INSIGHTS

Global Sports’ Great Comeback Means Opportunities for Leagues, Clubs, and Investors

Interest in sports has roared back since the pandemic, but how can leagues and clubs create sustainable engagement and monetize their fanbases?

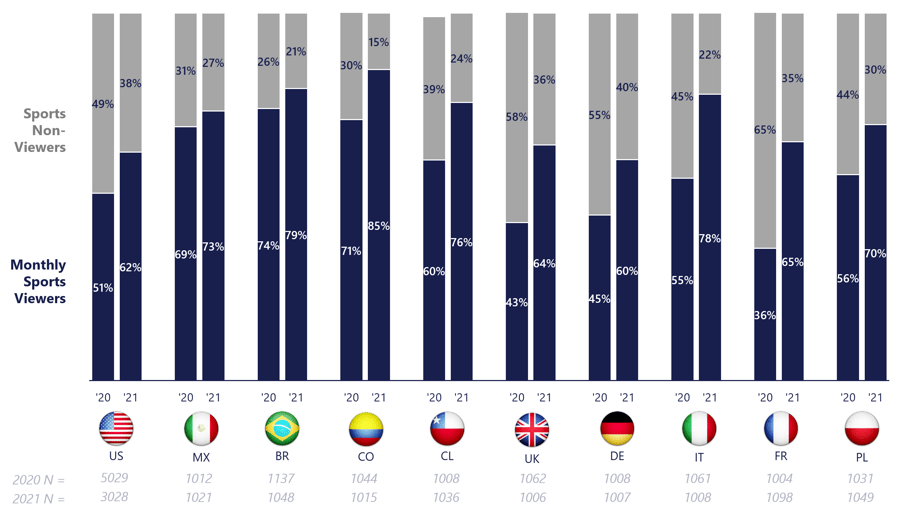

Altman Solon’s 2021 Global Sports Survey, which gauged viewing and fandom among 18,000 respondents in 16 countries across North America, Europe, Latin America, and Asia, shows that sports are bouncing back in popularity following a lost year for live contests. Overall, sports are getting more popular globally with over 60% of respondents saying they watch sports at least monthly compared to as few as 43% last year. In local markets, the increases for 2021 ranged from 6% in Mexico up to 81% in France, driven by the return of full traditional sports schedules and the rescheduling of major delayed international events like the Summer Olympics, the European Soccer Championship, and the Ryder Cup.

Sports Viewership YoY Comparison

(% of all respondents; 2020 vs. 2021 in countries included in 2020 and 2021 surveys)

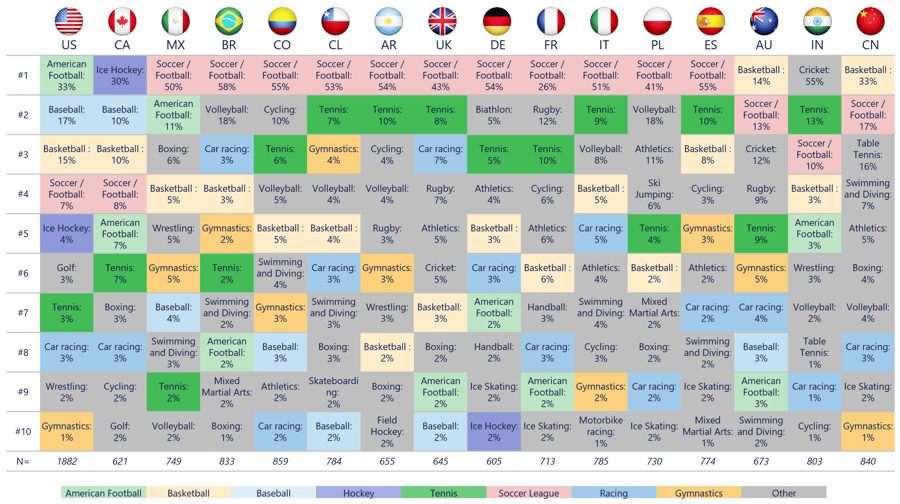

Soccer generates the strongest interest globally as it is the favored sport across Europe and Latin America for typically more than 50% of monthly sports viewers. In the U.S., preferences are less concentrated, with the big three sports, American football (33%), baseball (17%), and basketball (15%), all garnering strong interest. Similarly, viewing interests in Canada, Australia, and China are more diverse, while India is heavily skewed towards cricket.

Favorite Sport to Watch

(% of monthly sports viewers in each country)

The survey revealed that watching sports represents a significant share of sports fans’ total TV consumption. In addition, live sports are a strong driver of willingness to pay for Pay TV or streaming services: monthly sports viewers are more likely to subscribe to Pay TV (up to 46% more likely in Germany, where public and FTA broadcasters are in a strong position but Pay TV provider Sky holds key soccer rights).

While TV rights and licensing have historically been financial pillars of professional sports, leagues and teams need to diversify their revenue streams and add new ways to engage audiences and monetize fandom. Some of the areas with significant potential include:

- Ancillary revenue from events due to integration of other entertainment / leisure activities – such as in-arena gaming, betting, or commerce – that can drive live viewership

- Creation of additional touchpoints to experience the brand – especially for international fans – as well as exclusive moments and experiences (in-person and digital/virtual ranging from off-season tours to VR museums) that build and strengthen fan loyalty and engagement

- Digital products and services, such as direct-to-consumer channels, exploit opportunity around exclusive content to keep engagement high throughout the week and the season (and off-season) at home and abroad – providing an opportunity to create direct relationships with fans and generate fan data, in addition to driving more engagement, subscriptions, and revenues

More details on trends in sports, TV consumption, and adjacent fields to monetize across 16 countries can be found in Altman Solon’s Global Perspective on Sports report. Please submit the form below to request the report.

Altman Solon, the world’s largest strategy consulting firm exclusively focused on Telecommunications, Media, and Technology, conducted the 2021 Global Sports Survey in August-September with more than 18,000 respondents across 16 countries. Please click here for more results from the survey.