10? It will also improve the experience in Netflix, TikTok, Zoom, and everything else you’re doing online. New applications and use cases are driving the need for better internet, and consumers are willing to pay for that.”

This should yield opportunities for both consumer-focused broadband providers and infrastructure players that support those services, such as edge cloud operators, data center operators, cell site operators, and other players in the telecom ecosystem.

While COVID-19’s impact on the gaming industry has been widely documented, not all gaming formats benefited equally from the stay-at-home restrictions of the past two years. Altman Solon’s survey shows the biggest gains in consumption during the pandemic occurring on console (50% increase in daily usage) and PC platforms (33% increase in daily usage). By contrast, daily game usage on Mobile only increased by 11%. Moreover, gaming trends on Mobile platforms indicate that hyper-casual games saw a slowdown in growth compared to other mobile and PC/Console games, which saw growth acceleration.

We were seeing a huge trend towards consuming ‘on-the-go’ in mobile up to 2020, with over 50% of mobile players stating they played while commuting to work or traveling,

Swope Fleming, Partner at Altman Solon

“That figure pulled back over the course of the pandemic, and it likely disproportionately impacted short-form hyper-casual and casual games the most.”

Despite the short-term hit to casual mobile formats, overall gaming increased during COVID-19, with 83% of gamers attributing the change to the pandemic and the stay-at-home restrictions. Fortunately for the industry, 25% of gamers expect to play more a year from now, compared to just 12% that expect to play less.

Covid brought new players into the ecosystem, and some of them are going to stick around,

Swope Fleming, Partner at Altman Solon

While COVID-19 served as a short-term boon to the overall gaming industry, trends that saw greater consumption of digital goods and experiences will continue as we emerge from the pandemic. As digital existence becomes more commonplace – and as technological advancements enable a more seamless online experience, gaming platforms that have established strong communities today stand to benefit the most. Microsoft and Sony have acknowledged this with their recent shift to content and community acquisition, and independent content creators must decide whether they can remain successful as a neutral party or if they should pursue integration into an existing or new platform. Regardless of the fate of individual studios, it seems clear that the gaming industry and its consumers will usher in an era of new media and digital consumption.

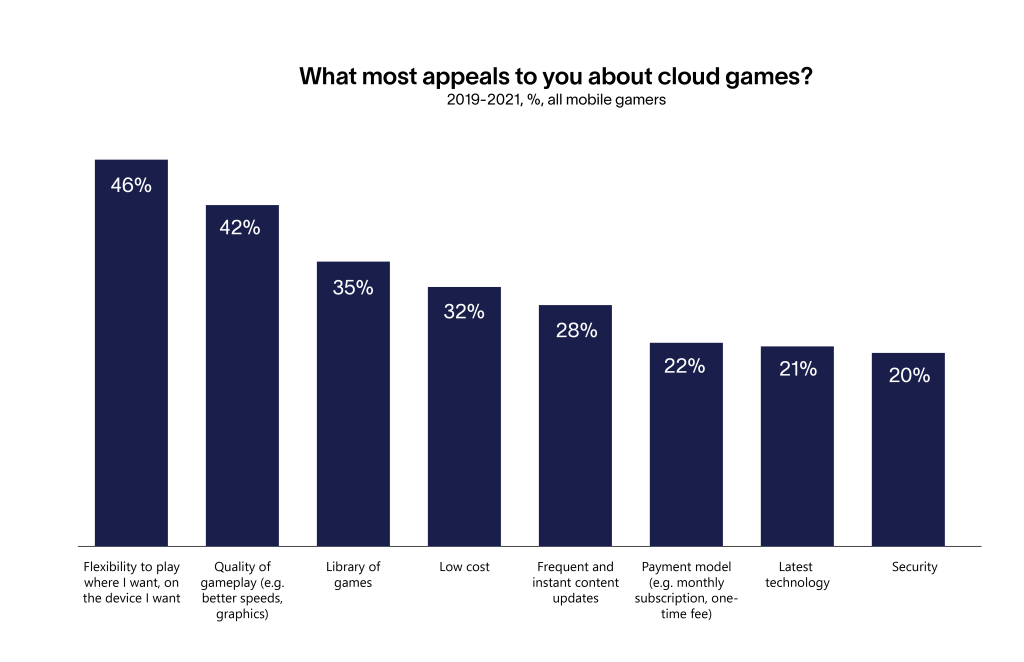

Despite the popularity of online gaming, North American and Western European users have been slow to adopt cloud-based gaming, primarily due to a lack of awareness, a sticky aversion to paying for games online, and, in some cases, limited access to quality internet service. The survey revealed that cloud gaming has modest awareness globally, with fewer than one-third of gamers aware of the most prominent cloud platforms. However, this awareness level should improve in the future as some of the world’s largest technology companies – including Sony and Microsoft – put more marketing investment behind their cloud gaming offers.

Those gamers who have made the transition to the cloud cite flexibility (46%), gameplay quality (42%), library of content (35%), and lower cost (32%) as the top benefits. With the recent proposed acquisition of Activision Blizzard, Microsoft is positioned to expand its library's value by adding the target’s expansive catalog to Xbox Game Pass. In the coming years, this could push more gamers to the cloud.

There is some skepticism about cloud gaming because of the tepid response to Stadia’s debut and the slow adoption of other cloud offers, but this is changing quickly with services like Game Pass and the revamped PlayStation Plus that are blending compelling libraries with a mix of traditional and cloud games.

Marianne Konikoff, Altman Solon

Please complete the form below to receive future insights from our Global Consumer Gaming Survey in your inbox.

Insights

Bring clarity to your next move in TMT.