The virtual and augmented reality market has experienced uneven growth and its share of flops over the past decade. Still, with name-brand companies focusing more on monetizing consumer access to new digital worlds, market realities may be changing. Global technology giants are introducing new products and functionalities that transcend what once was impossible for consumers and businesses interacting in a virtual world. With innovations dating back nearly half a century, when the first true VR interface, Sword of Damocles, displayed virtual wireframe shapes to its users, AR/VR has evolved to include realistic haptic feedback, ultra-responsive imagery, and immersive virtual experiences.

The evolution of virtual reality has come in waves, with its fair share of peaks and valleys, usually driven by leading technology firms. Google made a splash with Google Glass nearly 10 years ago, but the device never had significant commercial success. Magic Leap reached a $2 billion valuation in 2021, only to abandon the consumer market in 2023 and shift focus to enterprise. More recently, Meta has been investing heavily in its Metaverse concept and has built out an ecosystem to match, but it appears to be putting that concept on the backburner to focus on AI.

With the confetti still settling after Apple’s announcement, it is too early to predict how its new headset will affect the AR/VR device market. Apple’s long history of transforming consumer hardware such as PCs, mobile phones, watches, and headphones, suggests that the world’s largest tech company can be a big player in bringing AR/VR to the masses. However, Apple is entering a crowded market that already includes other tech giants, like Meta and Sony, that have spent years investing in this promising technology space.

Evolution over revolution: the fragmented AR/VR device landscape today and where Apple would play

