INSIGHTS

Pay TV Relies on Sports, NFL More than Ever, with 90% of Sports Fans Subscribing to Pay TV

U.S. sports fans love NFL teams, NBA superstars, Serena Williams, and baseball (still!), according to sprawling new survey on sports viewership, fandom, and betting by Altman Vilandrie & Company

Altman Vilandrie & Company fielded an online survey in August 2019 to more than 5,000 U.S. respondents, measuring consumer interest and willingness to pay for sports and news programming, and gleaning insights about sports fandom, viewership, and betting habits. The findings, some of which are highlighted below, show the importance of sports – and specifically the NFL – to the Pay TV industry and reveal the underlying passions of sports fans. The survey also found that the traditional sports leagues and top teams and athletes are most popular, but sports fans – especially younger fans – have distinct preferences for which sports entities they want to watch. This note is the first in a series we’ll be publishing to share results and implications from the survey.

Fast Facts:

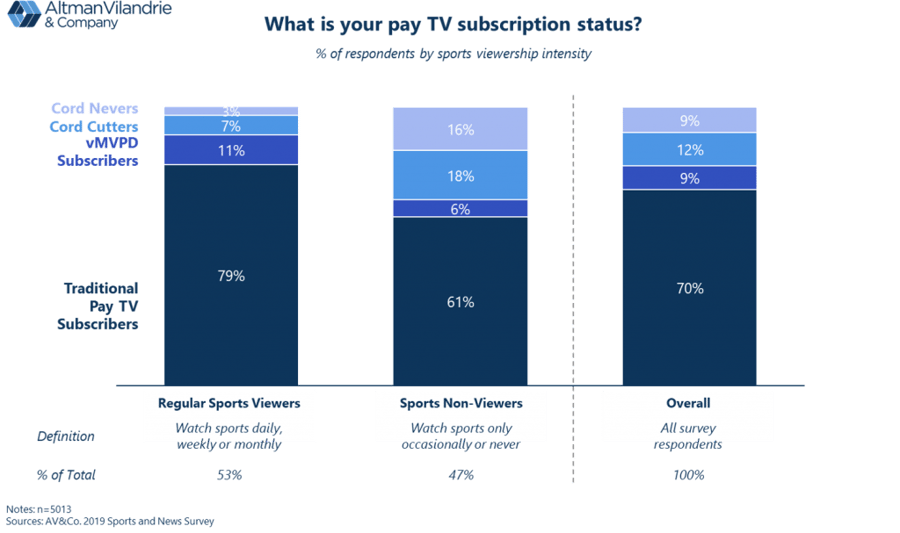

- 90% of sports fans who watch sports regularly subscribe to Pay TV, compared to only 67% of sports non-viewers

- NFL is the top favorite sport to watch, with 62% of all fans selecting it as “a favorite” and 30% as their “top favorite” league (out of 21 leagues/sports presented)

- More than 50% (14) of the top 25 most favorite sports entities to watch are from the NFL, as NFL teams and players dominate favorites list

- Serena Williams is the top individual-sport athlete to watch, ahead of Tiger Woods and Roger Federer

- 44% of younger respondents (18-24) selected a sports league other than the NFL, NBA, MLB, College Football, or College Basketball as their “top favorite” league

- 56% of respondents under the age of 24 identified themselves as frequent or occasional sports gamblers, compared to 17% of respondents over the age of 55+

- The more frequent a gambler, the more likely a Pay TV subscriber as 91% of those who are frequent gamblers (participate regularly in sports betting and/or fantasy sports) are subscribers

Pay TV relies on sports, especially football

How important is sports to Pay TV penetration in the U.S.? We found that sports – and specifically the National Football League – is must-have programming for Pay TV. Ninety percent of the sports fans who watch sports regularly are subscribing to traditional or virtual MVPDs (Internet-based TV like YouTube TV or Hulu Live). In contrast, only 67% of sports non-viewers are subscribing to Pay TV.

