INSIGHTS

Global Consumers’ – and Media Companies’ – Appetite for Podcasting Is Increasing

As listeners and revenues grow so does competition and consolidation

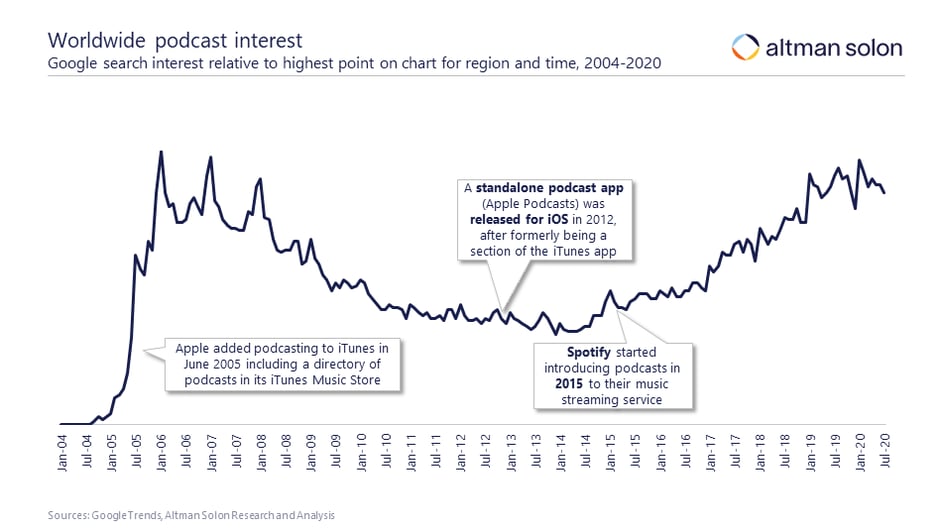

Podcasting, a growing sector of the media ecosystem, is increasingly drawing interest from global consumers, advertisers, publishers, and media companies. Global podcasting ad revenues increased more than 65% annually from 2016-2019, and by 2023 the podcast industry will boast nearly two billion regular listeners.

The podcasting wave continues to grow as consumers spend more time listening to podcasts. More recently, the competition has intensified, with media and tech companies looking to capture consumer time/attention and spending via podcasts. Recent examples include Spotify (multiple) and Amazon (Wondery) seeking access to new content creation and audio capabilities and new technology to support and monetize their podcasting endeavors.

This article outlines key trends in podcasting demand and supply from Altman Solon’s new report, Podcasting Industry Perspectives, which is available upon request using the form below the article.

Market Assessment

- The demand for podcasts has been on the rise globally with increasing customer usage and penetration. Global monthly podcast listeners grew with a 42% CAGR from 287 million in 2016 to 835 million in 2019. Going forward, global monthly podcast listeners are expected to grow with 20% per year between 2020 and 2023, reaching ~1.8 billion by 2023.

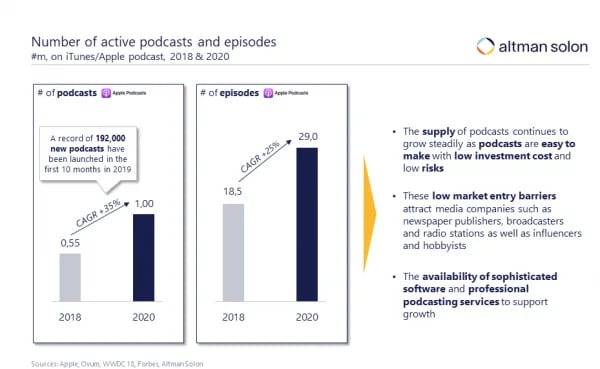

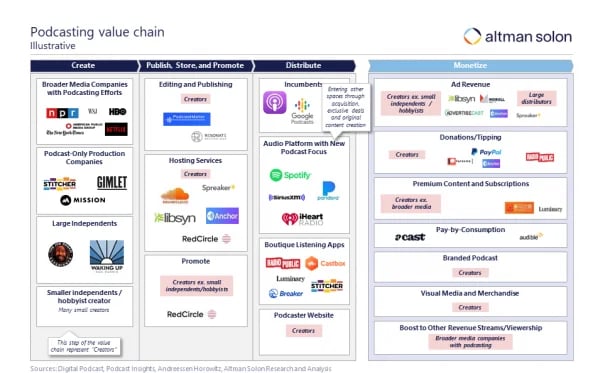

- The supply of podcasts continues to grow steadily as podcasts are easy to make with low investment cost and low risks. In addition to attracting media companies and podcast service/software providers, the low entry cost has attracted publishers and studios seeking new sources of IP while established players like Spotify seek new content to attract and retain subscribers.

