INSIGHTS

Private Wireless Networks: A New Era for Business Connectivity

The emergence of private wireless networks

Wireless cellular technology has been in the spotlight recently. On the consumer side, 5G is grabbing headlines as seemingly every wireless carrier boasts having the ”fastest” or ”widest coverage” 5G network. For businesses, however, the buzz around 5G is related to new use cases that 5G can enable, primarily through private wireless networks. A private wireless network is a cellular network that can be exclusively set up for private use. Businesses are interested in setting up their own private networks because their existing technology does not meet mobility requirements (wired connection, or short-range mobile solutions) or lacks network performance and security (Wi-Fi). Private networks are especially suited to support the Internet of Things (IoT), which requires better network performance.

Promising use cases abound across heterogenous technologies

Private networks are not new. In fact, mining, utilities, and industrial sectors have been early adopters of private wireless networks, with over 1,000 global trials mostly in the U.S. and Europe. Many early private wireless networks were deployed over LTE, often with the goal of increased network coverage and stronger reliability. 5G is seen as a game changer to expand the use cases infeasible with LTE. For example, Associated British Ports, or ABP, operates 21 ports in the U.K., accounting for a quarter of the U.K.’s sea trade. They deployed a private 5G network in Southampton and achieved “significant difference in the efficiency gain in a challenging RF (radio frequency) environment”, with a design that included seven 5G radios as opposed to hundreds with Wi-Fi. Other 5G private networks use cases include agriculture, with Agrifood Connects’ dual LTE and 5G private network that covered condition monitoring in farm fields in Australia; and media, with ViacomCBS’s 5G private network, which used network slicing from a public 5G network for remote filming in Amsterdam. These new use cases are starting to take full advantage of 5G and turning the vision for geographically customized networks into a reality.

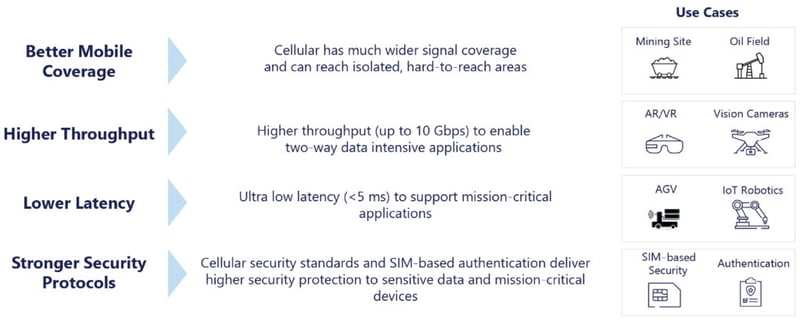

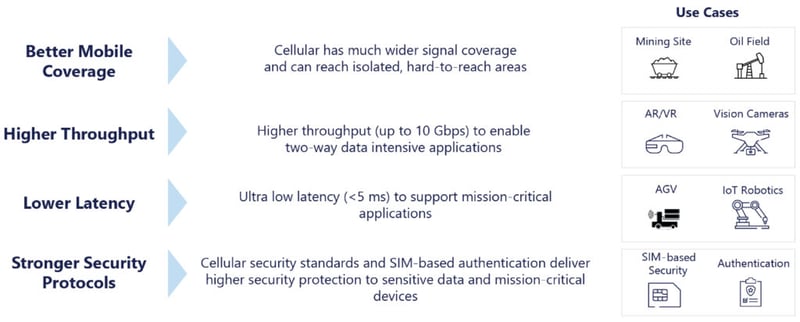

Private Wireless Network Value Props and Use Cases

Even with improved performance, private networks will likely complement, not replace, existing networking technologies. Wi-Fi, widely adopted by enterprises, can serve connectivity needs where lower cost of ownership is critical and highly customizable Quality of Service, or QoS, is not required. In some cases, Wi-Fi and private networks could be used in parallel. For example, the Angel Stadium in Anaheim, California has leveraged wireless technologies across DAS, Wi-Fi, and private networks to address different connectivity needs across operations and fan experience. The end state for many enterprise networks will likely be a network infrastructure of co-existing technologies where each technology is deployed for specific, fit-for-purpose use cases.

A growing ecosystem with diverse solution options

As is common with emerging technology, private networks attract a diverse group of providers – from traditional equipment manufacturers like Ericsson and Nokia to Mobile Network Operators (MNOs) like Verizon and Vodafone offering services from design to deployment. There are many other players, including specialized solution providers like Federated Wireless or Boingo; and traditional system integrators like Cognizant or Capgemini. Hyperscalers, such as AWS or Google Cloud, have also recently started to enter the market with offerings that integrate their existing cloud services.