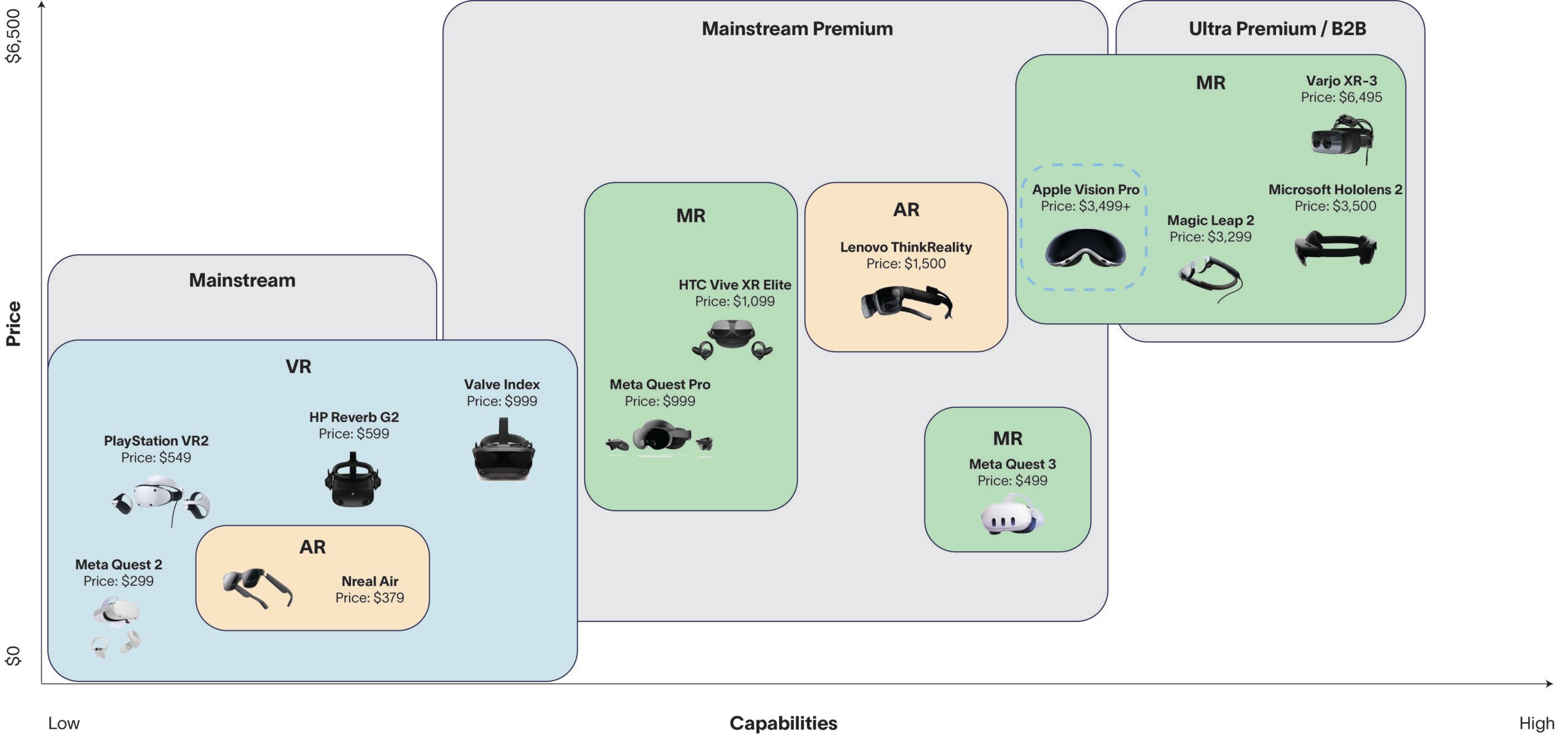

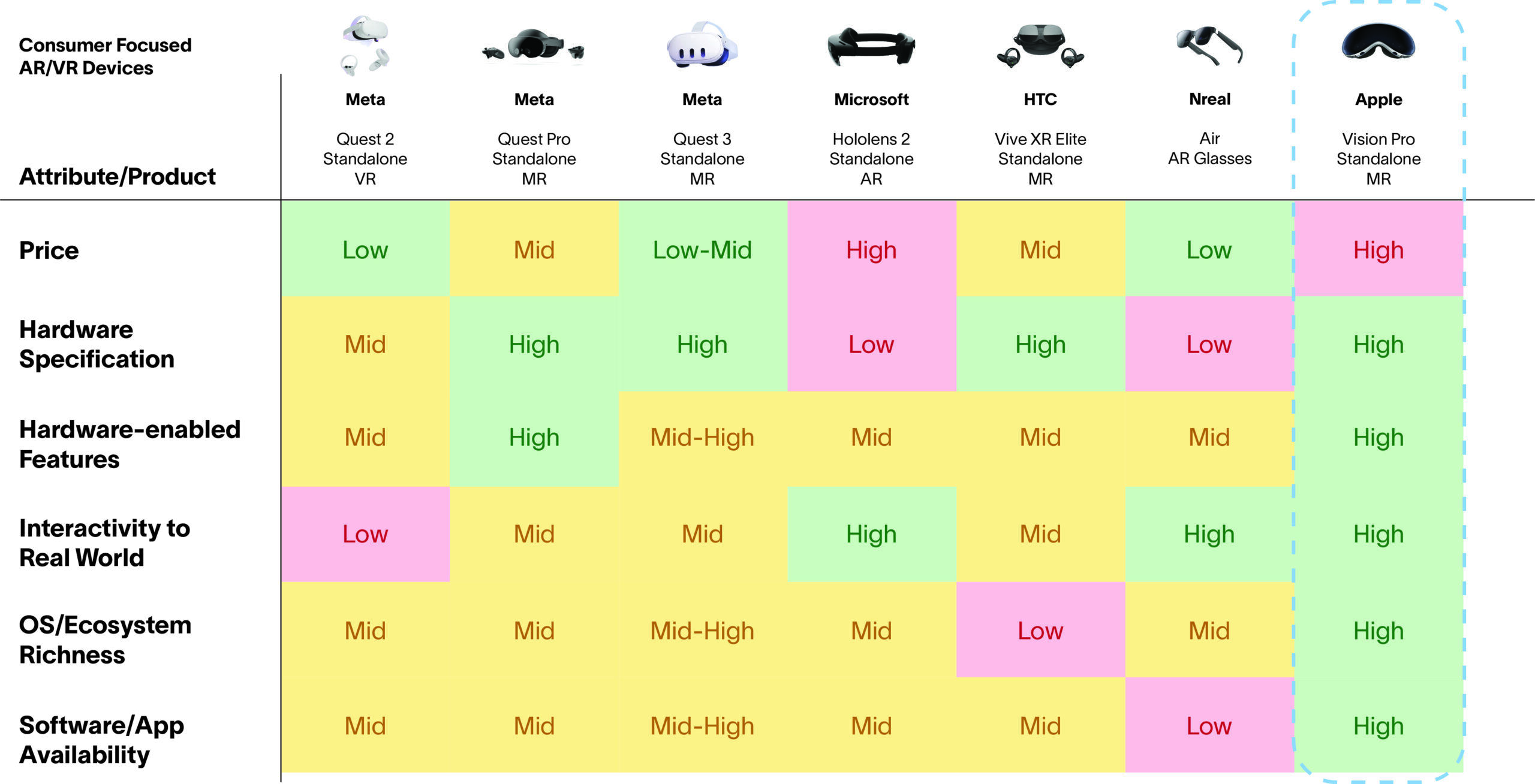

According to findings from Grand View Research, the global virtual reality headset market reached $7.77B in 2022 but is expected to grow to nearly $60B by 2030, with a CAGR of 30.6%. Several prominent products are at the forefront of virtual, mixed, and augmented reality headsets, including the Meta Quest Pro, Microsoft HoloLens, HTC Vive, and Nreal Air. Each has its strengths in hardware, features, and interactive functionalities. With its $3,499 starting price tag, Apple’s Vision Pro is expected to straddle the line between the ”Mainstream Premium” and “Ultra Premium” categories of AR/VR products, with a focus on consumer products. While more advanced – or ”Ultra Premium” – devices, such as Varjo XR and Microsoft HoloLens, are targeted towards enterprise, Apple’s device appears to be more consumer-focused.

