The future of cloud computing looks bright. In 2022, global spending on public cloud services was $498 billion – an over 23% year-on-year rise, buoyed by an uptick in organizational data production and off-premises workload migration. Despite the recent stock slump of many Cloud Service Providers (CSPs) and post-pandemic layoffs, it is still estimated that public cloud spend will continue to grow and reach approximately $860 billion by 2025.

Competition among CSPs like Microsoft Azure, Amazon Web Services (AWS), Google Cloud Platform (GCP), and IBM Cloud is fierce. Unsurprisingly, this growth in the public cloud has incubated a diverse and highly competitive set of cloud service partners of all sizes and competencies. These partners support customers who want to migrate their workloads onto the public cloud, develop apps on top of the public cloud infrastructure, and provide services throughout the cloud journey. Cloud partners have sought unique positioning in the market following various strategies, such as aligning with specific CSPs, investing in building CSP-certified competencies to define focus areas (i.e., compliance, machine learning, threat management), and developing various operating models to serve customer needs.

For the past three years, Altman Solon’s proprietary Cloud Partner Database has analyzed certification trends and the business performances of over 60,000 credentialed cloud partners globally. The Cloud Partner Database has organized 250+ competencies across all four CSPs into seven major competency segments – infrastructure & data management, analytics, applications & development, productivity & collaboration, security, industry, and workload—for direct comparison between CSPs as well as tracking over time. Altman Solon’s database is a comprehensive list of global cloud partners by CSP, including granular information on partner headquarters location, headcount, revenue estimates, competencies, and partnership level with CSPs. The database uses quantitative data on partnership programs, interviews with key stakeholders, and publicly available data from CSP partner lists and websites.

This year, we explored trends on how cloud partners are evolving, getting certified in specialized competencies, and partnering with multiple CSPs as cloud adoption further matures.