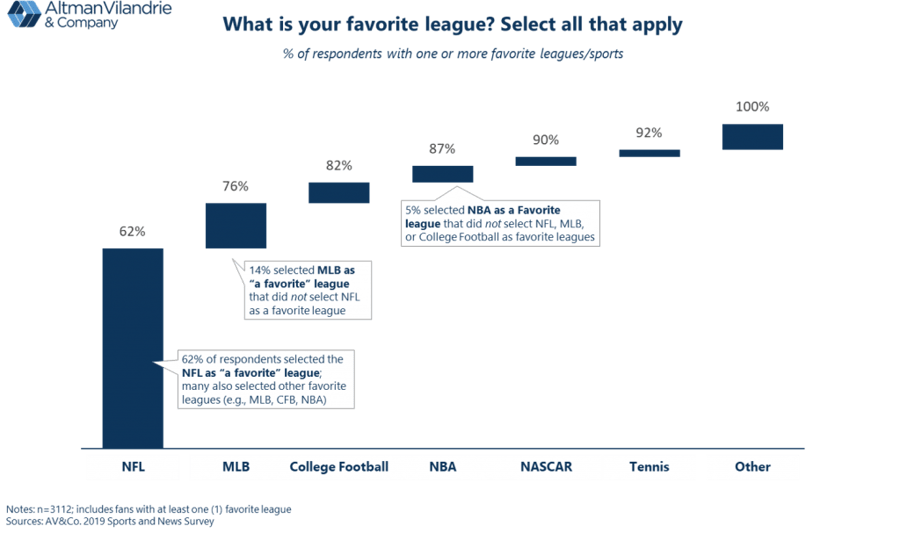

Which sports attract the most fans and viewers? The NFL of course, with 62% of all fans selecting it as “a favorite”. Many NFL fans are also fans of other sports. Of fans that did not select the NFL as “a favorite”, MLB makes up the next largest cohort with an additional 14% of sports fans. Collectively, 92% of all sports fans can be reached with one of six leagues.

To arrive at these findings, we presented respondents with 20+ sports leagues and asked them about their interest in each league and, for their favorite leagues, interest in the teams and players for each league. In total, we gleaned insights about 300+ sports teams and 400+ athletes.

NFL teams, NBA stars, drive fandom and tune-in

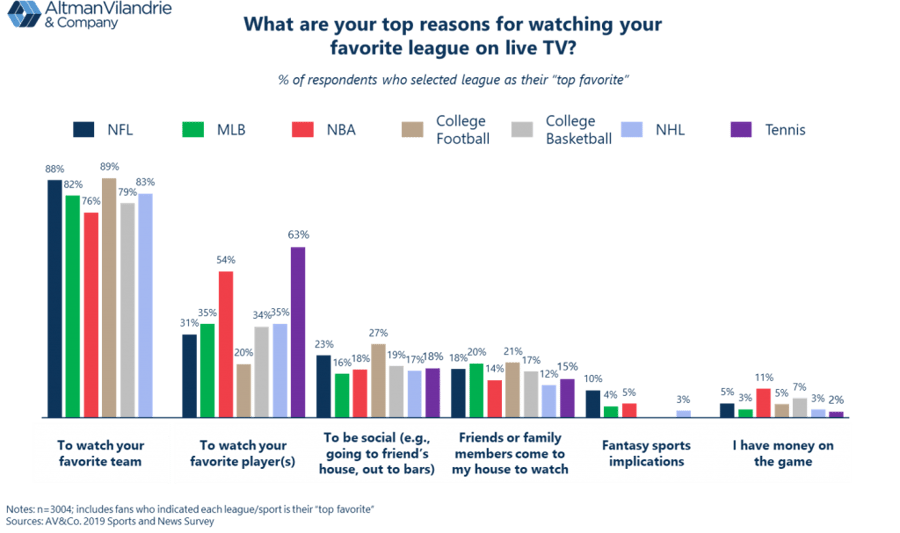

What drives viewing of professional sports leagues in the U.S.? Of the four major pro sports, the NFL was the number one sport for viewers who wanted to watch their favorite team (88% of NFL fans) and for fantasy implications. In contrast, the NBA had the fewest respondents who watch because of a favorite team (76%), but the highest respondents that watch because of a favorite player(s) (54%). This confirms the player-driven focus of the NBA and the impact high profile players have on the sport.