The elephant enters the room: Apple’s $3,499 Vision Pro

Apple’s first virtual reality headset is targeting the high-end consumer market. While priced at the high end of virtual reality headsets, the Vision Pro offers high-tiered hardware and software, along with integration in Apple’s App Store. The Vision Pro will feature eye and face tracking, iris scanning authentication, and device continuity – syncing across other Apple products like the iPhone, iPad, and Mac.

Apple’s Vision Pro is expected to hit the shelves alongside other household names like Microsoft and Meta in early 2024. It will likely compete closely with Meta’s Quest Pro for consumer dollars. While both devices offer similar hardware with a good selection of software, Meta’s headset comes at a fraction of the price of Apple’s product. Meta is also doubling down on their price advantage in advance of the Vision Pro launch: just days before Apple’s announcement, Meta previewed the Meta Quest 3, a consumer headset, available this fall for $500.

Apple’s entry into the AR/VR market poses strategic questions for the ecosystem’s future. Will the Vision Pro drive competition among existing industry players? Will new consumer use cases for AR and VR emerge? What considerations should retailers, content providers, insurance providers, and carriers keep in mind as they navigate this changing market?

In early July came reports that Apple is reducing its initial production of the Vision Pro from 1 million to 400,000. This is not unexpected, considering that Apple would not want to sacrifice production quality over quantity. The challenge with a complex device like the Vision Pro is that the user experience features, both digital (display, sound) and physical (padding, strap, corrective optical replacements, etc.), must seamlessly work together to deliver the user experience that Apple has promised through its rollout marketing campaign. Ensuring a high-quality initial batch likely will require a lengthy and even manual QA process for each piece produced and shipped. Apple could also likely target developers for the initial batch of Vision Pro devices that would be more tolerant of initial production issues. Over time, this delivery cycle would shorten, but we are still in the trial-and-error period in the short term.

Once Apple announced the Vision Pro’s high price and ambitious user experience, it was clear that the company’s first push into AR/VR would not become a blockbuster product overnight. However, revised production schedules six months before the product is broadly available to consumers should not dim Vision Pro’s long-term viability.

Business as usual or shock to the ecosystem? Considerations for key AR/VR headset market players

As Apple enters the mainstream consumer market for AR/VR headset devices, these are the key factors for industry players to understand the potential market impacts:

- OEM/AR/VR Manufacturers: Apple has historically disrupted product categories within the technology space. From smartwatches to headphones, Apple’s entry into these categories has threatened the incumbent companies with innovative products and software offerings. While it is difficult to make the same call at the launch of the Vision Pro, OEM/AR/VR producers are left to prepare for Apple disrupting yet another product category. How should they evolve their current product and service offering to stay ahead of the curve and remain competitive among brands with strong consumer loyalty?

- Developers: This could represent a significant opportunity for developers to make software for a major new platform; however, refining software for a complex device like the Vision Pro with much more interaction methods could mean longer development and testing cycles.

- Content Providers: With this new device on the market, content providers must ensure their existing content delivers a seamless consumer experience in this new format and consider any renegotiation of licensing rights with Apple. Should providers develop new content specifically for this device?

- Carriers: Seamless interactions with the virtual world through AR/VR devices are heavily dependent on high-speed, efficient networks. As AR/VR device adoption boosts traffic on global networks, carriers will need to anticipate the increased strain on their systems and manage their networks effectively for content delivery on top of the existing network load. Would this be another use case for 5G technologies like Mobile Edge Compute or new monetization models?

- Retailers: The Vision Pro headset will now find space alongside the Quest Pro and Hololens 2 on the shelves. As these products compete for consumer dollars, retailers must consider how product placement and advertising of these similar products boost sales and competition. How should these competing products be marketed and positioned toward consumers ready to invest in a new VR device?

- Device Insurance Providers: Given the higher price of Vision Pro and many other AR/VR devices, device insurance costs will likely be much higher than smartphones to ensure that devices with complex hardware and software are thoroughly protected. How should providers rethink their insurance packages and financing options for consumers purchasing new AR/VR devices?

Preparing for the future of the AR/VR headset market

Apple’s Vision Pro is likely to spur competition and fuel new use cases for the industry over the coming months and years. This product launch has several potential implications across industry players, and Altman Solon is helping clients understand what these changes mean for their product roadmaps and service offerings.