INSIGHTS

Internet of Things: Competitive Advantages Beyond Connectivity

The Internet of Things (IoT) has gone mainstream, and opportunities abound to develop use cases through emerging tech and business models.

With the rise of mass-market devices, including wearable tech (e.g., Apple Watch), connected cars (e.g., Tesla, and traditional car manufacturers such as BMW), and smart home devices (e.g., Nest), as well as the growing demand and implementation of Industrial IoT solutions (e.g., smart factories, smart metering, digital twins), connected objects have gone from prototype to potential growth and productivity driver.

Buoyed by the rise of 5G and low power wide area network (e.g., LTE-M, LoRaWan) technology, connected devices can rely on increasingly reliable, secure, and ubiquitous network infrastructures, which will further stimulate IoT innovation and new use cases.

Most national MNOs (Mobile Network Operators) have been slower to build up their IoT business than multinational MNOs, as well as specialized IoT MVNOs (Mobile Virtual Network Operators), which have aggressively focused on retailing IoT connectivity on a worldwide scale. Still, in an evolving market, MNOs have significant potential growth from providing IoT solutions through B2B or B2B2C models that leverage unique advanced capabilities (including security and analytics) as well as existing relationships with sophisticated enterprise customers.

IoT is here to stay, but offering IoT connectivity alone may be exposed to price pressures

Today’s mobile Telecommunications market is highly competitive with the commoditization of products and services: in several markets, price wars have driven down margins, impacting profitability and sometimes stability of MNOs.

Similarly, IoT connectivity is also exposed to price pressures, but potential price declines are compensated for by the almost exponential growth of IoT traffic. Alternative ways to deliver IoT connectivity (low power wide area cellular solutions, e.g., NB-IoT) are enabling MNOs to compete at price points that are more competitive and technically more suitable compared to traditional cellular technologies. In an increasingly homogeneous and nearly commoditized IoT pure-play connectivity market, additional services – such as IoT edge infrastructure, advanced IoT analytics, and cybersecurity – are key differentiators and drive margins.

The global IoT market is projected to grow rapidly from over 10.9 billion active connections in 2022 to over 20 billion connected IoT devices by 2025[i]. Industrial IoT – which is poised to revolutionize sectors as diverse as automotive, logistics, transport, utilities, manufacturing, and energy – currently makes up half of all Internet of Things devices (the other half being mass-market IoT). Industrial IoT requires industry-specific solutions. These include partnerships with providers within the ecosystem (e.g., IoT hardware OEMs, IoT platform providers, system Integrators, value-added hardware resellers, IoT hardware distributors) as well as connectivity tools of varying sophistication, such as low-latency connectivity, deep indoor coverage, or, in specific circumstances, edge computing, to keep devices performing.

Due to the complexity associated with putting together end-to-end solutions, most national MNOs have been slower to scale their own IoT businesses, which has enabled the rise of an abstraction layer made up of several IoT MVNO intermediaries like Aeris, Kore, Telit, Cubic, and Truphone among others. However, MNOs can leverage existing customer relationships, local focus, or LTE-M and NB-IoT solutions to their advantage when faced with competition from MVNO intermediaries.

IoT connectivity combined with add-on features and enabling infrastructure helps differentiation and drives value

Packaging IoT Connectivity

There are several opportunities for MNOs to leverage IoT.

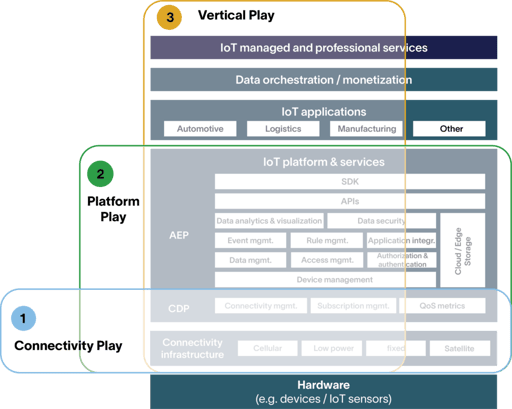

The most natural choice for MNOs is provisioning IoT connectivity (and a connected device platform) across the most common IoT connectivity standards (e.g., 5G, LTE-M, NB-IoT) with specific IoT roaming and pricing options in combination with Service-Level Agreements (connectivity play).

Most MNOs have followed a different path, offering integrated IoT connectivity and platform solutions with additional security and analytics services (platform play). This positioning creates additional customer stickiness and helps increase IoT connectivity margins through differentiation.

Advanced MNO IoT players, Vodafone, for example, create bespoke end-to-end IoT solutions in partnership with specialized players across the IoT ecosystem, offering specific answers for promising industries and use cases (vertical play).

Address end-to-end industry-specific use cases

MNOs can create bespoke offers through private networks within specific industry verticals. Industrial ports, for example, are prime areas for this type of specific use case, where an MNO can sell (project-based) services linked to internal processes, ranging from remote-controlled cranes, remote inspections via drones, video surveillance, automated guided vehicles, and more. All internal processes are monetized by ports via traditional port docking services, where connectivity is retailed as part of an overall global docking fee, not as a standalone product. Although bespoke solutions are, by their nature, tailored to the client, as time goes on, MNOs can develop a standardized model for industry-specific use cases. A standardized proposition is key to enabling scale and sits at the heart of value-based selling and guides winning IoT sales strategies.