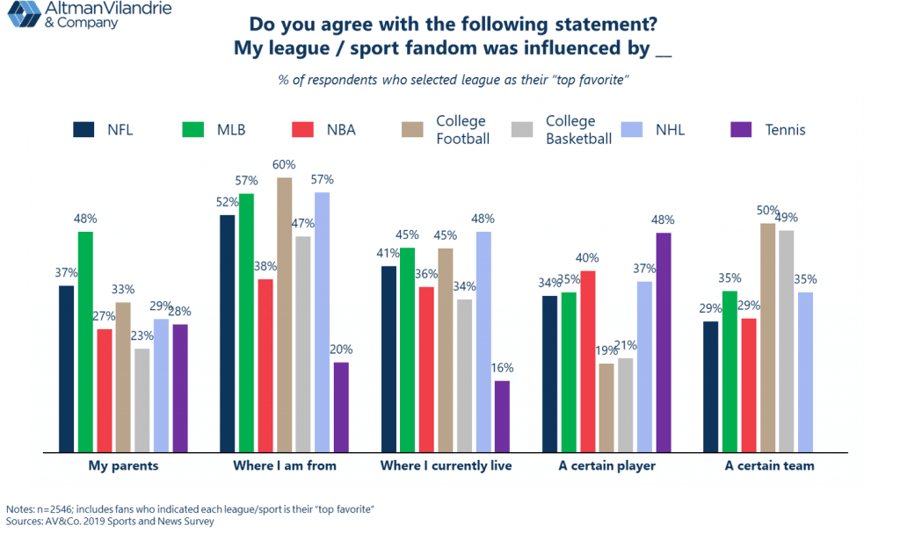

The player-driven influence of the NBA is further supported by respondents’ belief that the draw of a certain player was the most important factor to their NBA fandom (40% agreed it was an influence), highest among the team-based sports surveyed. Only tennis, at 48%, had a higher percentage. In contrast, MLB sees a much higher degree of fandom influenced by family and geography, with 48% of MLB fans noting their parents influenced their fandom, by far the highest of any league.

NFL and Steph Curry are leading draws for sports viewers

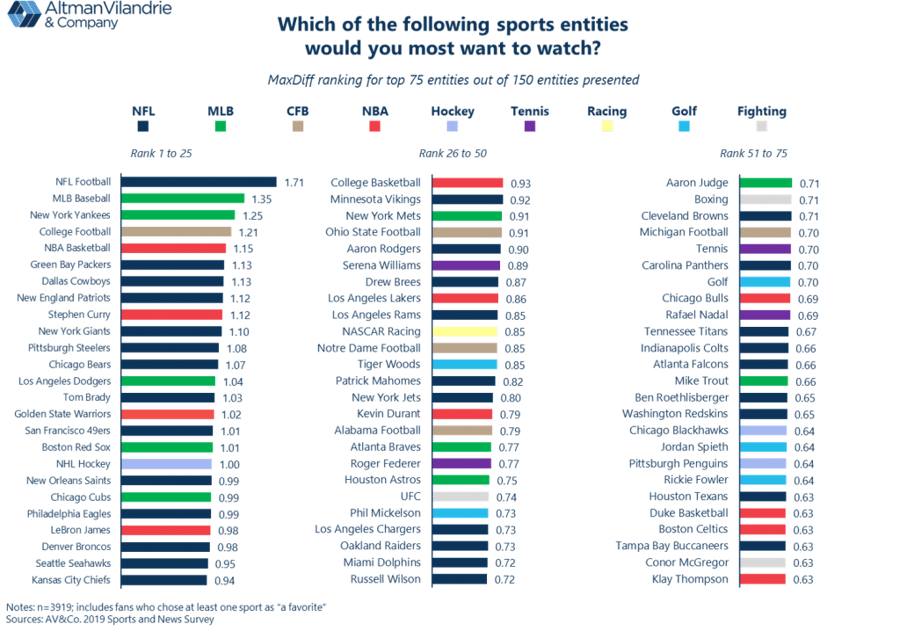

What are sports fans’ favorite sports entities to watch on Pay TV? In this case, an entity could mean a sports league, a team, or an individual athlete. The NFL is the overwhelming winner here as it was chosen as the favorite league with twelve teams named and one player (Tom Brady) cited among the top 25 most favorite entities. More than 50% of the top 25 most favorite sports entities to watch are NFL entities, while College Football is fourth most popular.

Major League Baseball is the second most popular entity and has the most popular single team (New York Yankees) but not one single baseball player made the top 25 list. All in, there are five MLB entities on the top 25 list. In contrast, the NBA is the seventh most popular entity but the only league with two players – Steph Curry and LeBron James – in the top 25. Only one NBA team – the Golden State Warriors – made the top 25. Serena Williams is just outside the top 25, and is the top individual-sport athlete to watch, ahead of Tiger Woods and Roger Federer.