Today, deploying a private network involves a series of decisions ranging from device ecosystem, spectrum access options, deployment models, and total cost of ownership. During the Request-for-Proposal (RFP) process, price quotes can vary three to fivefold. If the scope involves multiple locations or multiple countries, the complexity increases dramatically. These dynamics have slowed down the adoption of private networks and stalled scalability.

Private Network Value Chain and Market Participants (non-exhaustive)

Key drivers to accelerate adoption

There are several market forces that impact the development of private networks. Four key categories vary in their maturity timeline and level of impact:

Key Private Network Market Forces

Maturity of Technology Standards and Ecosystem: The technology supporting private networks is still maturing with various development efforts happening in parallel. Typically, tech maturation goes through three stages: Creation, Adoption, and Proliferation. Private networks are currently in between Creation and Adoption phases and will take a few years before they reach Proliferation. Below are some key activities at each stage:

- Creation: LTE is currently leading the number of private network deployments, though 5G is expected to surpass LTE by 2026. 3GPP, the governing body for 5G standards, has been working on defining industrial IoT standards and some will come in release 18 and 19 in the next few years. Multi-access Edge Compute (MEC), the technology that provides cloud-computing capabilities at the edge of the network, will be an integral part of private networks in meeting low latency requirements for 5G. The standards have entered phase 3 where MEC Framework and Reference Architecture are defined to enable system interoperability.

- Adoption: The use of spectrum is both a design specification and a cost consideration. Countries have adopted different approaches in managing spectrum. In countries like the U.K., Germany, and Japan, private spectrum is only available for 5G. The 3.5 GHz CBRS spectrum in the U.S. is open for public access and is being piloted by vendors with Spectrum Access Systems (SAS) authorization. There are also other shared and leased options from MNOs to enable network-slicing for dedicated use of private networks. The use of spectrum is geography-dependent and both vendors and buyers would need to evaluate each location to strike a balance between performance, management complexity, and cost.

- Proliferation: Device availability is critical for the market to flourish. For example, many industrial 4.0 use cases require devices built for Ultra-Reliable Low Latency Communications (URLLC) and there are still not enough URLLC-enabled devices on the market. It will take a few years for chipset makers, network equipment OEMs, and operation technology OEMs to collaborate to build a richer, commercially viable device ecosystem.

Increasing Market Awareness Through Proven Use Cases: Market awareness is still developing as the use cases for private networks are largely vertical specific and space dependent. Industries and spaces with broad outdoor network needs, like ports and utilities, can see more immediate applications and ROI. Indoor and confined outdoor use cases with higher requirements on security, quality coverage, and latency have been growing along with the maturity of private networks. For buyers to gain more confidence, the use cases would need to be demonstrated on a real-world, operational-level scale where the business value can be easily identified – whether it is improving operational efficiency in a warehouse, enabling clinical communications at a hospital, or elevating fan experience in a stadium.

From Bespoke Design to Standardized Deployment: Today many private network deployments are custom designed, and enterprises own post-implementation service and maintenance. Pre-packaged solutions that are easy to install are key to appealing to mid-market enterprise buyers. Network or IT professionals are looking for a simpler, pre-configured “Wi-Fi-like” solutions, capable of integrating heterogeneous networks across LAN, WLAN, and cellular. Different solutions should start to address interoperability standards so buyers can worry less about vendor lock-in, or worse, owning an “orphan technology” that is neither upgradeable nor swappable.

Simplified Pricing and Ownership Model: Many private network offerings follow the traditional CapEx model where the enterprises own most of the hardware. For some industries, such as utilities, this model is familiar to buyers. For others, especially mid-size enterprises with limited financial resources, an OpEx pricing model would be more appealing to drive initial adoption. A positive sign in this direction is AWS, who is offering Private-Network-As-a-Service packages on a monthly, all-in price without large initial investment.

The road ahead

Private networks allow enterprises to reduce costs, improve productivity, and create a competitive advantage; yet considerable technical and commercial challenges remain. Vendors and service providers should continue educating buyers and proving the technology through scalable deployments. Vendors should also seek to evolve their pricing from fully customized models to more standard packages. Forming partnerships to provide end-to-end solutions will better address different buyer needs; and in turn, buyers should understand that there will be a learning curve starting from pilots to large scale operations. For buyers to take full advantage of what private networks can offer, having a cross-functional team where business and technology work together is critical in exploring innovative, value-added use cases. Ultimately, while private networks are still maturing, a new wave of growth is expected over the coming few years as they unlock significant value of the next generation networking architecture.

Please complete the form below to receive a PDF of the full report and to connect with our team.