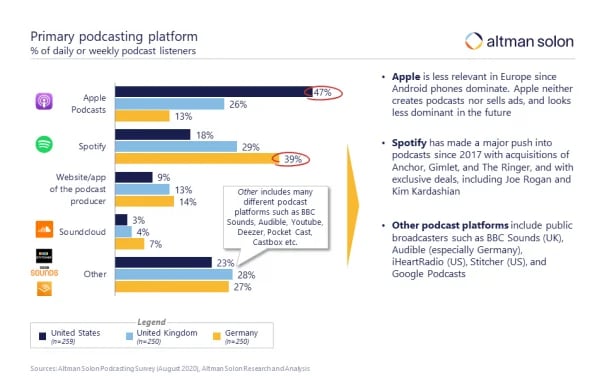

- The podcast market has become highly competitive as tech and media players – like Google and Podimo – are entering the space. Global streaming platforms such as Spotify, Apple and Deezer compete for listeners, but also established publishers and broadcasters like the New York Times, BBC, and ProSiebenSat1 are getting involved in podcasts.

Customer Behavior

- Apple dominates the US, Spotify has become the primary podcast platform in Europe. Podcasts have traditionally been associated with Apple devices, but that is changing as new players enter the market, especially in Europe. In Germany and the UK, podcast listeners use Spotify (39%/ 29%) as their primary podcasting source. In the US, Apple Podcasts is the dominant platform (47%).

- Podcast listeners enjoy a variety of genres; society & culture most popular. Society & culture is the most popular genre across the US and Germany and ranks second in the UK. Younger audiences ( under 25 years) have a higher tendency to listen to comedy while the older audiences (55+) tend to prefer news.

- Podcast listeners have different demographics than the traditional TV or music audience. Podcast listeners tend to be younger, well educated, and mainly listen via headphones/mobile phones. These demographics & habits are enticing to publishers and broadcasters who are finding it harder to reach younger consumers.

- Positive impact of COVID-19 on podcast listening. More than 40% of survey respondents in the US, Germany, and the UK indicated that they spend more time listening to podcasts since COVID-19 started. Although some podcast listening decreased as it is a commuting habit, people started listening in the house while doing other tasks.

Podcast Monetization

- Podcasting primarily generates money from advertising – ad revenues are increasing. Globally, podcast ad revenues increased by ~67% annually (‘16-’19) and are expected to eclipise $4 billion in 2023. Aside from in-episode advertising, other sources of revenue include (premium) subscriptions and donations.

- Reach and ad revenue are highly concentrated in the top 15% of podcasts. With select group of postcasts dominating revenue and reach, smaller players run the risk of being squeezed out. Some platforms, such as new entry Podimo, offer podcast creators a share of revenue from their subscribers.

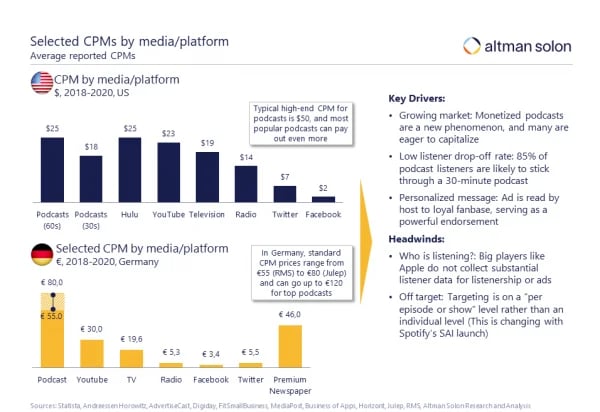

- CPMs for podcasts tend to be higher than for other media. In the US, average podcast CPMs range between $18 (30-second ads) and $25 (60-second ads); in Germany, podcast CPMs range between €55-80. These CPMs are higher – often significantly – than those for other media, including TV, radio, and social media. However, ad personalization and engagement of podcasts makes them a promising medium for media companies.

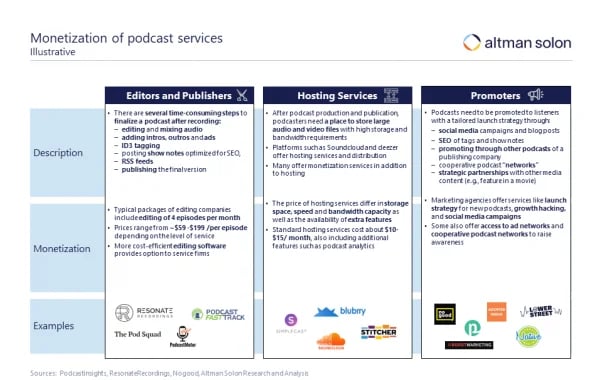

- The growth of the podcating ecosystem has created new business and revenue options for workers and companies:

Trends in Podcasting

- M&A activity among podcasters has spiked over the last year with companies looking to secure original and exclusive content as well as production / monetization and hosting capabilities. Big tech companies and others seek access to audio capabilities and new technology to support and monetize their podcasting endeavors.

- Establishing user payments as new form of monetization. User payments are expected to move center stage with direct & alternative monetization methods establishing themselves in the market to complement ad-based revenue streams.

- Development of new platform features, podcast quality, formats and ad models. Spotify is currently testing an interactive ad feature called “In-App Offers” to create a direct funnel for brands. The quality of podcasts increases as better tools for podcasters are available and audience expectations rise. Spotify also offers a new video podcast feature with select podcasts.

Contact form

More details on the types of new companies targeting podcasting, consumer listening habits, monetization strategies, and other trends can be found in Altman Solon’s report Global Podcasting Industry Perspectives, which is available upon request.