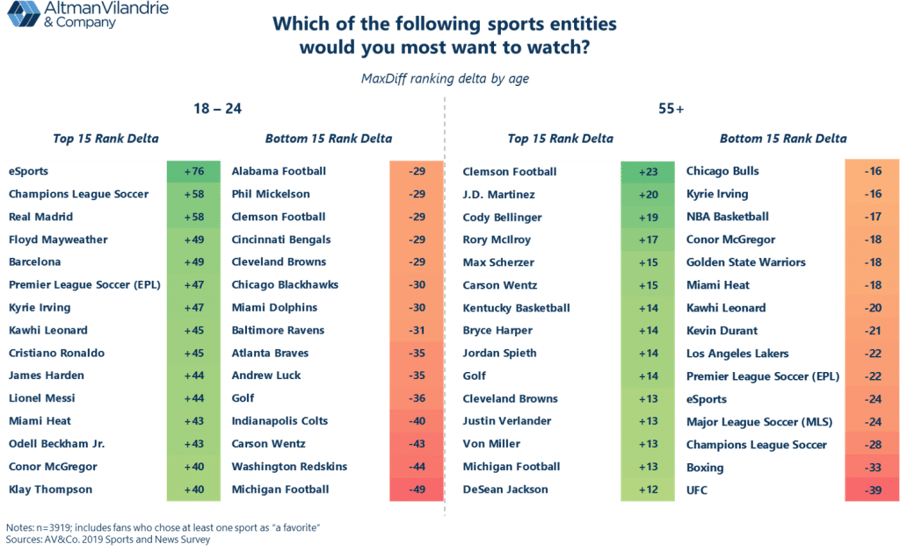

Which sports entities have the biggest differences in popularity among younger vs. older sports fans? Younger viewers (18-24) are much more likely to want to watch eSports and professional European football (Champions League, EPL, Real Madrid, Barcelona, Ronaldo, Messi) than older viewers and less likely to watch college or professional football. In contrast, older sports viewers are more likely to watch College Football, College Basketball, MLB and golf and are less interested in watching combat sports (boxing or UFC), eSports and European soccer than younger viewers. We also see stark differences in popularity of sports entities across demographic segments and geographies, which we will cover in a subsequent note.

Younger sports fans have broader sports interests

The sports landscape has changed significantly over the last decade. New sports have emerged, and MVPDs have made international sports viewing more accessible to U.S. sports fans. This means an unprecedented number of sports leagues – from here and abroad – are competing for eyeballs and attention.

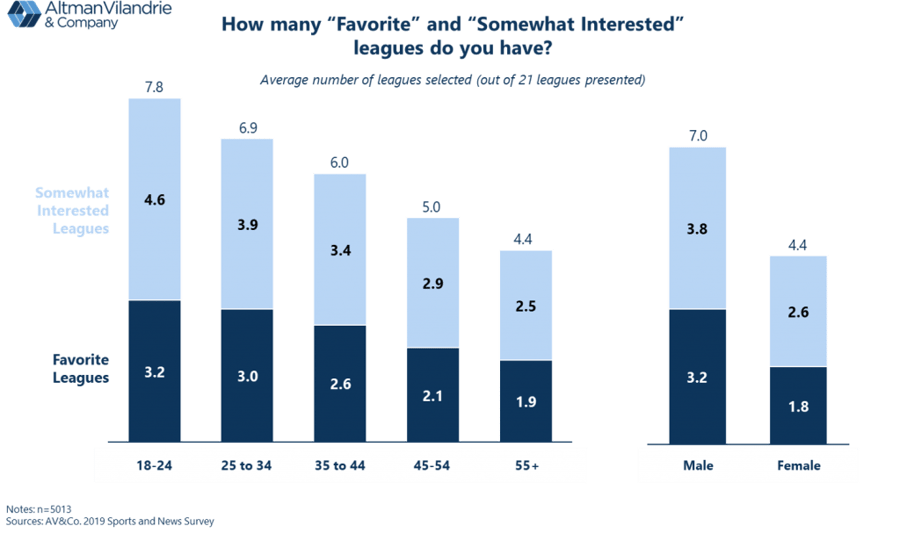

One result of these changes is the broader interest in a wider array of sports among younger audiences. We found that, on average, younger sports fans (18-34) identify nearly twice as many sports leagues as “a favorite” or “somewhat interested” than older sports fans (55+). For older fans, perhaps growing up in a broadcast or analog only world has limited their interest to fewer leagues.