Set up hybrid B2B-wholesale divisions to tackle IoT mass-market use cases

MNOs can create dedicated hybrid B2B-wholesale divisions to offer plug & play end-to-end IoT infrastructure services – which can be scaled globally – to enterprises with connected devices. AT&T, for example, is a leader in connected cars, going so far as to co-create bespoke IoT services with OEMs – including by partnering with intermediaries within the IoT ecosystem and the IoT value chain. AT&T services can include vehicle telemetry for the OEM as well as in-vehicle Wi-Fi and access to streaming apps for the vehicle owner. Depending on the nature of the connectivity partnership, the end user can choose whether to use AT&T’s services in-vehicle through adding to their additional plan or purchasing data volumes a la carte, all of which can be seamlessly provided through eSIMs.

Specialized smaller MNOs (Jersey Telecom, Melita) and IoT-focused MVNOs have built a strong IoT business by leveraging favorable regulatory conditions and international roaming agreements combined with platform capabilities (often procured on the market).

National MNOs – particularly in Europe – have the potential to focus on national IoT clients – a segment where international connectivity is not a differentiator. This way, they can target mass-market IoT by serving ambitious and innovative local companies allowing them to scale.

Different “IoT connectivity” monetization models – to be tailored case-by-case to maximize Over-The-Top service success – are emerging

IoT is a maturing industry, and monetization models vary depending on the use case and vertical. Some emerging connectivity models include:

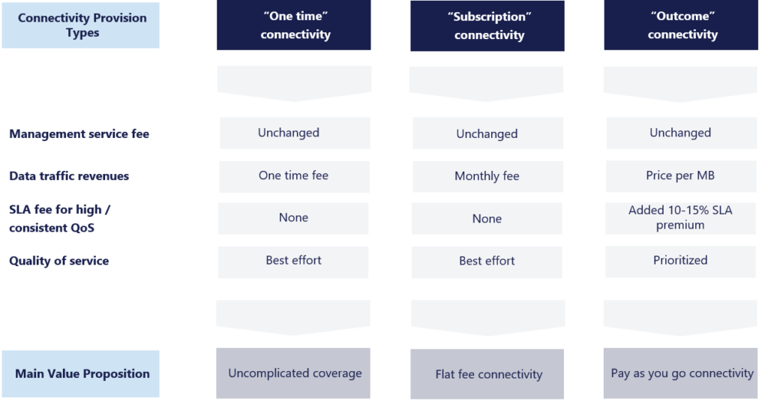

- One-time connectivity: Particularly relevant for “services” where connectivity structurally increases the (perceived) money value proposition of the Over-The-Top service provided – includes connected home devices, like “smart” ovens or dishwashers, where the customer makes a one-time payment for the product to the OEM.

- Subscription-based connectivity: Relevant in cases where connectivity can be sold on-top as a premium service to augment or extend the experience of the Over-The-Top service provided. This is the model with Tesla, where for certain vehicles, users pay a fixed monthly fee to access exclusive premium services which require connectivity or where connectivity enhances the experience (e.g., real-time traffic updates).

- Outcome-based connectivity: Where users pay depending on how much they consume of the service when connectivity is required. This is relevant in cases where connectivity is consumed occasionally. In an increasingly competitive market, having offers that guarantee Quality of Service and respective SLAs for specific use cases on a Pay-As-You-Go basis will be critical to the success of IoT as the industry matures.

MNOs should devise compelling offers that consider coverage and capacity as well as Quality of Service (QoS) requirements. Commercial strategies should be tailored around specific use cases to maximize Over-The-Top service take-up and stimulate usage and penetration.

On the low end of the spectrum, the most basic connectivity model would have no SLA (coverage, availability, capacity, etc.) to deliver consistent QoS – this could be ideal for mass-market (“best effort”) use cases.

For clients that have distributed and high-volume traffic, as in connected cars, a model where clients buy an allowance (fair usage policy) based on a subscription model may be preferable. Finally, for clients where a high QoS is required, for instance, for Industrial IoT requiring private networks, MNOs could charge a premium SLA for prioritized Quality of Service.

While niche MNOs and IoT-focused MVNOs were early succeeders in the IoT connectivity business, in-country non-global MNOs can still compete in this rapidly growing market by providing integrated IoT connectivity and platform solutions starting from more sophisticated enterprises. As the IoT mass market crystallizes, creating offers centered around the success of Over-The-Top services appears to be a winning proposition as it would allow ambitious local companies to scale products and services globally.

It is up to MNOs to shore-up the resources to tackle the IoT mass market, the enterprise & industrial IoT opportunity, and address more complex hybrid scenarios.

Please complete the form below to receive a PDF of the full report and to connect with our team.

[i] ABI Research, 2022