Despite economic headwinds, 2023 was a good year for the public cloud: spending is expected to reach $468 billion by year’s end, up from $379 billion in 2022. Indeed, global IT spending is on the rise and on track to top $1 trillion by 2027; Infrastructure-as-a-Service (IaaS) is leading growth with an estimated 25.4% compound annual growth rate (CAGR). Globally, competition among the major public cloud providers is fierce, as Microsoft Azure, Google Cloud Platform (GCP), and IBM vie for market share against first-mover Amazon Web Services (AWS).

The major public clouds depend on partners who help scale revenues, develop apps and APIs, and provide implementation, integration, and managed services—for growth. While historically, Microsoft Azure has the most extensive partner program in the industry, AWS and GCP have aggressively grown their partner programs.

For the past four years, Altman Solon has developed an annual database of cloud partners who work across the major cloud platforms. This ecosystem has grown to over 70,000 partners in 2023. For investors, this cloud partner database goes beyond the pitch decks of IT Service providers, allowing them to meticulously screen for targets and gain insights into emerging trends. For service providers, the database can serve as a valuable research tool to benchmark the competitive landscape and evaluate the attractiveness of their ecosystem. The scope is global and includes data from 2023 as well as comparative year-over-year data. Findings show:

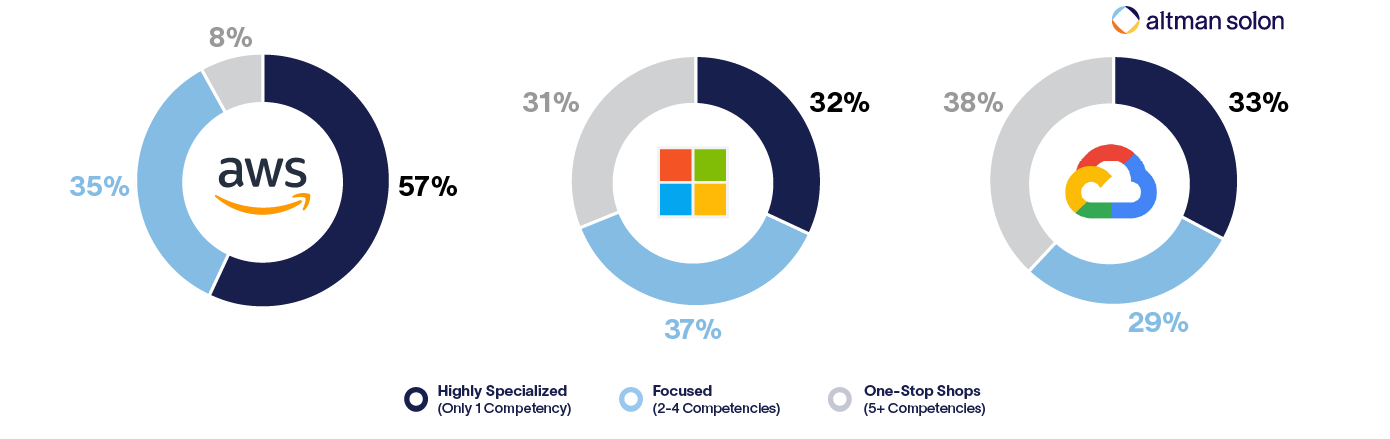

- There are two schools for partner strategy: Providers like AWS invest in highly specialized partners, whereas GCP and Microsoft favor a “one-stop-shop” approach, encouraging multiple competencies.

- An increasing number of cloud partners are getting specialized across multiple public clouds (albeit from a low base). Our findings show that diversification generates more revenue per full-time employee.

The partner channel is central to growth; providers have different approaches to partner competencies

Microsoft has the biggest network of partners, numbering over 45,000. The channel is central to their sales. Overall, Microsoft balances a “one-stop-shop” approach – approximately 31% of Microsoft’s partners hold multiple (five or more) competencies – alongside highly specialized partners who only have a single competency and make up 32% of their ecosystem. Since 2021, there has been a steady decline in specialist partners and a growth in “one-stop shops.”

On the other side of the spectrum are cloud providers encouraging partners to have highly specialized competencies, like AWS, the first mover and top cloud provider.