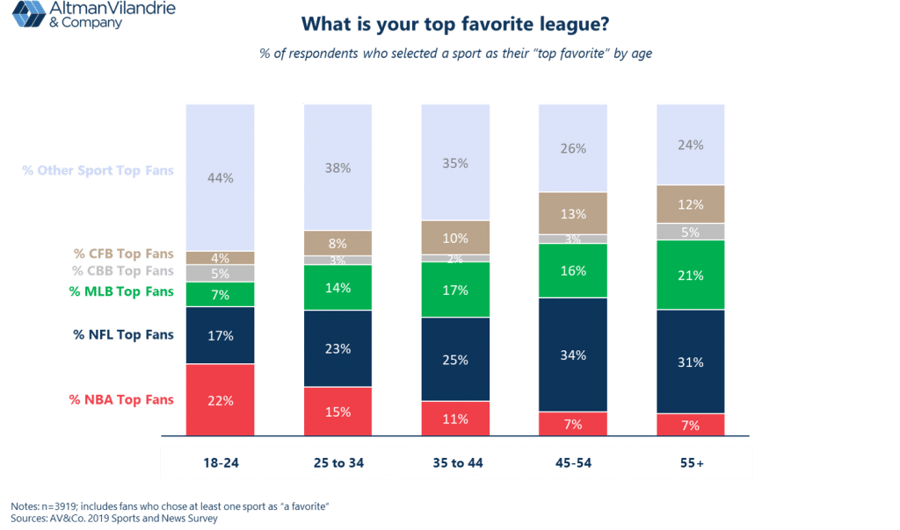

Looking at respondents’ top favorite leagues, we found the NFL to be the most popular league across all age segments except 18-24 year-olds, where the NBA is most popular. Younger individuals also have a more diverse distribution of top favorite leagues with 44% of respondents listing a league other than the NFL, NBA, MLB, College Football, or College Basketball.

Legalized sports gambling will likely drive greater interest in top leagues and Pay TV

The legalization of sports gambling has accelerated in recent years, with 15 states currently allowing some form of legal sports betting and a couple dozen more considering legalization bills. Relaxing sports gambling laws has the potential to boost the top sports leagues, the networks, and the Pay TV providers that showcase their games.

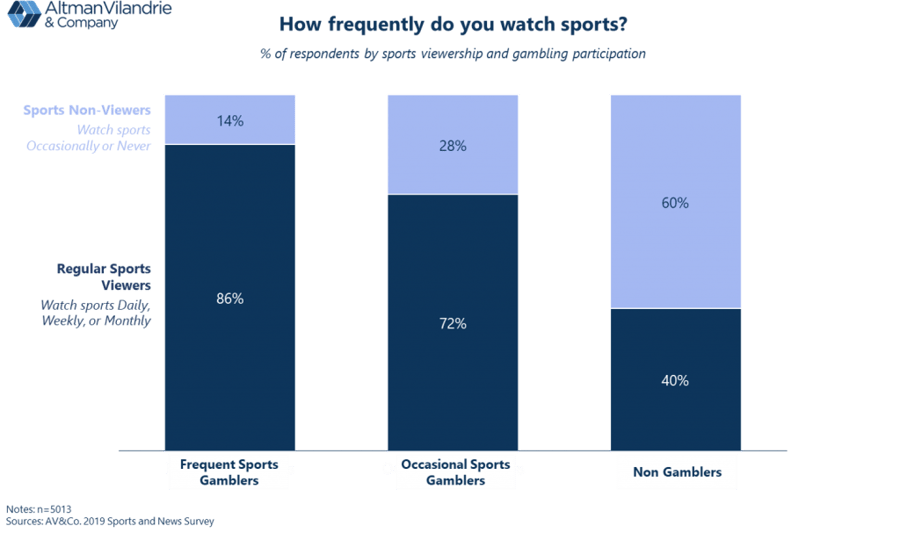

Not surprisingly, the more frequent a gambler, the heavier the sports viewer as 86% of frequent gamblers are regular viewers of sports. Sports viewing behavior declines by sports gambling intensity. Of non-gamblers, only 40% of respondents are regular sports viewers. As such, as sports gambling becomes more mainstream, the higher the likelihood that sports viewing and Pay TV subscribership could increase.