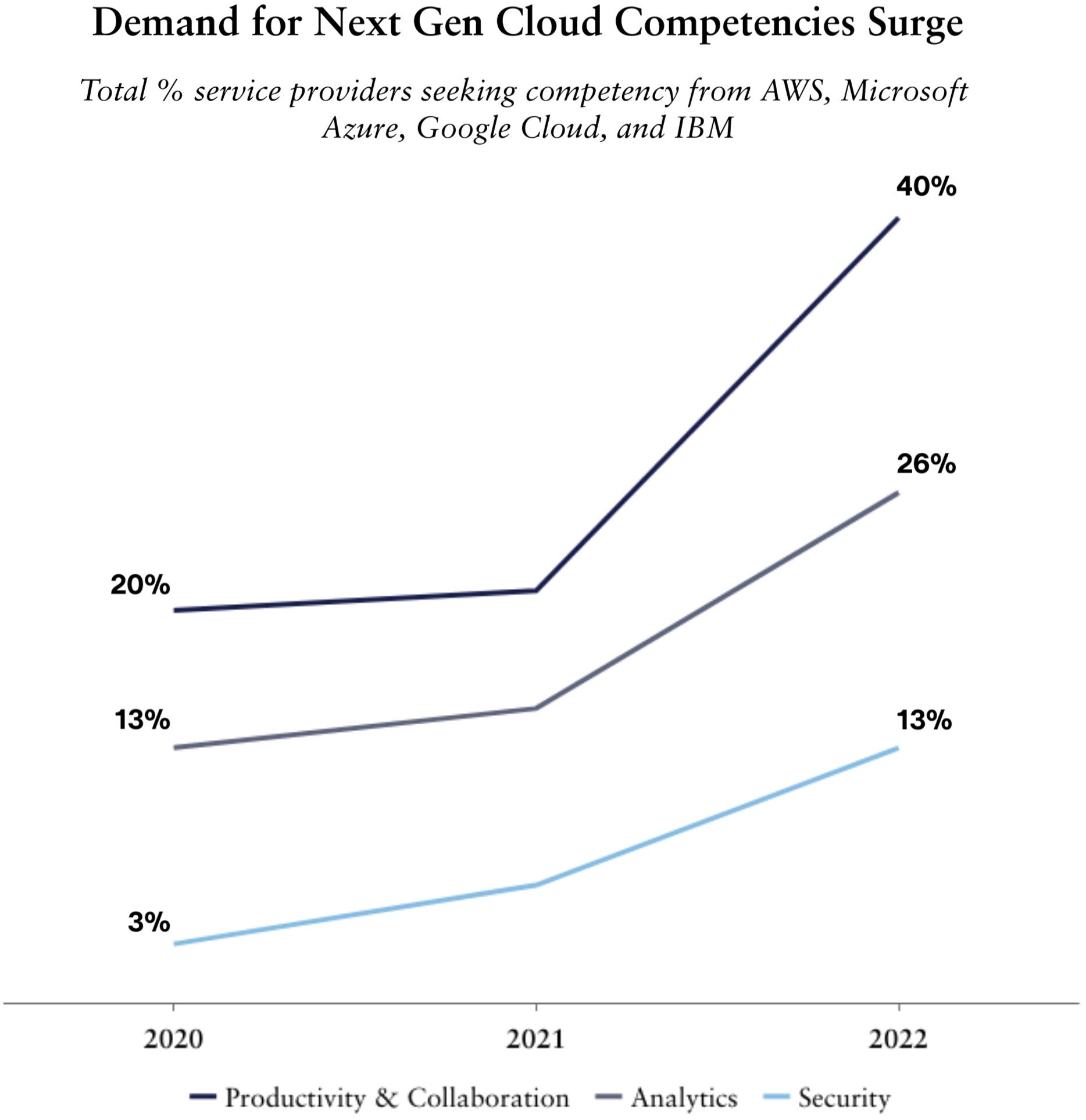

Productivity, analytics, and security take center stage as the focus of new competencies

Since 2020, the adoption of competencies earned by cloud partners within productivity & collaboration, analytics, and security have consistently accelerated across the CSP ecosystem. Productivity competencies can include collaboration, identity & device management, and enterprise mobility management; analytics competencies can include sector-specific analytics, IoT functions, and data warehousing; and security competencies can include migration, disaster recovery, and compliance.

In just two years, the percentage of cloud partners with security certifications has tripled from 3% to 13%. Likewise, partners with certifications in productivity and collaboration have doubled from 20% to 40%; and analytics certifications among partners have grown from 13% to 26%. Growth in these three categories represents a fundamental shift in the overall market, which is beginning to mature in its cloud journey by optimizing workloads and reacting to the heightened threat landscape.

While partners have long prioritized competencies around infrastructure, their customers’ cloud needs are maturing as well. Today, customers seek tailored cloud-native applications, seamless orchestration between systems, and optimized data aggregation for informed decision-making. According to a VP at an IT services provider: ”Right now, there is so much interest in developing cloud-native apps. Before, the interest was in IaaS, but now the focus is on productizing the environment.”

Aside from these emerging competencies, security remains a top priority for C-suite leaders who are aware of the heightened threat landscape and the cost of breaches – leading to increased demand for third-party support to secure their networks.