Fifty-seven percent of AWS partners have a single specialty. There is very little diversification among AWS partners, only 8% of which have over five competencies. The distribution of competencies with AWS has seen very little year-over-year change.

GCP, on the other hand, has embarked on an ambitious challenger strategy. In 2023, the provider increased certified partners by 9%. It has the largest list of competencies among cloud providers and encourages diversification: 38% of their partners have five or more competencies. GCP has significantly increased its share of highly credentialed partners between 2021 and 2023 and has the highest concentration of partners with multiple competencies.

Multi-cloud trend led by mid-market segment continues and pays off

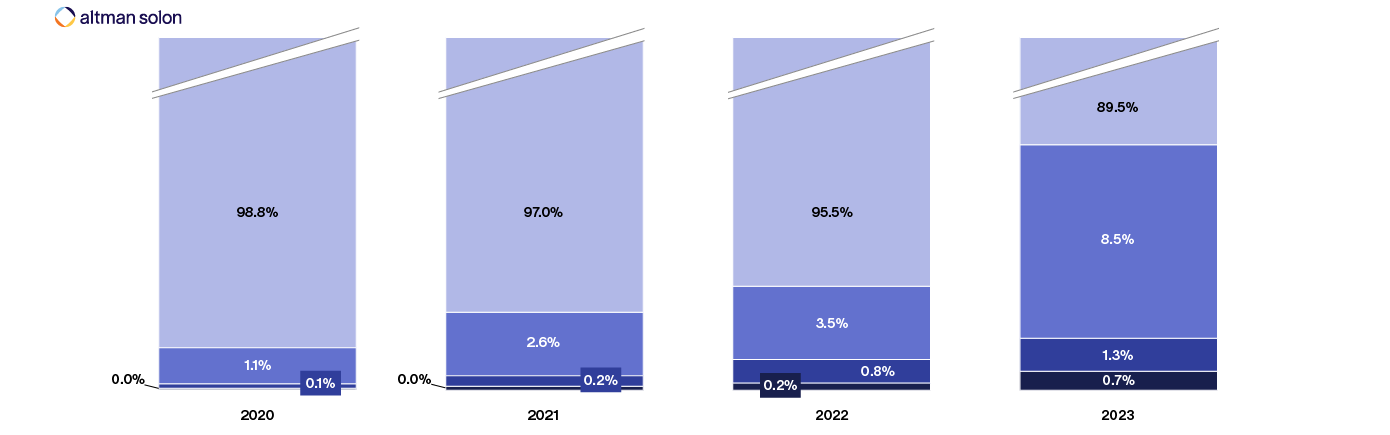

Diversification doesn’t just stop at competencies; our cloud partner database has recorded a steady rise in cloud partners working with multiple cloud providers. While this still represents an edge case—89.5% of partners are certified with a single cloud provider—this category has seen a 6% year-over-year decline. Likewise, the number of partners credentialed with two providers more than doubled, from 3.5% in 2022 to 8.5% in 2023.

End users that adopt a multi-cloud strategy cite flexibility, cost, performance, and service as critical motivators for diversifying their cloud partners. Data from our cloud survey shows that companies—mid-market and enterprise segments in particular—anticipate adding a provider, suggesting a long-term growth market.

Unsurprisingly, our findings demonstrate that partnering across multiple cloud providers pays off: earnings per full-time employee increase incrementally each time a partner works with more than one cloud provider and plateaus at more than three clouds. As companies explore multiple clouds for different use cases, it makes sense that increasing numbers will work with different providers.

As enterprise cloud adoption matures, competition between providers will continue to heat up. We believe the partner channel will become increasingly central to the growth of each hyperscaler in the years to come. Cloud partners have a unique opportunity to gain certifications across multiple clouds.

About the Altman Solon Public Cloud Partner Database

For four years running, Altman Solon’s proprietary Cloud Partner Database has synthesized data from over 70,000 credentialed partners for AWS, Azure, GCP, and IBM, as well as insights from interviews with C-level management at cloud partners. The database includes a structured seven-pillar taxonomy to segment and compare cloud partner strategies, providing a full overview of the various multi-cloud competencies and how they perform over time. Along with insights from Altman Solon’s global team of consultants, this data offers learnings into competency growth strategies and informs potential acquisitions and investments in the cloud partner ecosystem.