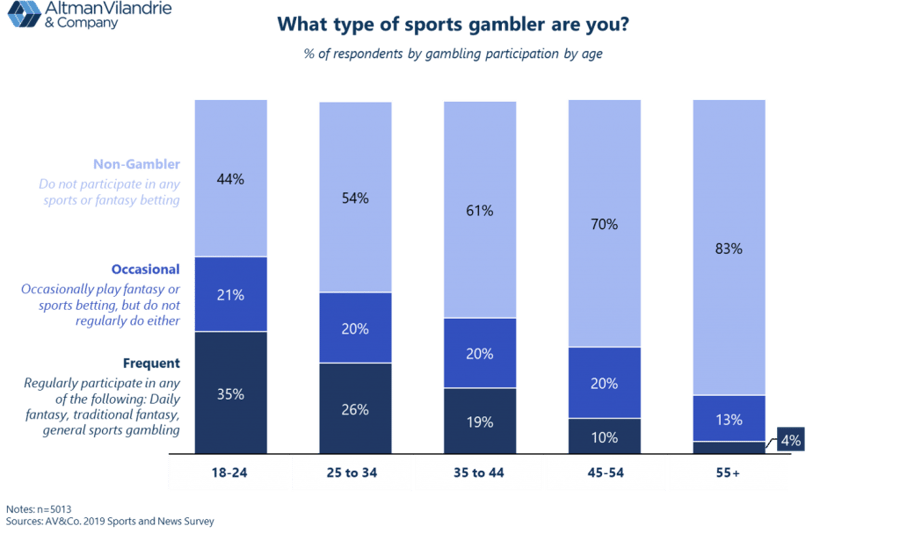

Gambling intensity differs considerably by age group with 56% of respondents under the age of 24 identifying themselves as frequent or occasional sports gamblers, compared to 17% of respondents over the age of 55+. This trend will have a long-term impact on sports viewership and Pay TV subscription if gambling becomes more mainstream and legalized across the country.

Sports and news programming value to Pay TV

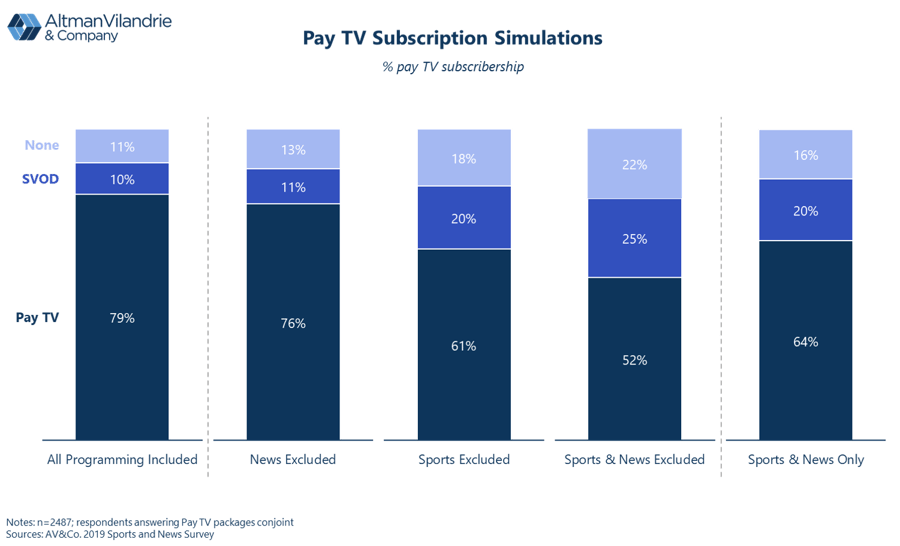

To dig still deeper into the impact of sports and news on Pay TV adoption, we designed a conjoint instrument that enabled us to include or exclude major sports leagues, news programming, and other genres from Pay TV offers. This allowed us to simulate respondent migration away from Pay TV to SVOD-only subscribership, or to non-subscriber status, under various scenarios. For example, what would happen if Pay TV did not have live sports and news, or, in other words, how much of Pay TV subscribership is currently driven by inclusion of sports and/or news? As shown in the exhibit below, simulations using this instrument showed that only 52% of households would still subscribe to live Pay TV if sports and news were removed. Excluding sports has a much greater impact than excluding news, with only 61% of households continuing to subscribe to Pay TV when sports is removed, while 76% of households would still subscribe if news were excluded.

What about a world where the only programming available live were sports and news, with other genres available on demand only? The simulator found that subscribership would drop from 79% to 64%, showing again that live programming in other genres is still important. However, as we’ve seen earlier, consumer preferences vary dramatically across age, sports fandom, etc., so the key to success is understanding willingness to Pay for various types of content across consumer segments.