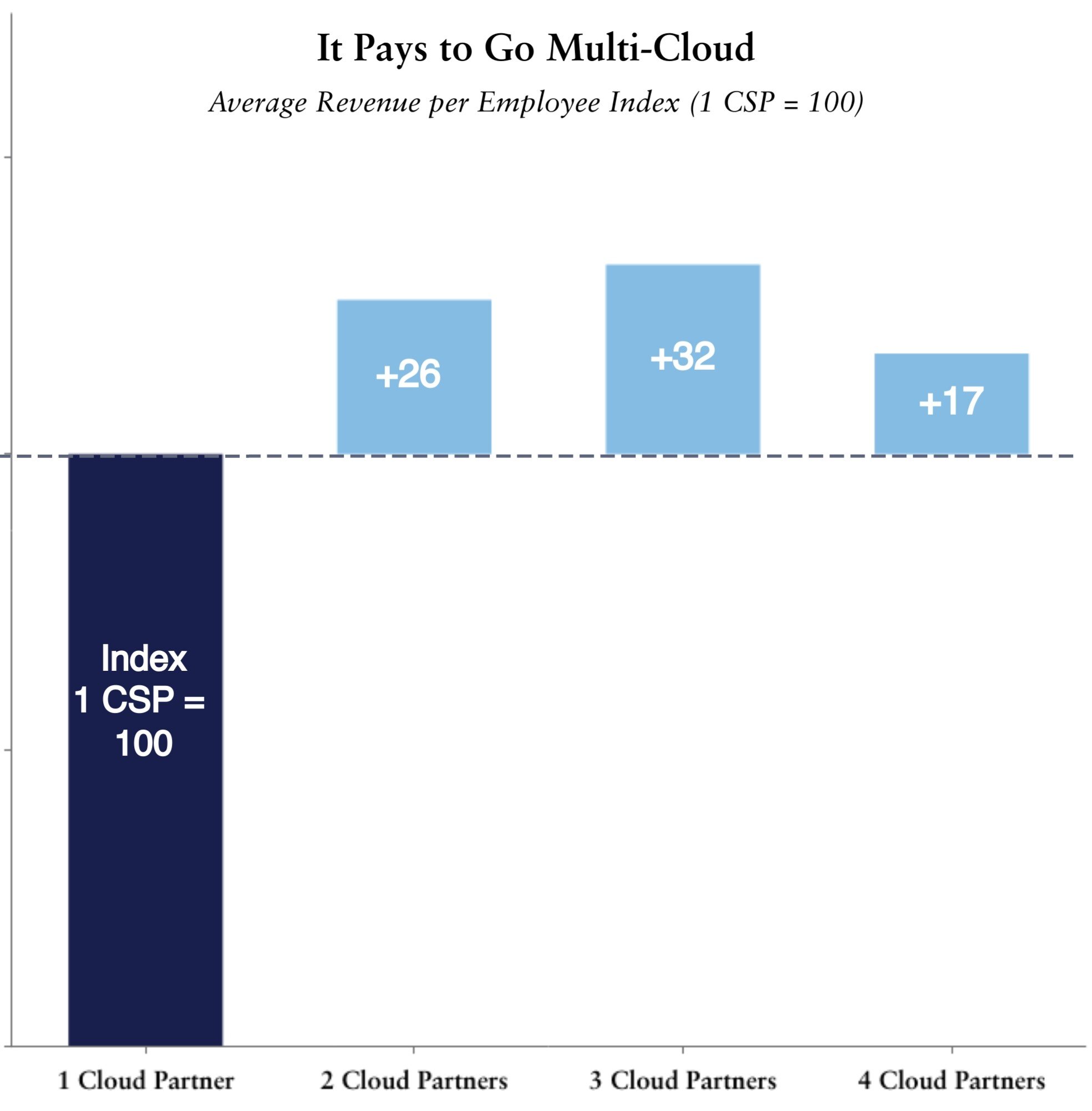

It pays to go multi-cloud

As cloud migration reaches maturity, companies are increasingly spreading their workloads across different CSPs through independent business unit decision-making – as a result of M&A – to meet compliance standards or due to specialized cloud capabilities. In the words of a Senior Business Development Director at a CSP, “Companies need to spread the risk and have a backup if one system goes down.” Indeed, over the past two years, the number of credentialed partners (with a headcount of five or more) with two or more CSPs has increased from 5% to 14%, with much of this growth coming from mid-sized service providers. Across all regions, AWS and Azure have the most common overlap. Unsurprisingly, Azure is the platform with the biggest dedicated coverage.

Our database shows that companies that partner with more than one CSP in a range of competencies give their employees exposure to multi-cloud, enabling them to take on higher-value projects. Survey findings show these multi-cloud companies earn 17% to 32% more per employee than companies that partner with a single CSP. While gaining credentials requires investment in employees, sales development, and commitments to the CSPs, many service providers are seeing the benefits of spreading their focus across multiple CSPs. This trend is likely to continue. As an SVP at a CSP noted: ”We definitely see partnerships across multiple cloud providers getting more traction. The CSPs are not enthused about this, but right now, it doesn’t seem to threaten existing partnership status.”

About the Altman Solon public cloud partner database

For three years running, Altman Solon’s proprietary Cloud Partner Database has synthesized data from over 60,000 credentialed partners for AWS, Azure, GCP, and IBM, as well as insights from interviews with C-level management at CSPs and their partners. Along with insight from Altman Solon’s global team of consultants, this data offers insight into competency growth strategies and informs potential acquisitions and investments in the cloud partner ecosystem.